Form it 636 Alcoholic Beverage Production Credit Tax Year 2021

What is the Form IT 636 Alcoholic Beverage Production Credit Tax Year

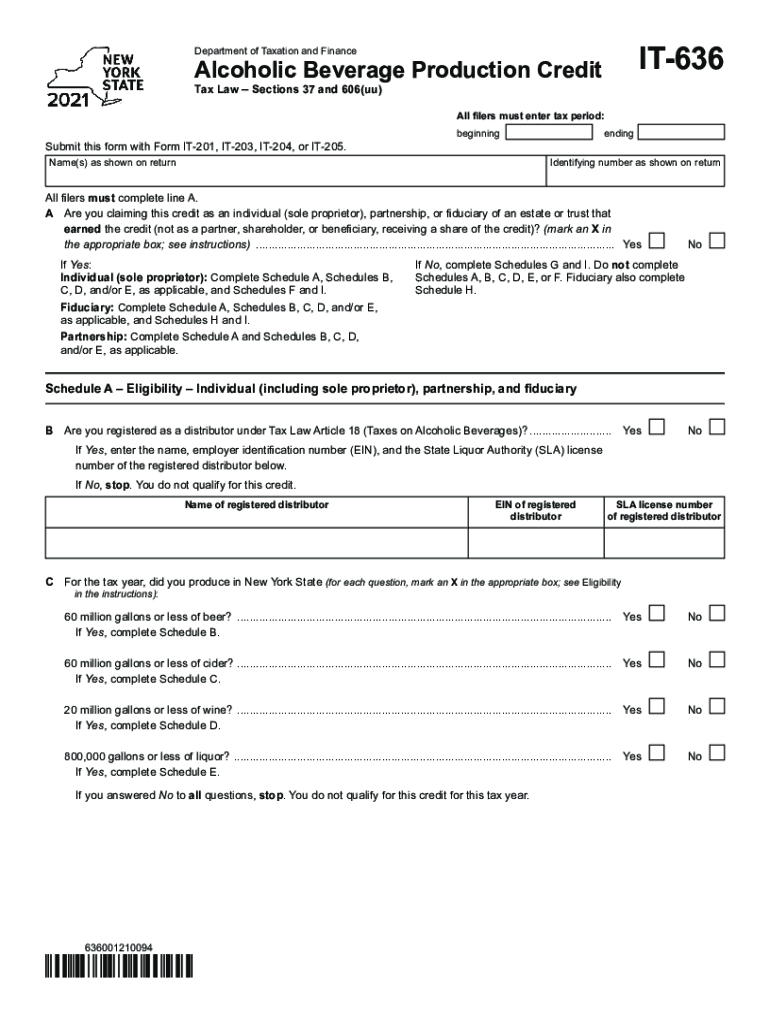

The Form IT 636 is a tax document used in the United States, specifically for claiming the Alcoholic Beverage Production Credit. This credit is designed for businesses involved in the production of alcoholic beverages, allowing them to receive a tax benefit based on their production activities. The form must be completed accurately to ensure compliance with tax regulations and to maximize potential savings for eligible producers.

How to use the Form IT 636 Alcoholic Beverage Production Credit Tax Year

Using the Form IT 636 involves several key steps. First, gather all necessary financial records related to alcoholic beverage production for the tax year in question. This includes production volumes, sales data, and any relevant expenses. Next, accurately fill out the form, detailing the production figures and calculating the credit based on the guidelines provided by the state tax authority. Finally, submit the completed form as part of your overall tax return to ensure you receive the appropriate credits.

Steps to complete the Form IT 636 Alcoholic Beverage Production Credit Tax Year

Completing the Form IT 636 requires careful attention to detail. Start by entering your business information at the top of the form. Then, list your production quantities and any other required financial data. It is essential to follow the instructions closely to ensure all calculations are correct. After filling out the form, review it for accuracy and completeness before submission. Consider consulting a tax professional if you have questions or need assistance with complex entries.

Legal use of the Form IT 636 Alcoholic Beverage Production Credit Tax Year

The legal use of the Form IT 636 hinges on compliance with state tax laws and regulations governing alcoholic beverage production. Businesses must ensure they meet eligibility criteria to claim the credit. This includes maintaining proper records of production and sales, as well as adhering to all relevant tax filing deadlines. Failure to comply with these legal requirements can result in penalties or denial of the credit.

Eligibility Criteria

To qualify for the Alcoholic Beverage Production Credit using Form IT 636, businesses must meet specific eligibility criteria. Primarily, the business must be engaged in the production of alcoholic beverages and must have incurred production expenses during the tax year. Additionally, the business must be compliant with all state regulations regarding the production and sale of alcoholic beverages. It is crucial to review the eligibility requirements thoroughly to ensure compliance before filing.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 636 can be submitted through various methods, depending on the preferences of the business and the requirements of the state tax authority. Common submission methods include online filing through the state’s tax portal, mailing a paper copy of the form, or submitting it in person at designated tax offices. Each method has its own set of guidelines and deadlines, so it is important to choose the one that best fits your needs while ensuring timely submission.

Quick guide on how to complete form it 636 alcoholic beverage production credit tax year

Handle Form IT 636 Alcoholic Beverage Production Credit Tax Year effortlessly on any device

Digital document management has gained immense traction among companies and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to easily locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage Form IT 636 Alcoholic Beverage Production Credit Tax Year on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

The simplest way to modify and eSign Form IT 636 Alcoholic Beverage Production Credit Tax Year with ease

- Find Form IT 636 Alcoholic Beverage Production Credit Tax Year and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal authority as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you choose. Modify and eSign Form IT 636 Alcoholic Beverage Production Credit Tax Year and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 636 alcoholic beverage production credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 636 alcoholic beverage production credit tax year

The best way to create an e-signature for a PDF online

The best way to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

The way to generate an e-signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the primary benefit of using airSlate SignNow for IT 636?

The primary benefit of using airSlate SignNow for IT 636 is its ability to streamline document signing processes, ensuring that your business can operate more efficiently. With an easy-to-use interface, it allows for quick eSigning of important documents, which enhances productivity and reduces turnaround times signNowly.

-

How does airSlate SignNow ensure document security for IT 636 users?

AirSlate SignNow prioritizes document security for IT 636 users by utilizing advanced encryption technologies and following industry-standard practices. This ensures that all signed documents are securely stored and accessible only to authorized users, thereby protecting sensitive information from unauthorized access.

-

What are the pricing options available for airSlate SignNow regarding IT 636?

AirSlate SignNow offers flexible pricing options tailored for IT 636 that cater to various business needs. Whether you're a small startup or a large enterprise, you can choose from multiple subscription plans that provide you with all essential features at a competitive price.

-

Can I integrate airSlate SignNow with other tools I use for IT 636?

Yes, airSlate SignNow offers seamless integrations with a variety of business applications and tools essential for IT 636. This allows you to enhance your existing workflows by connecting with popular platforms such as CRM systems, project management tools, and cloud storage services.

-

What features does airSlate SignNow provide for managing IT 636 documents?

AirSlate SignNow includes a range of features specifically designed for managing IT 636 documents, including customizable templates, in-app annotations, and automated workflows. These tools help ensure that the document management process is efficient and user-friendly, improving overall productivity.

-

How can airSlate SignNow improve the efficiency of my IT 636 processes?

By utilizing airSlate SignNow for your IT 636 processes, you can drastically improve efficiency through automation and ease of use. The platform simplifies document routing, reduces manual errors, and ensures that all parties can sign documents from anywhere, thus speeding up approvals and increasing operational agility.

-

Does airSlate SignNow offer customer support for IT 636 users?

Absolutely! airSlate SignNow provides dedicated customer support for IT 636 users through various channels, including live chat, email, and an extensive knowledge base. This ensures that any questions or issues can be resolved quickly, leading to smoother operations for your business.

Get more for Form IT 636 Alcoholic Beverage Production Credit Tax Year

Find out other Form IT 636 Alcoholic Beverage Production Credit Tax Year

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online