Form Tc 41s Credit for Income Tax Paid to Another State 2021

What is the Form M1CR 2020?

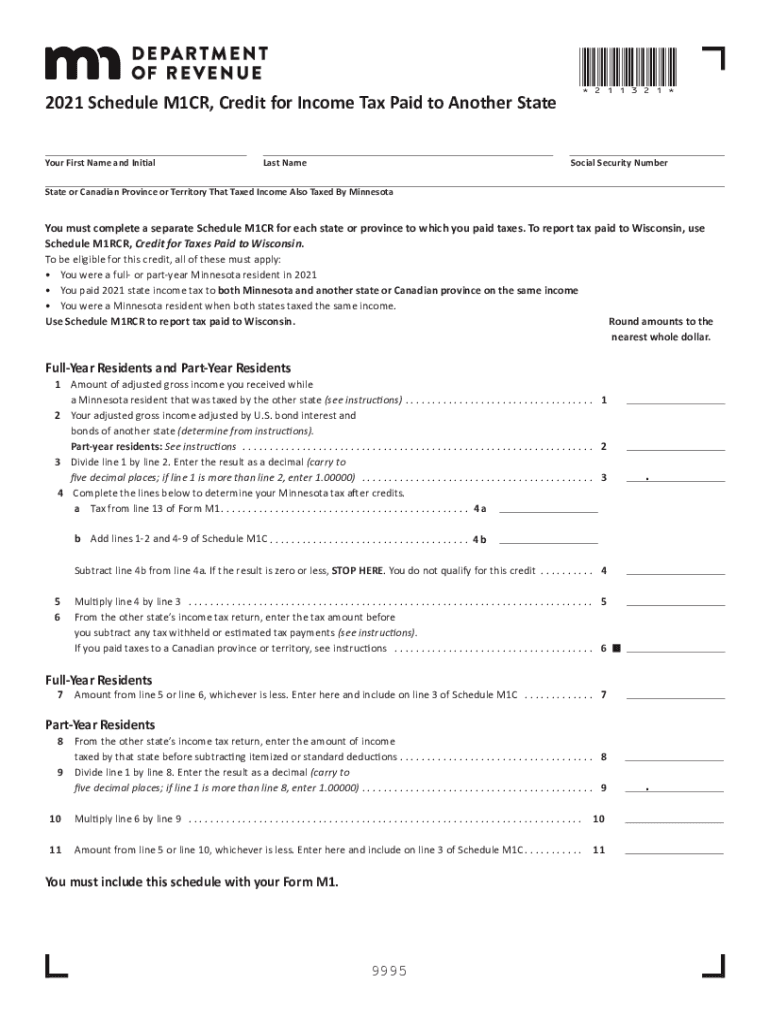

The Form M1CR 2020 is a tax form used in the United States for claiming a credit for income tax paid to another state. This form is particularly relevant for individuals who have income sourced from multiple states and need to ensure they are not taxed twice on the same income. By completing the M1CR, taxpayers can receive a credit that reduces their overall tax liability, making it an essential tool for managing state taxes effectively.

How to Use the Form M1CR 2020

Using the Form M1CR 2020 involves several steps to ensure accurate completion. First, gather all necessary documentation, including proof of income earned in the other state and any tax returns filed there. Next, fill out the form by providing your personal information, details of the income earned, and the amount of tax paid to the other state. It is crucial to review the instructions carefully to avoid errors that could delay processing or result in penalties.

Steps to Complete the Form M1CR 2020

Completing the Form M1CR 2020 requires careful attention to detail. Follow these steps:

- Obtain the form from the appropriate state tax authority or download it from their website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report the income earned in the other state, ensuring to include any necessary documentation.

- Calculate the credit amount based on the tax paid to the other state.

- Sign and date the form before submission.

Eligibility Criteria for the Form M1CR 2020

To be eligible to use the Form M1CR 2020, taxpayers must meet specific criteria. Primarily, individuals must have paid income tax to another state while being residents of their home state. Additionally, the income must be taxable in both states to qualify for the credit. It is important to verify that all income and tax details are accurate to ensure eligibility and compliance with state regulations.

Filing Deadlines for the Form M1CR 2020

Filing deadlines for the Form M1CR 2020 typically align with the general tax filing deadlines set by the IRS. Taxpayers should ensure that they submit the form by the due date to avoid late fees or penalties. It is advisable to check with the relevant state tax authority for any specific deadlines or extensions that may apply to the M1CR filing.

Form Submission Methods for M1CR 2020

The Form M1CR 2020 can be submitted through various methods, depending on the state’s regulations. Common submission methods include:

- Online submission through the state tax authority's website.

- Mailing a physical copy to the designated address provided in the form instructions.

- In-person submission at local tax offices, if available.

Quick guide on how to complete form tc 41s credit for income tax paid to another state

Easily prepare Form Tc 41s Credit For Income Tax Paid To Another State on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form Tc 41s Credit For Income Tax Paid To Another State on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Form Tc 41s Credit For Income Tax Paid To Another State effortlessly

- Find Form Tc 41s Credit For Income Tax Paid To Another State and click Get Form to begin.

- Use the tools available to complete your form.

- Highlight essential sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you would like to deliver your form, via email, SMS, an invitation link, or download it to your computer.

Eliminate the risk of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Form Tc 41s Credit For Income Tax Paid To Another State and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form tc 41s credit for income tax paid to another state

Create this form in 5 minutes!

How to create an eSignature for the form tc 41s credit for income tax paid to another state

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an e-signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the form m1cr 2020 and how is it used?

The form m1cr 2020 is a document used for various business purposes, including tax filings and official communications. With airSlate SignNow, businesses can easily fill out, sign, and send this form electronically, streamlining the process and ensuring compliance.

-

How does airSlate SignNow simplify the completion of form m1cr 2020?

airSlate SignNow offers an intuitive platform that simplifies the completion of form m1cr 2020 by providing easy-to-use templates and drag-and-drop features. This allows users to quickly input necessary information and electronically sign the document, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow for form m1cr 2020?

airSlate SignNow offers competitive pricing plans designed for businesses of all sizes. Users can choose from monthly or annual subscriptions that provide access to features specifically tailored for managing documents like form m1cr 2020, ensuring a cost-effective solution.

-

Can form m1cr 2020 be integrated with other software using airSlate SignNow?

Yes, airSlate SignNow supports integrations with various software applications, including CRM and accounting systems. This means that users can seamlessly manage their form m1cr 2020 alongside other business processes, enhancing efficiency and data accuracy.

-

What are the benefits of using airSlate SignNow for form m1cr 2020?

Using airSlate SignNow for form m1cr 2020 provides numerous benefits, such as speed, security, and ease of use. Businesses can reduce the time spent on paperwork, ensure document integrity, and maintain compliance with electronic signature laws.

-

Is airSlate SignNow compliant with e-signature laws for form m1cr 2020?

Absolutely! airSlate SignNow adheres to all e-signature laws and regulations, ensuring that documents like form m1cr 2020 are legally binding and recognized by authorities. This compliance gives users peace of mind when sending and receiving signed documents.

-

How can I track the status of my form m1cr 2020 with airSlate SignNow?

airSlate SignNow provides a tracking feature that allows users to monitor the status of their form m1cr 2020 throughout the signing process. Users receive real-time notifications when the document is viewed, signed, or completed, ensuring transparency and accountability.

Get more for Form Tc 41s Credit For Income Tax Paid To Another State

- Expungement packet florida form

- Florida juvenile form

- Fl foreclosure form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497303302 form

- Florida annual 497303303 form

- Notices resolutions simple stock ledger and certificate florida form

- Organizational meeting florida form

- Florida file form

Find out other Form Tc 41s Credit For Income Tax Paid To Another State

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors