Printable Minnesota Form M1CR Credit for Income Tax Paid to Another State 2020

What is the Printable Minnesota Form M1CR Credit For Income Tax Paid To Another State

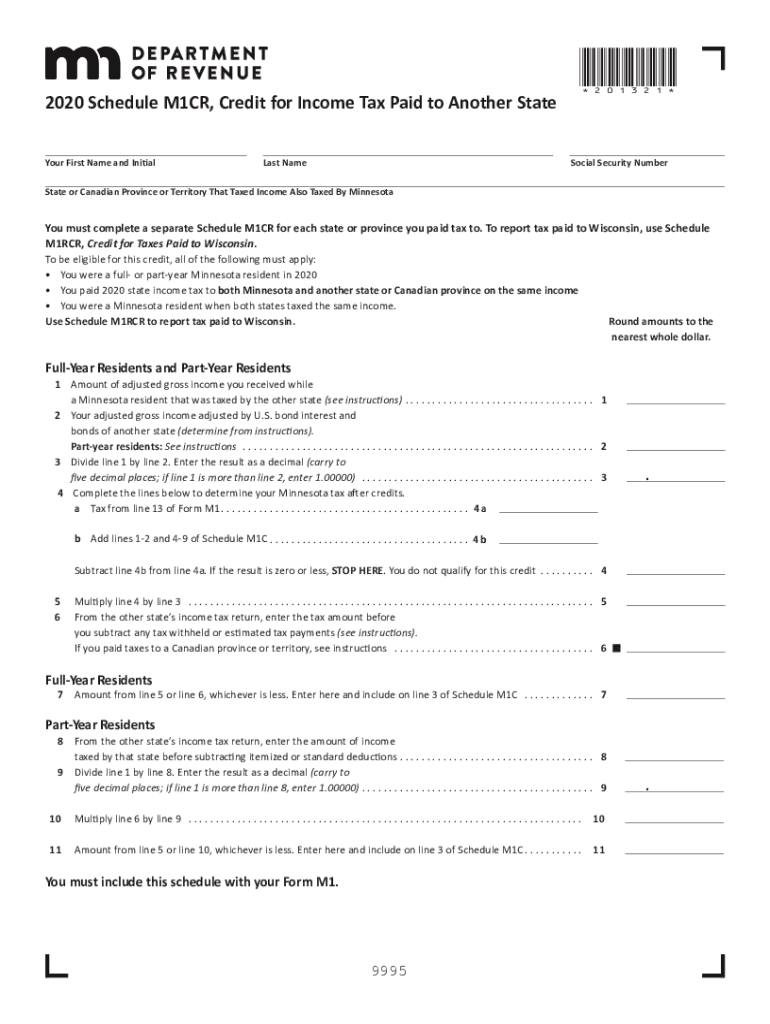

The Printable Minnesota Form M1CR is a tax document used by residents of Minnesota to claim a credit for income taxes paid to another state. This form is essential for individuals who have earned income in states outside of Minnesota and have paid state income tax there. By utilizing this credit, taxpayers can reduce their Minnesota tax liability, ensuring they are not taxed twice on the same income.

How to use the Printable Minnesota Form M1CR Credit For Income Tax Paid To Another State

To effectively use the Printable Minnesota Form M1CR, taxpayers need to gather relevant information about the income earned in the other state and the taxes paid. This includes details such as the amount of income, the state where it was earned, and the corresponding tax paid. Once this information is compiled, it can be entered into the form, allowing for a precise calculation of the credit. This process helps ensure that taxpayers receive the appropriate reduction in their Minnesota tax obligations.

Steps to complete the Printable Minnesota Form M1CR Credit For Income Tax Paid To Another State

Completing the Printable Minnesota Form M1CR involves several key steps:

- Gather necessary documents, including W-2s and tax returns from the other state.

- Fill in personal information such as name, address, and Social Security number.

- Report the income earned in the other state and the taxes paid on that income.

- Calculate the credit amount based on the instructions provided with the form.

- Review the completed form for accuracy before submission.

Legal use of the Printable Minnesota Form M1CR Credit For Income Tax Paid To Another State

The Printable Minnesota Form M1CR is legally recognized as a valid document for claiming tax credits. To ensure compliance, it is important for taxpayers to adhere to the guidelines set forth by the Minnesota Department of Revenue. This includes using the most current version of the form and providing accurate information. Properly completed forms can help avoid legal issues related to tax filings and ensure that taxpayers receive the credits they are entitled to.

Eligibility Criteria

To be eligible to use the Printable Minnesota Form M1CR, taxpayers must meet specific criteria. They must be Minnesota residents who have paid income tax to another state on income earned outside of Minnesota. Additionally, the income must be subject to taxation in both states. It is essential for individuals to review their tax situations to confirm their eligibility for this credit before filing.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Printable Minnesota Form M1CR. Typically, this form is due on the same date as the Minnesota state income tax return, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Staying informed about these dates is crucial to avoid penalties and ensure timely submissions.

Quick guide on how to complete printable 2020 minnesota form m1cr credit for income tax paid to another state

Prepare Printable Minnesota Form M1CR Credit For Income Tax Paid To Another State effortlessly on any device

Web-based document management has become increasingly popular among enterprises and individuals alike. It offers an ideal eco-friendly alternative to conventional paper documents that need to be printed and signed, empowering you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Printable Minnesota Form M1CR Credit For Income Tax Paid To Another State on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest method to modify and eSign Printable Minnesota Form M1CR Credit For Income Tax Paid To Another State seamlessly

- Find Printable Minnesota Form M1CR Credit For Income Tax Paid To Another State and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Printable Minnesota Form M1CR Credit For Income Tax Paid To Another State and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 minnesota form m1cr credit for income tax paid to another state

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 minnesota form m1cr credit for income tax paid to another state

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is the best way to schedule m1cr using airSlate SignNow?

To effectively schedule m1cr, simply log into your airSlate SignNow account, select the document you want to send for signing, and choose the scheduling options. With our intuitive interface, you can customize the delivery date and time for seamless workflow integration.

-

How does airSlate SignNow handle document security when scheduling m1cr?

AirSlate SignNow prioritizes document security while you schedule m1cr by employing encryption and secure access protocols. Your sensitive information is protected during the entire signing process, ensuring compliance with industry standards.

-

Is there a trial period available for scheduling m1cr with airSlate SignNow?

Yes, airSlate SignNow offers a free trial period for prospective users to explore our features, including scheduling m1cr. This allows businesses to understand how our platform can enhance their document workflows before committing to a plan.

-

What pricing plans are available for scheduling m1cr?

AirSlate SignNow provides various pricing plans tailored to different business needs when scheduling m1cr. These plans include monthly and annual subscriptions, allowing you to choose a cost-effective solution that aligns with your usage requirements.

-

Can airSlate SignNow integrate with other applications while scheduling m1cr?

Absolutely! AirSlate SignNow integrates seamlessly with popular applications like Salesforce, HubSpot, and Google Workspace, enabling you to schedule m1cr without disrupting your existing workflows. This integration enhances your overall efficiency and document management.

-

What are the key benefits of using airSlate SignNow to schedule m1cr?

Using airSlate SignNow to schedule m1cr offers numerous benefits, including time-saving automation, ease of use, and enhanced document tracking. These features empower businesses to streamline their signing processes and improve overall productivity.

-

How can airSlate SignNow assist businesses in scheduling m1cr efficiently?

AirSlate SignNow assists businesses in scheduling m1cr efficiently by providing robust tools for document management and timely notifications. These features allow users to manage their signing processes easily, ensuring that documents are signed on schedule.

Get more for Printable Minnesota Form M1CR Credit For Income Tax Paid To Another State

Find out other Printable Minnesota Form M1CR Credit For Income Tax Paid To Another State

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will