Form it 636 Alcoholic Beverage Production Credit Tax Year 2023-2026

Understanding the 636 Form for Alcoholic Beverage Production Credit

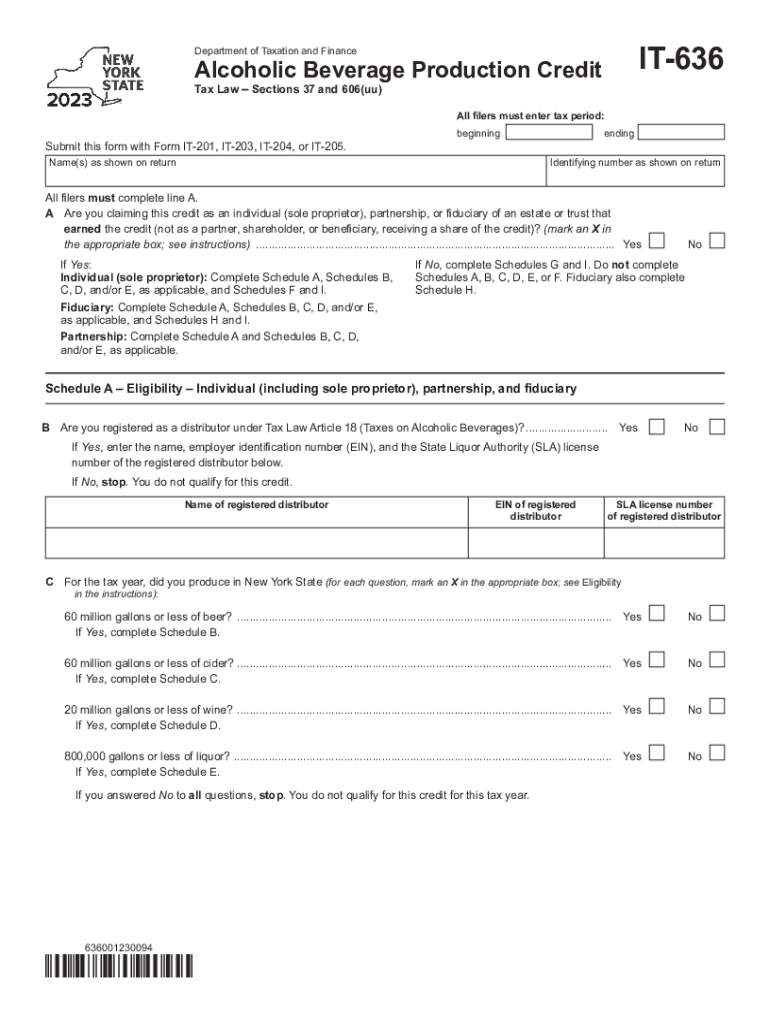

The 636 form, officially known as the IT 636, is utilized by businesses in the alcoholic beverage industry to claim a tax credit for production activities. This form is specifically designed for producers of alcoholic beverages in the United States, allowing them to receive credits that can significantly reduce their tax liabilities. The credit aims to support local businesses and promote economic growth within the industry by offsetting production costs.

Steps to Complete the 636 Form

Completing the 636 form requires careful attention to detail to ensure accuracy and compliance with IRS guidelines. Here are the essential steps:

- Gather Necessary Information: Collect all relevant business information, including your Employer Identification Number (EIN) and details about your production activities.

- Fill Out the Form: Provide accurate figures regarding the volume of alcoholic beverages produced and any associated costs. Ensure that all calculations are correct.

- Review for Accuracy: Double-check all entries for errors or omissions. This step is crucial to avoid delays or penalties.

- Submit the Form: Decide on your submission method—online, by mail, or in person—and ensure it is sent to the appropriate tax authority.

Eligibility Criteria for the 636 Form

To qualify for the tax credit using the 636 form, businesses must meet specific eligibility criteria. These include:

- Type of Business: The business must be a registered producer of alcoholic beverages, such as breweries, wineries, or distilleries.

- Production Volume: There may be minimum production thresholds that need to be met to qualify for the credit.

- Compliance with State Regulations: Businesses must adhere to all state laws and regulations governing alcoholic beverage production.

Obtaining the 636 Form

The 636 form can be obtained through several avenues. It is typically available on the official state tax authority's website or can be requested directly from the tax office. Additionally, many tax preparation software programs include the form as part of their offerings, making it easier for businesses to access and complete it electronically.

Legal Use of the 636 Form

The legal use of the 636 form is essential for ensuring compliance with tax laws. Businesses must use the form solely for its intended purpose—claiming credits for eligible production activities. Misuse of the form, such as falsifying information or using it for ineligible activities, can result in significant penalties, including fines and legal repercussions.

Filing Deadlines for the 636 Form

Filing deadlines for the 636 form vary based on state regulations and the specific tax year. Generally, businesses should be aware of the following:

- Annual Filing: The form is typically due at the same time as the business's annual tax return.

- Extensions: If additional time is needed, businesses may apply for an extension, but they must still meet the extended deadline to avoid penalties.

Quick guide on how to complete form it 636 alcoholic beverage production credit tax year

Effortlessly manage Form IT 636 Alcoholic Beverage Production Credit Tax Year on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Form IT 636 Alcoholic Beverage Production Credit Tax Year on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered procedure today.

The most efficient approach to modify and eSign Form IT 636 Alcoholic Beverage Production Credit Tax Year with ease

- Obtain Form IT 636 Alcoholic Beverage Production Credit Tax Year and then click Get Form to initiate the process.

- Utilize the resources we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Verify all the details and then click on the Done button to preserve your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form IT 636 Alcoholic Beverage Production Credit Tax Year and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 636 alcoholic beverage production credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 636 alcoholic beverage production credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 636 form and how is it used?

The 636 form is a document used to collect information and facilitate transactions in specific business contexts. It provides a clear structure for sharing essential data, ensuring compliance and accuracy. With airSlate SignNow, you can easily create, edit, and eSign your 636 form, streamlining your business processes.

-

How can airSlate SignNow help me manage my 636 form?

airSlate SignNow offers a user-friendly platform for managing your 636 form efficiently. You can customize the form, send it for eSignature, and track its status in real-time. This saves time and reduces the hassle of paperwork, allowing you to focus on your core business activities.

-

Is there a cost associated with using the 636 form feature in airSlate SignNow?

Yes, while airSlate SignNow provides a range of affordable pricing plans, the cost will depend on the specific features and the number of users. However, the benefits of managing your 636 form digitally often outweigh these costs, as you’ll save time and reduce errors associated with manual processes.

-

Can I integrate airSlate SignNow with other applications for my 636 form?

Absolutely! airSlate SignNow supports integration with numerous third-party applications, enabling seamless workflows for your 636 form. Whether you’re using CRM software or document storage solutions, you can easily connect them to ensure your forms are always accessible and up-to-date.

-

What are the key benefits of electronically signing a 636 form?

Electronically signing your 636 form through airSlate SignNow enhances security and speeds up the signing process. It eliminates the need for physical paperwork, reducing the chance of errors and ensuring that your forms are stored safely and retrieved easily at any time.

-

Is it easy to create a new 636 form using airSlate SignNow?

Yes, creating a new 636 form with airSlate SignNow is very simple. The platform provides intuitive tools and templates to help you design your form according to your specific requirements. This ease of use allows you to focus on your content rather than getting bogged down in complicated processes.

-

How secure is the information on my 636 form with airSlate SignNow?

airSlate SignNow prioritizes your security, ensuring that all data, including that on your 636 form, is protected with robust encryption and compliance with industry standards. This means your sensitive information remains confidential and secure throughout the signing process.

Get more for Form IT 636 Alcoholic Beverage Production Credit Tax Year

- Dmv physician reporting form california

- Cigna ltd claim form

- Concrete placement log louisiana form

- Getting there a curriculum for people moving into employment form

- Prc program toledo ohio form

- Form 29 form 30 himachal nic

- Radiation declaration fedex form

- Green gobbler money back guarantee 3 send the original cash form

Find out other Form IT 636 Alcoholic Beverage Production Credit Tax Year

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure