Printable Minnesota Form M1CR Credit for Income TaxPrintable Minnesota Form M1CR Credit for Income TaxPrintable Minnesota Form M 2022-2026

Understanding the Printable Minnesota Form M1CR Credit for Income Tax

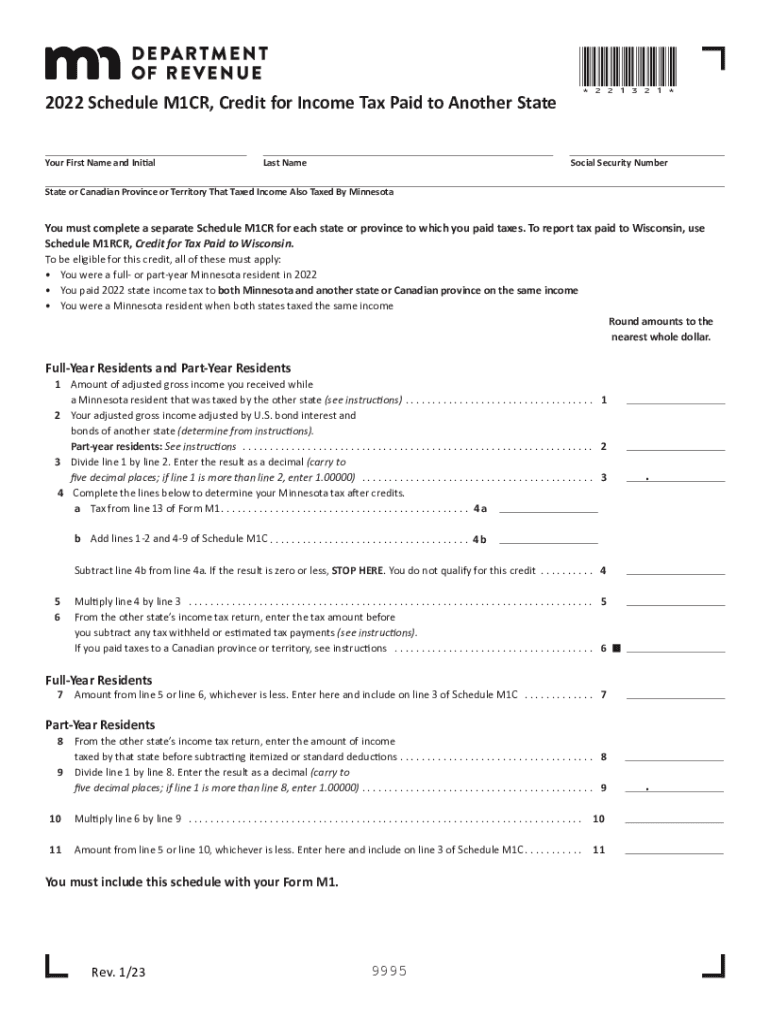

The Printable Minnesota Form M1CR is designed for taxpayers who have paid income tax to another state. This form allows individuals to claim a credit for taxes paid to other states, reducing their Minnesota tax liability. It is essential for residents who earn income in multiple states or who have moved to Minnesota during the tax year. Understanding the purpose of this form is crucial for maximizing potential tax benefits.

Steps to Complete the Printable Minnesota Form M1CR Credit for Income Tax

Completing the Printable Minnesota Form M1CR involves several key steps:

- Gather necessary documents, including W-2s and any tax returns from the other state.

- Fill out your personal information accurately, including your Social Security number and address.

- Report the income earned in the other state and the amount of tax paid there.

- Calculate the credit based on the instructions provided on the form.

- Review the form for accuracy before submission.

Legal Use of the Printable Minnesota Form M1CR Credit for Income Tax

The Printable Minnesota Form M1CR is legally recognized for claiming credits on taxes paid to another state. To ensure compliance, it is important to follow the guidelines set forth by the Minnesota Department of Revenue. This includes accurate reporting of income and taxes paid, as well as adherence to filing deadlines. Using this form correctly can help avoid penalties and ensure that you receive the credit you are entitled to.

Eligibility Criteria for the Printable Minnesota Form M1CR Credit for Income Tax

To qualify for the credit using the Printable Minnesota Form M1CR, taxpayers must meet specific eligibility criteria:

- You must be a resident of Minnesota for part of the tax year.

- You must have paid income tax to another state on income earned during the same tax year.

- The income must be included in your Minnesota taxable income.

Form Submission Methods for the Printable Minnesota Form M1CR Credit for Income Tax

The Printable Minnesota Form M1CR can be submitted through various methods:

- Online: If filing electronically, ensure that you use compatible tax software that supports the form.

- By Mail: Print and send the completed form to the address specified by the Minnesota Department of Revenue.

- In-Person: You may also deliver the form directly to a local Minnesota Department of Revenue office.

Key Elements of the Printable Minnesota Form M1CR Credit for Income Tax

Important components of the Printable Minnesota Form M1CR include:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Income Reporting: Accurate reporting of income earned in the other state.

- Tax Paid: Documentation of the tax amount paid to the other state.

- Calculation of Credit: A section to determine the eligible credit based on reported figures.

Quick guide on how to complete printable 2021 minnesota form m1cr credit for income taxprintable 2021 minnesota form m1cr credit for income taxprintable 2021

Complete Printable Minnesota Form M1CR Credit For Income TaxPrintable Minnesota Form M1CR Credit For Income TaxPrintable Minnesota Form M effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily locate the necessary form and store it securely online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without any holdups. Manage Printable Minnesota Form M1CR Credit For Income TaxPrintable Minnesota Form M1CR Credit For Income TaxPrintable Minnesota Form M on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The simplest way to modify and eSign Printable Minnesota Form M1CR Credit For Income TaxPrintable Minnesota Form M1CR Credit For Income TaxPrintable Minnesota Form M with ease

- Obtain Printable Minnesota Form M1CR Credit For Income TaxPrintable Minnesota Form M1CR Credit For Income TaxPrintable Minnesota Form M and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all your details and click on the Done button to retain your changes.

- Choose how you would like to send your form, whether via email, text (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device you prefer. Revise and eSign Printable Minnesota Form M1CR Credit For Income TaxPrintable Minnesota Form M1CR Credit For Income TaxPrintable Minnesota Form M and guarantee smooth communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2021 minnesota form m1cr credit for income taxprintable 2021 minnesota form m1cr credit for income taxprintable 2021

Create this form in 5 minutes!

People also ask

-

What is m1cr and how does it relate to airSlate SignNow?

m1cr refers to the advanced capabilities of airSlate SignNow that streamline document signing and management. This feature ensures that users can efficiently handle electronic signatures and document workflow, making it easier for businesses to adopt digital solutions.

-

How much does airSlate SignNow with m1cr features cost?

Pricing for airSlate SignNow with m1cr features varies based on the plan selected. We offer competitive pricing that includes essential capabilities for businesses of all sizes, ensuring that you get the best value for your eSigning needs.

-

What are the key features of airSlate SignNow's m1cr?

The m1cr features of airSlate SignNow include customizable workflows, secure document storage, and multi-platform access. These capabilities allow businesses to enhance their document processes and improve overall productivity by facilitating faster e-signatures.

-

What benefits does using m1cr with airSlate SignNow provide?

Using m1cr with airSlate SignNow offers several advantages, such as increased efficiency and reduced turnaround time for document signing. It empowers teams to collaborate better, reduces operational costs, and supports compliance with industry standards.

-

Can airSlate SignNow integrate with other tools using m1cr?

Yes, airSlate SignNow with m1cr seamlessly integrates with various tools and applications, such as CRM systems and project management software. This versatility allows businesses to create a cohesive digital workflow, enhancing overall performance.

-

Is airSlate SignNow secure when using m1cr?

Absolutely, airSlate SignNow prioritizes security when implementing its m1cr features. The platform utilizes advanced encryption protocols and follows stringent compliance measures to ensure that your documents and data remain safe and confidential.

-

Who can benefit from using airSlate SignNow's m1cr?

Businesses of all sizes across various industries can benefit from utilizing m1cr with airSlate SignNow. Whether you are a small startup or a large corporation, the platform is designed to enhance document management and eSigning experiences for everyone.

Get more for Printable Minnesota Form M1CR Credit For Income TaxPrintable Minnesota Form M1CR Credit For Income TaxPrintable Minnesota Form M

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497318251 form

- Ne corporation 497318252 form

- Nebraska dissolution form

- Living trust for husband and wife with no children nebraska form

- Nebraska living trust form

- Living trust for individual who is single divorced or widow or widower with children nebraska form

- Living trust for husband and wife with one child nebraska form

- Living trust for husband and wife with minor and or adult children nebraska form

Find out other Printable Minnesota Form M1CR Credit For Income TaxPrintable Minnesota Form M1CR Credit For Income TaxPrintable Minnesota Form M

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed