SECTION 606 Credits Against Tax LegislationNY State Senate 2022

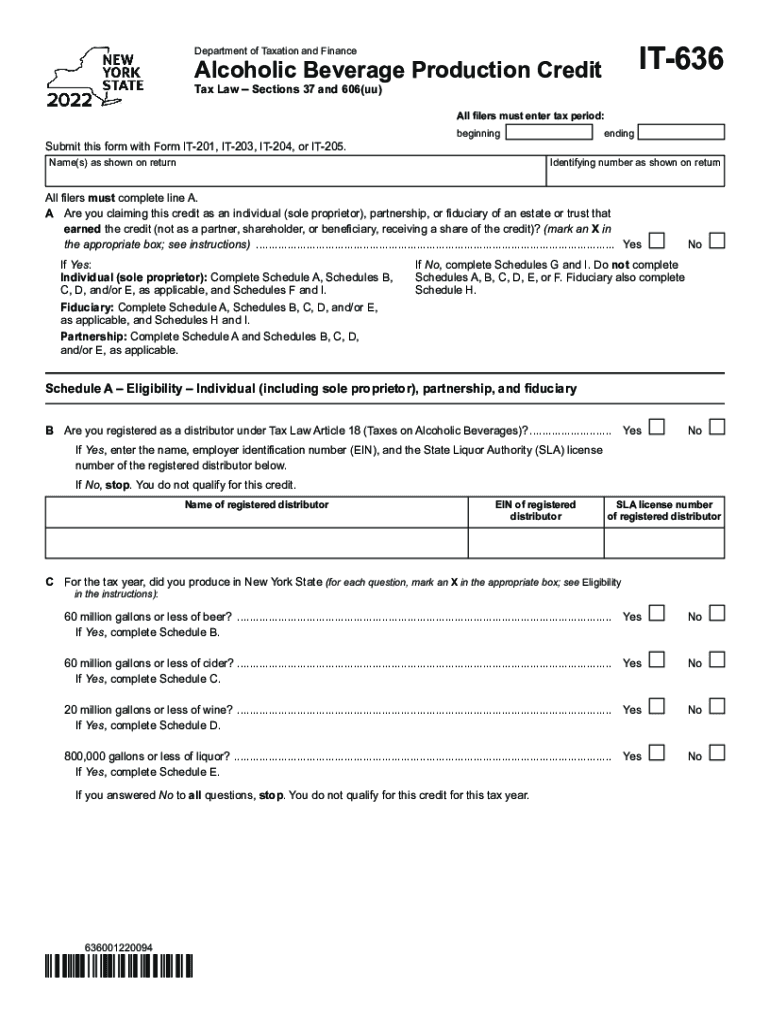

What is the 636 form?

The 636 form, also known as the IT 636, is a tax document used in the United States, specifically in New York, to claim the Section 606 credits against tax legislation. This form is essential for individuals and businesses seeking to benefit from tax credits designed to reduce their overall tax liability. Understanding the purpose of the 636 form is crucial for ensuring compliance with state tax laws and maximizing available tax benefits.

Steps to complete the 636 form

Completing the 636 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with your personal information, including your name, address, and Social Security number. Be sure to include any relevant details about your income and deductions. After completing the form, review it carefully for any errors before submitting it to the appropriate tax authority.

Eligibility criteria for the 636 form

To qualify for the benefits associated with the 636 form, individuals and businesses must meet specific eligibility criteria. Generally, applicants must be residents of New York and have taxable income that falls within the limits set by the state. Additionally, certain deductions and credits may apply based on the applicant's financial situation, so it is essential to review the requirements carefully before submitting the form.

Required documents for the 636 form

When preparing to submit the 636 form, certain documents are necessary to support your claim. These typically include proof of income, such as W-2 forms or 1099 statements, as well as documentation of any deductions you plan to claim. It may also be helpful to include previous tax returns to provide context for your current financial situation. Ensuring that all required documents are included can help facilitate a smoother review process by tax authorities.

Filing deadlines for the 636 form

Timeliness is critical when it comes to submitting the 636 form. The filing deadline typically aligns with the standard tax return due date, which is usually April fifteenth each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these deadlines to avoid penalties and ensure that you receive any eligible tax credits in a timely manner.

Legal use of the 636 form

The 636 form is legally binding when completed and submitted according to the regulations set forth by state tax authorities. To ensure its legal standing, it is essential to provide accurate information and adhere to all filing guidelines. Additionally, utilizing a reliable eSignature solution can enhance the legitimacy of the form, as it provides a digital certificate that verifies the identity of the signer and maintains compliance with relevant eSignature laws.

Quick guide on how to complete section 606 credits against tax legislationny state senate

Easily Prepare SECTION 606 Credits Against Tax LegislationNY State Senate on Any Device

Online document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage SECTION 606 Credits Against Tax LegislationNY State Senate on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign SECTION 606 Credits Against Tax LegislationNY State Senate Effortlessly

- Locate SECTION 606 Credits Against Tax LegislationNY State Senate and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign SECTION 606 Credits Against Tax LegislationNY State Senate and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct section 606 credits against tax legislationny state senate

Create this form in 5 minutes!

How to create an eSignature for the section 606 credits against tax legislationny state senate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 636 form and why do I need it?

The 636 form is a crucial document for businesses that require electronic signatures for various transactions. Utilizing airSlate SignNow allows you to easily create, manage, and send 636 forms for efficient processing, saving you time and ensuring compliance with regulations.

-

How does airSlate SignNow simplify the process of using a 636 form?

AirSlate SignNow streamlines the preparation and signing of 636 forms through its user-friendly interface. You can quickly upload documents, add fields for signatures, and send them to recipients, all while maintaining a secure and efficient workflow.

-

Is airSlate SignNow affordable for small businesses using the 636 form?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to small businesses, making it easy to manage 636 forms without breaking the bank. With various subscription options, you can choose a plan that fits your business needs and budget.

-

What features does airSlate SignNow offer for managing 636 forms?

AirSlate SignNow provides a range of features for 636 forms, including templates, customizable fields, and automated workflows. These functionalities not only enhance document management but also ensure quicker turnaround times for approvals and signatures.

-

Can I integrate airSlate SignNow with other software for 636 form management?

Absolutely! AirSlate SignNow integrates seamlessly with many popular software applications, allowing you to incorporate 636 forms into your existing workflows. This integration can help you enhance productivity and ensure a smooth document management process.

-

How secure is the signing process for a 636 form with airSlate SignNow?

The signing process for a 636 form on airSlate SignNow is highly secure, leveraging encryption and authentication protocols. Your documents are protected throughout their lifecycle, providing peace of mind that sensitive information remains confidential.

-

What benefits does eSigning a 636 form offer over traditional methods?

eSigning a 636 form through airSlate SignNow provides numerous benefits, including faster turnaround times and reduced paper usage. Additionally, it enhances accessibility, allowing users to sign from anywhere, which increases efficiency in business operations.

Get more for SECTION 606 Credits Against Tax LegislationNY State Senate

- Tennessee contract contractor form

- Renovation contract for contractor tennessee form

- Tn residential contractor form

- Concrete mason contract for contractor tennessee form

- Demolition contract for contractor tennessee form

- Framing contract for contractor tennessee form

- Security contract for contractor tennessee form

- Insulation contract for contractor tennessee form

Find out other SECTION 606 Credits Against Tax LegislationNY State Senate

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors