Minnesota Form M1MTC Alternative Minimum Tax Credit Minnesota Form M1MTC Alternative Minimum Tax Credit Minnesota Form M1MTC Alt 2019

Understanding the Minnesota Form M1MTC Alternative Minimum Tax Credit

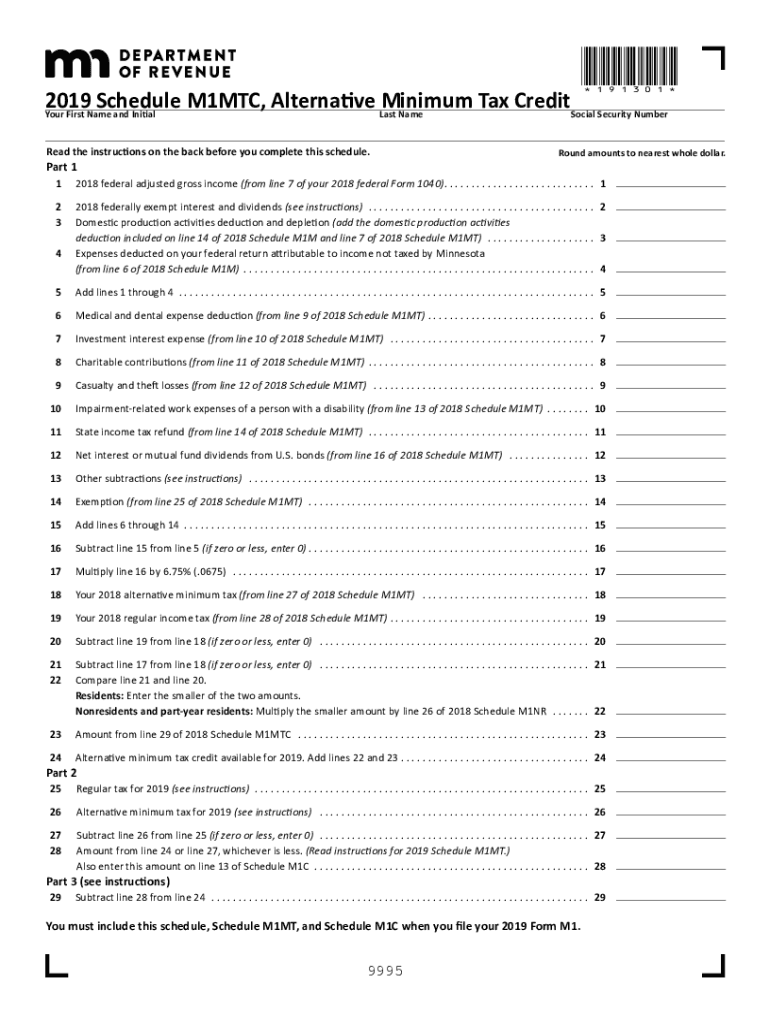

The Minnesota Form M1MTC is designed to provide taxpayers with a credit against their alternative minimum tax. This credit is particularly beneficial for individuals who may have higher taxable income due to certain deductions and credits that are not recognized under the alternative minimum tax system. Understanding the purpose and function of this form is crucial for eligible taxpayers in Minnesota, as it can significantly reduce their tax liability.

How to Obtain the Minnesota Form M1MTC

Taxpayers can obtain the Minnesota Form M1MTC through several avenues. The form is available on the Minnesota Department of Revenue website, where it can be downloaded and printed. Additionally, taxpayers may find the form in tax preparation software or through professional tax preparers. Ensuring you have the correct version of the form is essential for accurate filing.

Steps to Complete the Minnesota Form M1MTC

Completing the Minnesota Form M1MTC involves several key steps. First, gather all necessary documentation, including your income statements and any previous tax returns. Next, accurately fill out the form by following the instructions provided. This includes calculating your alternative minimum taxable income and determining the credit amount you are eligible for. Finally, review your entries for accuracy before submitting the form along with your state tax return.

Eligibility Criteria for the Minnesota Form M1MTC

To qualify for the Minnesota Form M1MTC, taxpayers must meet specific eligibility criteria. Generally, this includes having a certain level of alternative minimum taxable income and not exceeding specified income thresholds. Additionally, taxpayers must have paid alternative minimum tax in the previous year. It is important to review the eligibility requirements carefully to ensure compliance and maximize potential benefits.

Legal Use of the Minnesota Form M1MTC

The Minnesota Form M1MTC serves as a legally binding document when filled out and submitted correctly. For the form to be considered valid, it must be signed and dated by the taxpayer. Compliance with state tax laws is essential, as failure to adhere to these regulations may result in penalties or disqualification from receiving the credit. Utilizing a reliable eSignature solution can help ensure that the submission process is secure and legally recognized.

Filing Deadlines for the Minnesota Form M1MTC

Filing deadlines for the Minnesota Form M1MTC align with the state tax return deadlines. Typically, individual tax returns are due on April 15 each year, unless an extension is filed. It is crucial for taxpayers to be aware of these deadlines to avoid late fees or penalties. Keeping track of important dates ensures that all necessary forms, including the M1MTC, are submitted in a timely manner.

Examples of Using the Minnesota Form M1MTC

Utilizing the Minnesota Form M1MTC can be beneficial in various taxpayer scenarios. For instance, a taxpayer with significant deductions that are not allowed under the alternative minimum tax may find that this credit helps offset their tax liability. Additionally, individuals who have experienced changes in income or deductions from the previous year may also find value in applying for this credit. Each situation is unique, and understanding how the form applies can lead to substantial tax savings.

Quick guide on how to complete minnesota form m1mtc alternative minimum tax credit minnesota form m1mtc alternative minimum tax credit minnesota form m1mtc

Effortlessly Prepare Minnesota Form M1MTC Alternative Minimum Tax Credit Minnesota Form M1MTC Alternative Minimum Tax Credit Minnesota Form M1MTC Alt on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the appropriate form and securely store it on the internet. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Minnesota Form M1MTC Alternative Minimum Tax Credit Minnesota Form M1MTC Alternative Minimum Tax Credit Minnesota Form M1MTC Alt across any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Minnesota Form M1MTC Alternative Minimum Tax Credit Minnesota Form M1MTC Alternative Minimum Tax Credit Minnesota Form M1MTC Alt with Ease

- Find Minnesota Form M1MTC Alternative Minimum Tax Credit Minnesota Form M1MTC Alternative Minimum Tax Credit Minnesota Form M1MTC Alt and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with the features that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to finalize your edits.

- Choose your preferred method to share your form, via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form hunting, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your preference. Alter and eSign Minnesota Form M1MTC Alternative Minimum Tax Credit Minnesota Form M1MTC Alternative Minimum Tax Credit Minnesota Form M1MTC Alt and assure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota form m1mtc alternative minimum tax credit minnesota form m1mtc alternative minimum tax credit minnesota form m1mtc

Create this form in 5 minutes!

How to create an eSignature for the minnesota form m1mtc alternative minimum tax credit minnesota form m1mtc alternative minimum tax credit minnesota form m1mtc

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the process to schedule m1mtc using airSlate SignNow?

To schedule m1mtc with airSlate SignNow, simply log into your account and navigate to the scheduling feature. From there, you can select the desired date and time, making it easy to manage your document signing process efficiently. Our user-friendly interface ensures that scheduling is straightforward and fast.

-

Are there any costs associated with scheduling m1mtc?

Yes, while airSlate SignNow offers a range of competitive pricing plans, scheduling m1mtc may involve specific fees based on your selected plan. We recommend reviewing our pricing page to find the best option that fits your business needs and to understand any additional costs that may apply.

-

What features does airSlate SignNow offer for scheduling m1mtc?

airSlate SignNow provides robust features to schedule m1mtc, including automated reminders, customizable scheduling options, and integration with calendar applications. These features allow you to streamline your document processes, ensuring that everything is organized and timely.

-

How can scheduling m1mtc benefit my business?

Scheduling m1mtc allows your business to enhance its document management efficiency by providing a streamlined approach to signing and sending documents. This leads to reduced turnaround times and improved productivity, ensuring your team can focus on more important tasks without unnecessary delays.

-

Can I integrate other platforms with airSlate SignNow to schedule m1mtc?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, allowing you to schedule m1mtc directly from your existing workflow tools. Popular integrations include CRM systems, project management software, and email clients, making it easier to manage your documents in one place.

-

Is there a mobile app to help me schedule m1mtc?

Yes, airSlate SignNow offers a mobile application that allows you to schedule m1mtc on the go. This mobile functionality ensures that you can manage your documents and signing schedules right from your smartphone or tablet, providing flexibility and convenience.

-

What types of documents can I schedule m1mtc for?

You can schedule m1mtc for various document types, including contracts, agreements, and forms. airSlate SignNow supports multiple file formats, enabling you to prepare and send any document that requires signatures or approvals efficiently.

Get more for Minnesota Form M1MTC Alternative Minimum Tax Credit Minnesota Form M1MTC Alternative Minimum Tax Credit Minnesota Form M1MTC Alt

- Mod r form 535801102

- Land transfer form

- Iccrc retainer agreement template 2020 form

- Iccrc retainer agreement template form

- C966 rev jan 20192xdp form

- C966 bemployer39s authorizationb of a representative wcb ab form

- Request for information request form ehealth

- Consent and declaration for treatmentprodedure extcontent covenanthealth form

Find out other Minnesota Form M1MTC Alternative Minimum Tax Credit Minnesota Form M1MTC Alternative Minimum Tax Credit Minnesota Form M1MTC Alt

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast