M1MTC, Alternative Minimum Tax Credit Schedule for Calculating the Minnesota Alternative Minimum Tax Credit 2021

What is the M1MTC, Alternative Minimum Tax Credit Schedule For Calculating The Minnesota Alternative Minimum Tax Credit

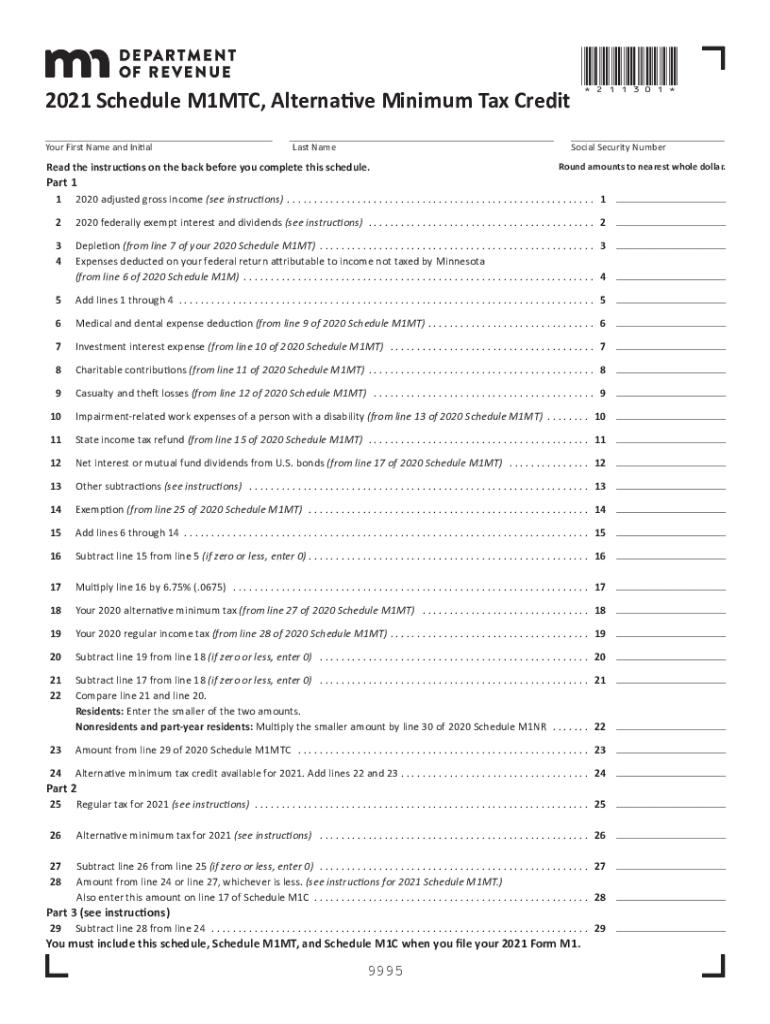

The M1MTC is a specific form used in Minnesota to calculate the Alternative Minimum Tax Credit. This credit is designed to assist taxpayers who may be subject to the alternative minimum tax (AMT), which ensures that individuals pay at least a minimum amount of tax. The M1MTC form allows taxpayers to determine their eligibility for this credit and calculate the amount they can claim. It is essential for individuals to understand how this credit functions, as it can significantly affect their overall tax liability.

How to use the M1MTC, Alternative Minimum Tax Credit Schedule For Calculating The Minnesota Alternative Minimum Tax Credit

Using the M1MTC involves several steps. First, taxpayers must gather their financial documents, including income statements and any previous tax returns. Next, they should fill out the M1MTC form, ensuring that all required fields are completed accurately. This includes reporting income, deductions, and any other relevant financial information. Once the form is completed, it should be submitted along with the Minnesota income tax return. It is important to keep a copy of the M1MTC for personal records and future reference.

Steps to complete the M1MTC, Alternative Minimum Tax Credit Schedule For Calculating The Minnesota Alternative Minimum Tax Credit

Completing the M1MTC requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including W-2s, 1099s, and prior year tax returns.

- Begin filling out the M1MTC form by entering personal information, such as name and Social Security number.

- Report your income, including wages, dividends, and any other sources.

- List deductions and credits that apply to your situation.

- Calculate the Alternative Minimum Tax and compare it to your regular tax liability.

- Determine the amount of credit you are eligible to claim.

- Review the completed form for accuracy before submission.

Key elements of the M1MTC, Alternative Minimum Tax Credit Schedule For Calculating The Minnesota Alternative Minimum Tax Credit

The M1MTC includes several key elements that are crucial for accurate completion. These elements consist of personal identification information, income details, and a comprehensive list of deductions. Additionally, the form requires taxpayers to calculate their alternative minimum taxable income and determine their AMT liability. Understanding these components is vital for ensuring that the form is filled out correctly and that the taxpayer receives the appropriate credit.

Eligibility Criteria

To qualify for the M1MTC, taxpayers must meet specific eligibility criteria. Generally, this includes being a resident of Minnesota and having income that exceeds certain thresholds. Additionally, taxpayers must have paid alternative minimum tax in previous years to claim the credit. It is essential for individuals to review these criteria carefully to determine their eligibility before completing the form.

Form Submission Methods (Online / Mail / In-Person)

The M1MTC can be submitted through various methods. Taxpayers have the option to file online using approved tax software, which often simplifies the process and ensures accuracy. Alternatively, the form can be mailed to the appropriate Minnesota tax authority. For those who prefer in-person assistance, visiting a local tax office is also an option. Each submission method has its own guidelines and deadlines, so it is important to choose the one that best suits the taxpayer's needs.

Quick guide on how to complete 2021 m1mtc alternative minimum tax credit schedule for calculating the minnesota alternative minimum tax credit

Effortlessly Prepare M1MTC, Alternative Minimum Tax Credit Schedule For Calculating The Minnesota Alternative Minimum Tax Credit on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents promptly without delays. Manage M1MTC, Alternative Minimum Tax Credit Schedule For Calculating The Minnesota Alternative Minimum Tax Credit from any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to effortlessly edit and eSign M1MTC, Alternative Minimum Tax Credit Schedule For Calculating The Minnesota Alternative Minimum Tax Credit

- Obtain M1MTC, Alternative Minimum Tax Credit Schedule For Calculating The Minnesota Alternative Minimum Tax Credit and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign function, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and then click the Done button to store your modifications.

- Select your preferred method of delivering your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or the need to print new document versions. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Modify and eSign M1MTC, Alternative Minimum Tax Credit Schedule For Calculating The Minnesota Alternative Minimum Tax Credit while ensuring smooth communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 m1mtc alternative minimum tax credit schedule for calculating the minnesota alternative minimum tax credit

Create this form in 5 minutes!

How to create an eSignature for the 2021 m1mtc alternative minimum tax credit schedule for calculating the minnesota alternative minimum tax credit

The best way to create an e-signature for your PDF document online

The best way to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to make an e-signature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

How to make an e-signature for a PDF file on Android OS

People also ask

-

What is m1mtc in relation to airSlate SignNow?

m1mtc refers to the unique features and functionalities offered by airSlate SignNow to streamline the eSigning process. This solution empowers users to sign documents quickly and securely, making it an essential tool for businesses looking to enhance their document workflow.

-

How does airSlate SignNow's pricing structure for m1mtc work?

The pricing for m1mtc within airSlate SignNow is designed to be cost-effective for businesses of all sizes. Different plans are available, allowing customers to choose the one that best fits their needs, ensuring you only pay for the features you utilize.

-

What key features does m1mtc offer to users?

m1mtc incorporates various features including customizable templates, automated workflows, and real-time tracking of document status. This comprehensive functionality allows businesses to efficiently manage their signing processes while improving overall productivity.

-

What are the benefits of using airSlate SignNow's m1mtc for my business?

By utilizing m1mtc, businesses can signNowly speed up their document signing processes, reduce paperwork, and enhance customer satisfaction. Its user-friendly interface ensures that both employees and clients can navigate the signing process with ease.

-

Can I integrate m1mtc with other tools and platforms?

Yes, airSlate SignNow's m1mtc offers seamless integrations with various third-party applications such as CRMs, cloud storage solutions, and productivity tools. This flexibility allows businesses to incorporate eSigning into their existing workflows effortlessly.

-

Is m1mtc compliant with legal standards?

Absolutely, airSlate SignNow's m1mtc adheres to all relevant legal standards for electronic signatures, ensuring that your signed documents are legally binding. This compliance gives users the confidence to rely on eSigning for critical business transactions.

-

What types of documents can I send using m1mtc?

With m1mtc, you can send a variety of document types for eSigning, including contracts, agreements, and forms. This versatility makes airSlate SignNow an ideal solution for any business looking to digitize their documentation processes.

Get more for M1MTC, Alternative Minimum Tax Credit Schedule For Calculating The Minnesota Alternative Minimum Tax Credit

- Flood zone statement and authorization florida form

- Name affidavit of buyer florida form

- Name affidavit of seller florida form

- Non foreign affidavit under irc 1445 florida form

- Florida affidavit pdf form

- Affidavit occupancy form

- Complex will with credit shelter marital trust for large estates florida form

- Marital legal separation and property settlement agreement for persons with no children no joint property or debts where 497303257 form

Find out other M1MTC, Alternative Minimum Tax Credit Schedule For Calculating The Minnesota Alternative Minimum Tax Credit

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF