Form it 636 'Alcoholic Beverage Production Credit' New York 2020

What is the Form IT 636 'Alcoholic Beverage Production Credit' New York

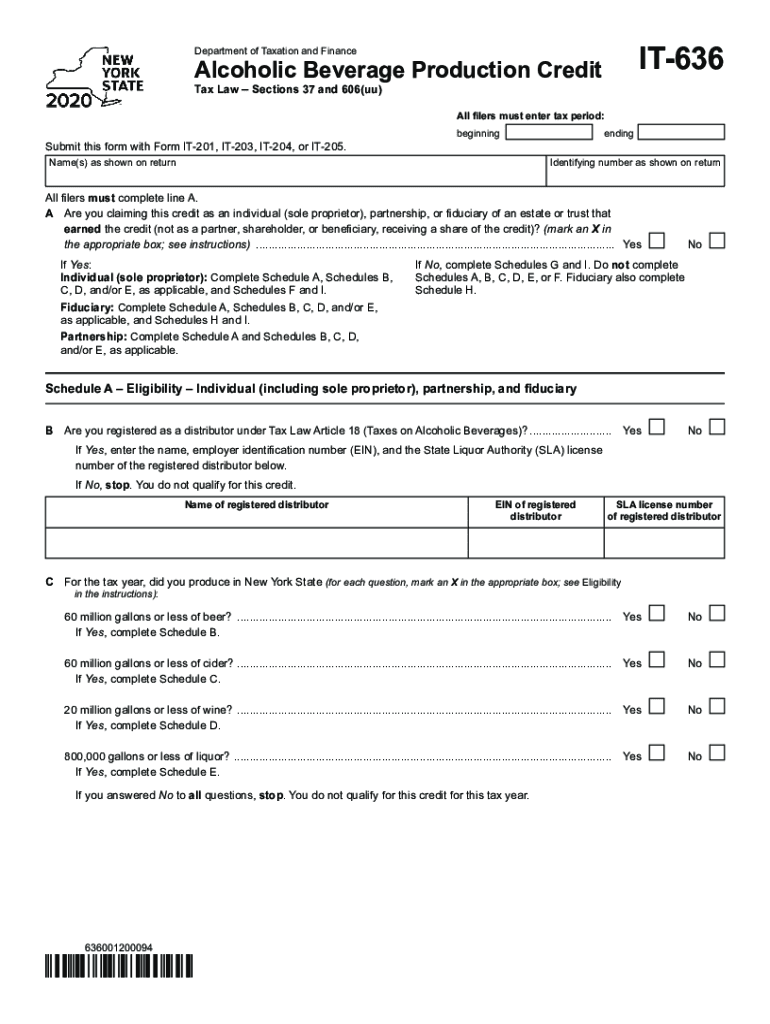

The Form IT 636 is a tax credit application specific to the alcoholic beverage industry in New York. It allows eligible producers to claim a credit for certain production costs associated with the manufacturing of alcoholic beverages. This form is particularly relevant for businesses that produce beer, wine, or spirits, providing them with financial relief by reducing their tax liabilities. The credit is designed to encourage growth and investment within the local alcoholic beverage sector.

How to use the Form IT 636 'Alcoholic Beverage Production Credit' New York

To effectively use the Form IT 636, businesses must first determine their eligibility based on production volume and type of alcoholic beverage produced. Once eligibility is confirmed, the form must be completed accurately, detailing production costs and any supporting documentation required. After completing the form, it should be submitted along with the business's tax return to the New York State Department of Taxation and Finance. Proper submission ensures that the credit is applied to the correct tax period.

Steps to complete the Form IT 636 'Alcoholic Beverage Production Credit' New York

Completing the Form IT 636 involves several key steps:

- Gather necessary financial records, including production costs and sales data.

- Fill out the form, ensuring all sections are completed with accurate information.

- Attach any required documentation that supports the claimed credit, such as invoices or receipts.

- Review the completed form for any errors or omissions.

- Submit the form along with your tax return by the designated filing deadline.

Eligibility Criteria

Eligibility for the Form IT 636 is primarily based on the type of alcoholic beverage produced and the volume of production. Businesses must be registered in New York and actively engaged in the manufacturing of beer, wine, or spirits. Additionally, the production must meet specific thresholds set by the state to qualify for the credit. It is essential for applicants to review the latest guidelines from the New York State Department of Taxation and Finance to confirm their eligibility.

Legal use of the Form IT 636 'Alcoholic Beverage Production Credit' New York

The legal use of the Form IT 636 is governed by state tax laws and regulations. To ensure compliance, businesses must adhere to the guidelines outlined by the New York State Department of Taxation and Finance. This includes maintaining accurate records of production and sales, submitting the form within the required timeframes, and providing truthful information. Failure to comply with these regulations can result in penalties or disqualification from receiving the tax credit.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 636 can be submitted through various methods to accommodate different business preferences. Businesses may choose to file online through the New York State Department of Taxation and Finance's e-file system, which offers a streamlined process. Alternatively, the form can be mailed directly to the department or submitted in person at designated offices. Each submission method has its own guidelines and deadlines, so it is important to select the most appropriate option for timely processing.

Quick guide on how to complete form it 636 ampquotalcoholic beverage production creditampquot new york

Effortlessly prepare Form IT 636 'Alcoholic Beverage Production Credit' New York on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed contracts, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents promptly without any delays. Handle Form IT 636 'Alcoholic Beverage Production Credit' New York on any platform using the airSlate SignNow Android or iOS applications and streamline any document-centric procedure today.

Easily modify and electronically sign Form IT 636 'Alcoholic Beverage Production Credit' New York

- Find Form IT 636 'Alcoholic Beverage Production Credit' New York and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or conceal sensitive information using the tools provided by airSlate SignNow specifically for that aim.

- Create your signature with the Sign tool, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Form IT 636 'Alcoholic Beverage Production Credit' New York to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 636 ampquotalcoholic beverage production creditampquot new york

Create this form in 5 minutes!

How to create an eSignature for the form it 636 ampquotalcoholic beverage production creditampquot new york

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

How to create an eSignature for a PDF document on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to it 636?

airSlate SignNow is an efficient eSigning solution designed to simplify document management and enhance workflow automation. The platform supports the it 636 standard, ensuring that electronic signatures are legal and compliant. Users can easily send, sign, and manage documents all in one place, streamlining their operations.

-

How much does airSlate SignNow cost for users managing it 636 documents?

The pricing for airSlate SignNow is competitive and varies based on the features and capabilities you need. For businesses dealing with it 636, there are subscription plans that cater to different budgets and requirements. Customers can choose between monthly or annual billing to find the best fit for their document signing needs.

-

What features does airSlate SignNow offer for it 636 compliance?

airSlate SignNow includes several features that ensure compliance with it 636, such as secure eSigning, audit trails, and customizable templates. These tools help businesses maintain legal validity and provide a clear record of all transactions. Additionally, the platform supports advanced authentication methods to further protect your documents.

-

Can airSlate SignNow integrate with other software for managing it 636 paperwork?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, enhancing functionality for users handling it 636 documents. Integrations with tools like Google Drive, Salesforce, and Microsoft Office allow users to manage workflows efficiently. This connectivity supports better collaboration and document tracking.

-

What are the benefits of using airSlate SignNow for it 636 document management?

Using airSlate SignNow for it 636 document management yields numerous benefits, including increased efficiency, cost savings, and improved compliance. The easy-to-use interface simplifies the signing process, signNowly reducing turnaround times for agreements. Businesses can also eliminate paper waste, contributing to more sustainable practices.

-

Is airSlate SignNow secure for handling it 636 documents?

Yes, airSlate SignNow prioritizes security and meets industry standards to protect your it 636 documents. The platform incorporates encryption, multi-factor authentication, and secure cloud storage to safeguard sensitive information. Users can trust that their data is managed safely while complying with legal requirements.

-

How does airSlate SignNow streamline the signing process for it 636?

airSlate SignNow streamlines the signing process for it 636 by allowing users to send documents for signatures electronically in just a few clicks. The platform automates notifications and reminders, ensuring timely responses from signers. This efficiency not only speeds up the approval process but also enhances overall productivity.

Get more for Form IT 636 'Alcoholic Beverage Production Credit' New York

- Georgia dekalb county order on affidavit of poverty form

- Subcontractor permit request aws form

- Texas grievance form 5522110

- Permit info 770 528 2043 inspection request www form

- Hawaii fact sheet for father minor by parent form

- Hawaii name change for family form

- Hawaii consent of minor minor by parent form

- How to form a trust wwwdownload appco

Find out other Form IT 636 'Alcoholic Beverage Production Credit' New York

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile