Form it 112 C New York State Resident Credit for Taxes Paid to a 2024-2026

Understanding Form IT-112 C: New York State Resident Credit for Taxes Paid to Another State

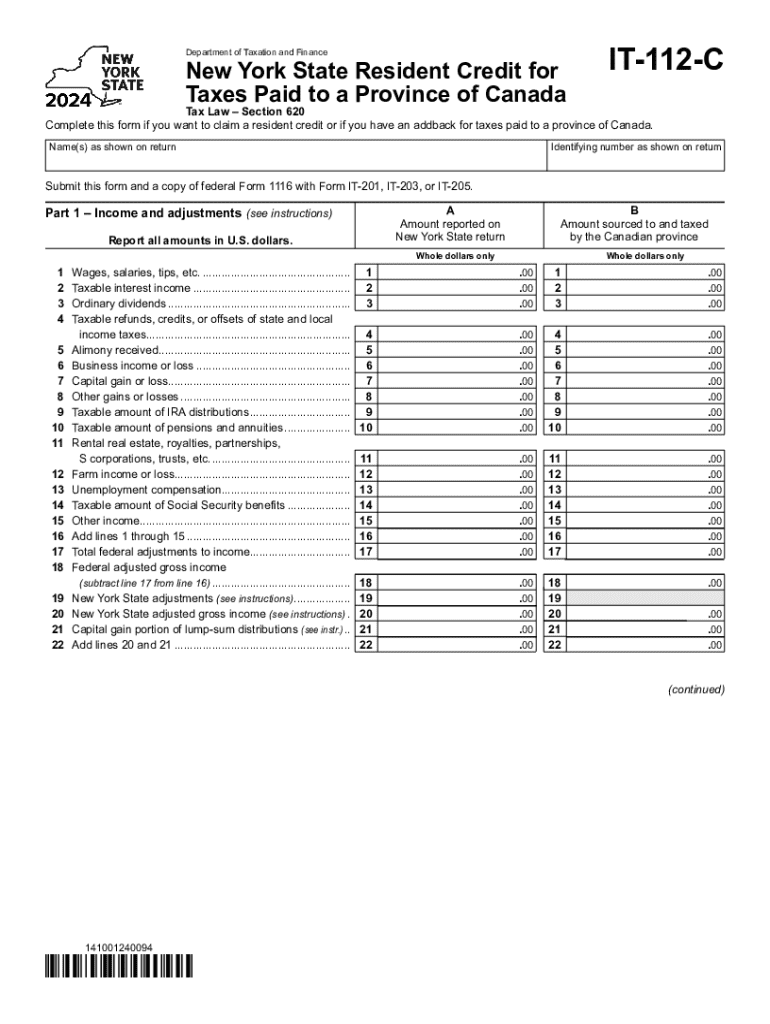

The IT-112 C form is designed for New York State residents who have paid income taxes to another state. This form allows taxpayers to claim a credit for those taxes, preventing double taxation on the same income. It is essential for residents who earn income outside of New York and wish to ensure they are not taxed twice on that income.

How to Obtain Form IT-112 C

To obtain Form IT-112 C, taxpayers can visit the New York State Department of Taxation and Finance website. The form is available for download in PDF format, allowing for easy access and printing. Additionally, taxpayers can request a physical copy by contacting the department directly or visiting local tax offices.

Steps to Complete Form IT-112 C

Completing Form IT-112 C involves several key steps:

- Gather necessary documents, including proof of taxes paid to the other state.

- Fill out personal information, including your name, address, and Social Security number.

- Report the income earned in the other state and the corresponding taxes paid.

- Calculate the credit amount based on the tax rates and income reported.

- Review the form for accuracy before submission.

Eligibility Criteria for Form IT-112 C

To qualify for the credit using Form IT-112 C, taxpayers must meet specific eligibility criteria. They must be residents of New York State and have paid income taxes to another state on income that is also subject to New York State taxes. Additionally, the income must be reported on their New York State tax return.

Legal Use of Form IT-112 C

Form IT-112 C is legally recognized by the New York State Department of Taxation and Finance. It is crucial for taxpayers to ensure that they are using the most current version of the form to comply with state regulations. Proper use of the form can help avoid penalties and ensure that taxpayers receive the credits they are entitled to.

Filing Deadlines for Form IT-112 C

Taxpayers must submit Form IT-112 C by the same deadline as their New York State income tax return. Typically, this means filing by April fifteenth unless an extension has been granted. It is important to adhere to these deadlines to avoid late fees and interest on unpaid taxes.

Create this form in 5 minutes or less

Find and fill out the correct form it 112 c new york state resident credit for taxes paid to a

Create this form in 5 minutes!

How to create an eSignature for the form it 112 c new york state resident credit for taxes paid to a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is taxation 112 c and how does it affect my business?

Taxation 112 c refers to specific tax regulations that can impact businesses in various ways. Understanding these regulations is crucial for compliance and can help you optimize your tax strategy. By utilizing airSlate SignNow, you can streamline document management related to taxation 112 c, ensuring that all necessary paperwork is efficiently handled.

-

How can airSlate SignNow help with documentation for taxation 112 c?

airSlate SignNow provides a user-friendly platform for sending and eSigning documents related to taxation 112 c. This ensures that all your tax-related documents are securely signed and stored, making it easier to manage compliance. With our solution, you can reduce the time spent on paperwork and focus more on your business.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. Our plans provide access to essential features that can assist with taxation 112 c documentation. You can choose a plan that best fits your needs and budget, ensuring you get the most value for your investment.

-

What features does airSlate SignNow offer for managing taxation 112 c documents?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning, all of which are beneficial for managing taxation 112 c documents. These features help streamline the process, reduce errors, and ensure compliance with tax regulations. With airSlate SignNow, you can efficiently handle all your tax-related documentation.

-

Is airSlate SignNow compliant with taxation 112 c regulations?

Yes, airSlate SignNow is designed to comply with various regulations, including those related to taxation 112 c. Our platform ensures that all documents are securely signed and stored, meeting the necessary legal requirements. This compliance helps protect your business and provides peace of mind when managing tax-related documents.

-

Can I integrate airSlate SignNow with other software for taxation 112 c?

Absolutely! airSlate SignNow offers integrations with various software applications that can assist with taxation 112 c. This allows you to connect your existing tools and streamline your workflow, making it easier to manage tax documentation and compliance. Our integrations enhance the overall efficiency of your business processes.

-

What are the benefits of using airSlate SignNow for taxation 112 c?

Using airSlate SignNow for taxation 112 c offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the eSigning process, allowing you to focus on your core business activities. Additionally, the secure storage of documents ensures that your tax-related information is always protected.

Get more for Form IT 112 C New York State Resident Credit For Taxes Paid To A

Find out other Form IT 112 C New York State Resident Credit For Taxes Paid To A

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation