Minnesota Form M1MTC Alternative Minimum Tax CreditMinnesota Form M1MTC Alternative Minimum Tax CreditMinnesota Form M1MTC Alter 2022-2026

Understanding the Minnesota Form M1MTC Alternative Minimum Tax Credit

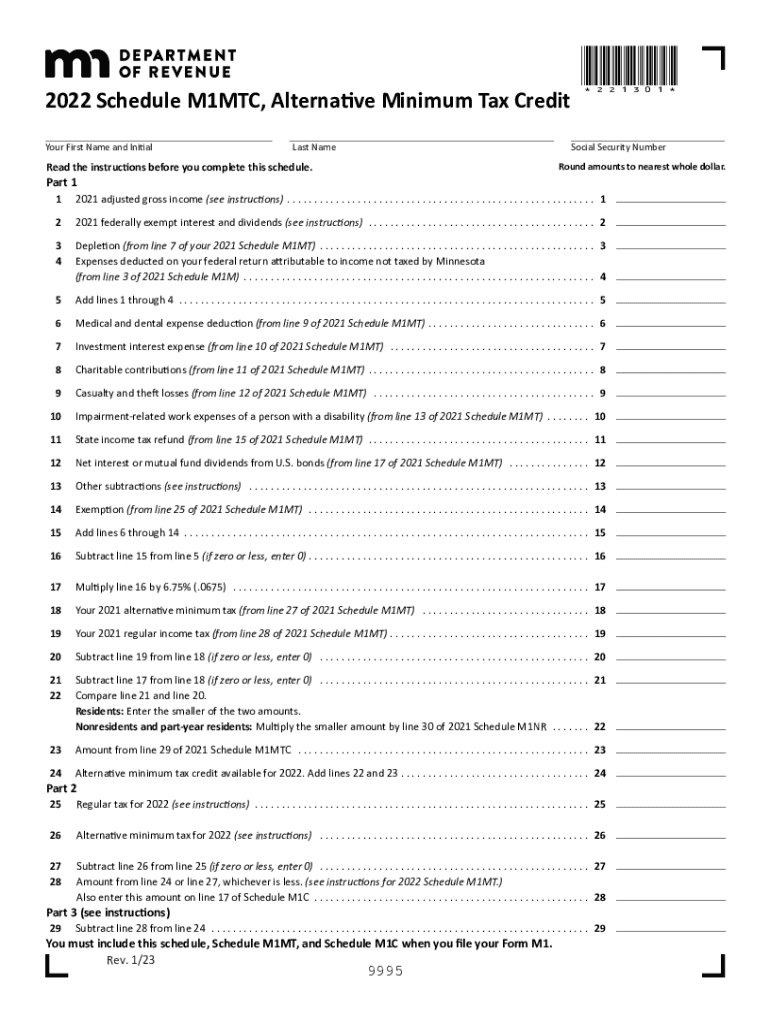

The Minnesota Form M1MTC is designed to help taxpayers claim the Alternative Minimum Tax (AMT) credit. This credit is available to individuals who have previously paid AMT and can now apply for a refund. It is essential for taxpayers to understand the purpose of this form, as it allows them to reduce their tax liability based on prior AMT payments. The M1MTC ensures that taxpayers are not penalized for their income levels, providing a fairer tax system.

Steps to Complete the Minnesota Form M1MTC

Completing the Minnesota Form M1MTC involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including previous tax returns and AMT calculations. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Then, calculate the amount of AMT you have paid in previous years and enter this figure on the form. Finally, review the completed form for any errors before submitting it to the Minnesota Department of Revenue.

Eligibility Criteria for the Minnesota Form M1MTC

To qualify for the M1MTC, taxpayers must meet specific eligibility criteria. Primarily, you must have paid Alternative Minimum Tax in previous years and be filing a Minnesota individual income tax return. Additionally, the credit is available to both residents and non-residents who have earned income in Minnesota. It is important to ensure that all requirements are met to avoid delays in processing your claim.

Obtaining the Minnesota Form M1MTC

The Minnesota Form M1MTC can be obtained from the Minnesota Department of Revenue's official website. It is available in a downloadable PDF format, which can be printed and filled out manually. Alternatively, taxpayers can access the form through tax preparation software that supports Minnesota tax forms. Ensuring you have the latest version of the form is crucial, as tax laws and requirements may change annually.

Key Elements of the Minnesota Form M1MTC

The M1MTC includes several key elements that are critical for proper completion. These elements consist of taxpayer identification information, a section for detailing prior AMT payments, and calculations that determine the credit amount. Additionally, the form may require supporting documentation to substantiate your claims, such as copies of previous tax returns where AMT was assessed.

Legal Use of the Minnesota Form M1MTC

When using the Minnesota Form M1MTC, it is essential to adhere to legal guidelines to ensure that the submission is valid. The form must be completed accurately and submitted by the designated deadline. Failure to comply with these regulations can result in penalties or denial of the credit. Furthermore, eSignatures are accepted for the electronic submission of the form, provided they meet the legal standards set forth by the state.

Quick guide on how to complete minnesota form m1mtc alternative minimum tax creditminnesota form m1mtc alternative minimum tax creditminnesota form m1mtc

Easily Prepare Minnesota Form M1MTC Alternative Minimum Tax CreditMinnesota Form M1MTC Alternative Minimum Tax CreditMinnesota Form M1MTC Alter on Any Device

Managing documents online has gained traction among companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the correct document and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any interruptions. Manage Minnesota Form M1MTC Alternative Minimum Tax CreditMinnesota Form M1MTC Alternative Minimum Tax CreditMinnesota Form M1MTC Alter on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

Effortlessly Edit and eSign Minnesota Form M1MTC Alternative Minimum Tax CreditMinnesota Form M1MTC Alternative Minimum Tax CreditMinnesota Form M1MTC Alter

- Find Minnesota Form M1MTC Alternative Minimum Tax CreditMinnesota Form M1MTC Alternative Minimum Tax CreditMinnesota Form M1MTC Alter and click Get Form to begin.

- Utilize the features we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which only takes a few seconds and holds the same legal significance as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it onto your computer.

Eliminate the hassle of lost or misplaced files, time-consuming form searches, or errors that prompt the need for new printed copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Minnesota Form M1MTC Alternative Minimum Tax CreditMinnesota Form M1MTC Alternative Minimum Tax CreditMinnesota Form M1MTC Alter to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota form m1mtc alternative minimum tax creditminnesota form m1mtc alternative minimum tax creditminnesota form m1mtc

Create this form in 5 minutes!

People also ask

-

What features are included with m1mtc?

The m1mtc plan includes a comprehensive set of features such as document editing, eSigning, and advanced security options. Users can easily customize their workflows, create templates, and send documents for signature in just a few clicks. Additionally, m1mtc supports integrations with other tools, enhancing your business processes.

-

How does m1mtc benefit businesses?

m1mtc offers signNow benefits for businesses by streamlining the document signing process. With its easy-to-use interface, businesses can reduce the time and resources spent on managing paperwork. This efficiency translates to faster transactions and improved customer satisfaction, making m1mtc an invaluable tool.

-

What is the pricing structure for m1mtc?

The pricing for the m1mtc plan is designed to be competitive and cost-effective for businesses of all sizes. You can choose from various subscription tiers that cater to different usage levels, ensuring that you get the features you need without overspending. For detailed pricing information, visit our website or contact our sales team.

-

Can m1mtc integrate with other software?

Yes, m1mtc seamlessly integrates with various third-party applications, which enhances its functionality and fits into your existing workflows. Popular integrations include tools like CRM systems, project management apps, and cloud storage services. These integrations help automate processes and improve collaboration across your organization.

-

Is m1mtc secure for sensitive documents?

Absolutely, m1mtc prioritizes security and complies with industry standards to protect sensitive information. It employs encryption for data transmission and storage, ensuring that your documents remain confidential. With m1mtc, you can rest assured that your information is safe and secure from unauthorized access.

-

How user-friendly is the m1mtc platform?

The m1mtc platform is designed to be extremely user-friendly, with an intuitive interface that requires no technical expertise. Users can easily navigate through the features to send documents for eSignature quickly. Comprehensive support resources further ensure that you can maximize the benefits of m1mtc.

-

Can I try m1mtc before purchasing?

Yes, you can take advantage of a free trial of m1mtc to explore its features and benefits without any commitment. This trial allows you to test the platform and see how it can streamline your document management processes. Sign up for the trial on our website to get started today.

Get more for Minnesota Form M1MTC Alternative Minimum Tax CreditMinnesota Form M1MTC Alternative Minimum Tax CreditMinnesota Form M1MTC Alter

- Property manager agreement nebraska form

- Agreement for delayed or partial rent payments nebraska form

- Tenants maintenance repair request form nebraska

- Guaranty attachment to lease for guarantor or cosigner nebraska form

- Amendment to lease or rental agreement nebraska form

- Warning notice due to complaint from neighbors nebraska form

- Lease subordination agreement nebraska form

- Apartment rules and regulations nebraska form

Find out other Minnesota Form M1MTC Alternative Minimum Tax CreditMinnesota Form M1MTC Alternative Minimum Tax CreditMinnesota Form M1MTC Alter

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document