Form 12508 Rev 6 Questionnaire for Non Requesting Spouse 2021-2026

What is the Form 12508 Rev 6 Questionnaire for Non Requesting Spouse

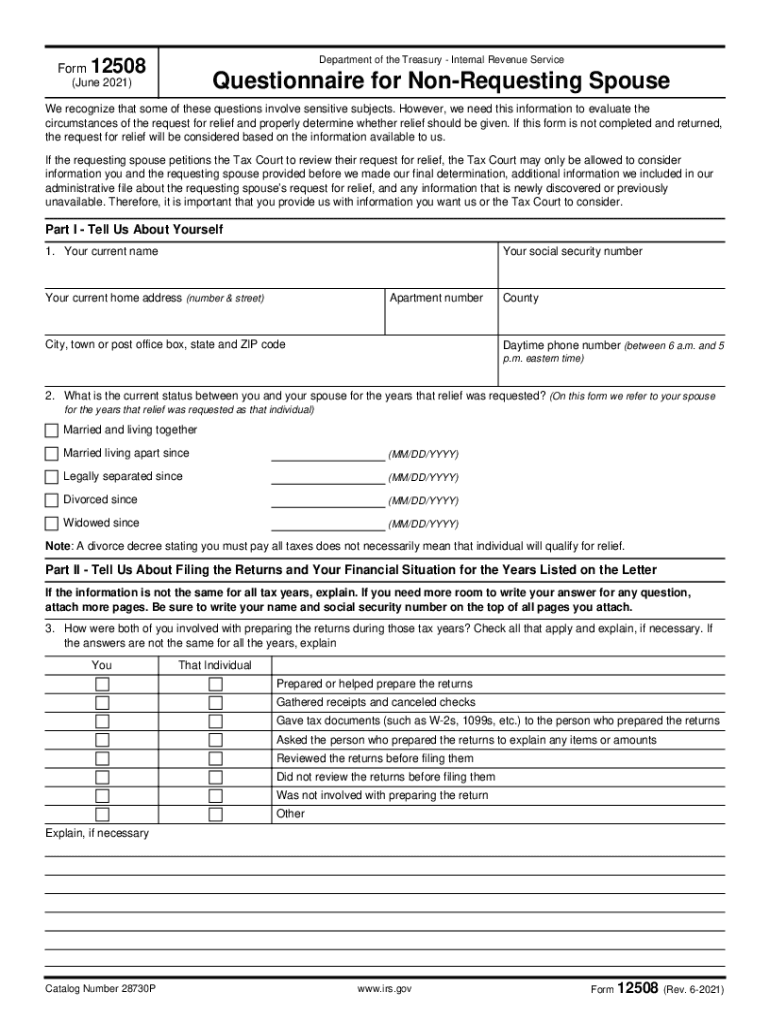

The Form 12508 Rev 6 is a crucial document used by the IRS to gather information from a non-requesting spouse in situations where one spouse is seeking relief from joint tax liability. This form is specifically designed for cases involving a request for innocent spouse relief, allowing the IRS to evaluate the circumstances surrounding the tax filings of both spouses. The questionnaire aims to clarify the non-requesting spouse's knowledge of the tax situation and any potential issues related to the joint return.

Steps to Complete the Form 12508 Rev 6 Questionnaire for Non Requesting Spouse

Completing the Form 12508 Rev 6 involves several important steps:

- Begin by carefully reading the instructions provided with the form to understand the requirements.

- Gather relevant documentation, including tax returns and any correspondence with the IRS.

- Answer each question truthfully and to the best of your knowledge, ensuring all information is accurate.

- Review the completed form for any errors or omissions before submission.

- Sign and date the form to certify that the information provided is correct.

Legal Use of the Form 12508 Rev 6 Questionnaire for Non Requesting Spouse

The Form 12508 Rev 6 is legally binding and must be completed accurately to ensure compliance with IRS regulations. It serves as a formal request for the IRS to consider the non-requesting spouse's perspective in tax liability matters. Proper use of this form can help protect the rights of the non-requesting spouse and may influence the IRS's decision regarding relief from joint liability.

IRS Guidelines for Form 12508 Rev 6

The IRS has established specific guidelines for the completion and submission of Form 12508 Rev 6. These guidelines include:

- Submission must occur within the designated time frame specified by the IRS.

- All questions must be answered fully, and supporting documentation should be provided when necessary.

- Failure to comply with IRS guidelines may result in delays or denial of relief requests.

Required Documents for Form 12508 Rev 6 Submission

When submitting the Form 12508 Rev 6, it is essential to include certain documents to support your case. Required documents may include:

- Copies of joint tax returns filed during the relevant years.

- Any correspondence received from the IRS regarding tax liabilities.

- Documentation that verifies the non-requesting spouse's financial situation.

Eligibility Criteria for Form 12508 Rev 6

To be eligible to use the Form 12508 Rev 6, the non-requesting spouse must meet specific criteria set by the IRS. These criteria typically include:

- The individual must have filed a joint tax return with the requesting spouse.

- The non-requesting spouse must demonstrate that they were unaware of the tax issues at the time of filing.

- Eligibility may also depend on the nature of the tax liability and the circumstances surrounding it.

Quick guide on how to complete form 12508 rev 6 2021 questionnaire for non requesting spouse

Complete Form 12508 Rev 6 Questionnaire For Non Requesting Spouse effortlessly on any device

Online document management has become popular with businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Form 12508 Rev 6 Questionnaire For Non Requesting Spouse on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign Form 12508 Rev 6 Questionnaire For Non Requesting Spouse effortlessly

- Locate Form 12508 Rev 6 Questionnaire For Non Requesting Spouse and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with the tools designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 12508 Rev 6 Questionnaire For Non Requesting Spouse and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 12508 rev 6 2021 questionnaire for non requesting spouse

Create this form in 5 minutes!

How to create an eSignature for the form 12508 rev 6 2021 questionnaire for non requesting spouse

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is the non filers stimulus and who qualifies for it?

The non filers stimulus refers to financial assistance provided by the government for individuals who do not usually file tax returns. Typically, this includes low-income individuals, some seniors, and dependents. Eligibility can be determined based on income levels and specific circumstances, making it essential to check the official guidelines.

-

How can airSlate SignNow help non filers submit their stimulus applications?

airSlate SignNow offers a seamless solution for non filers to easily eSign and submit documents related to their stimulus applications. With an intuitive interface, users can complete necessary forms remotely, ensuring they don't miss out on the non filers stimulus assistance. This simplicity is crucial for individuals unfamiliar with tax preparation.

-

Is there a cost associated with using airSlate SignNow for non filers?

Yes, airSlate SignNow provides several pricing plans suitable for different needs, including solutions for individuals and businesses. While there is a cost, the platform is designed to be cost-effective, offering valuable features that simplify the process of applying for the non filers stimulus. Users can evaluate the plans and choose one that fits their budget.

-

What documents do non filers need to submit for the stimulus?

Non filers typically need to provide proof of income, identification, and any relevant documentation that verifies their eligibility for the stimulus. This may include social security numbers or tax documents, depending on the requirements outlined by the IRS. Using airSlate SignNow, users can easily gather and eSign these necessary forms.

-

Are there integrations available with airSlate SignNow for tax filing?

Yes, airSlate SignNow integrates with various tax software and platforms to streamline the application process for the non filers stimulus. These integrations enhance the user experience by allowing for easy data transfer and document management. This feature is especially beneficial for businesses aiding clients in accessing the non filers stimulus.

-

What features does airSlate SignNow offer to help with document signing?

airSlate SignNow provides users with a variety of features including customizable templates, eSignature capabilities, and workflow automation. These features not only simplify the signing process but also ensure compliance and security for all documents, making it a reliable choice for obtaining the non filers stimulus.

-

How quickly can non filers receive their stimulus after signing documentation?

The time frame for receiving the non filers stimulus can vary depending on processing times by the IRS. However, by using airSlate SignNow to quickly sign and submit required documents, individuals can speed up their application process. Prompt submission helps to ensure that non filers receive their funds as timely as possible.

Get more for Form 12508 Rev 6 Questionnaire For Non Requesting Spouse

- Hsc data sharing questionnaire hsc unm form

- Employer on campus recruiting visit form kalamazoo

- 2019 2020 v 4 custom verification worksheet form

- High school code request form act

- International student immigration information questionnairepdf

- Dental benefits seminole county public schools form

- National preparedness and homeland security certificate form

- Radio angola entrevista com activista manuel nito alves radio form

Find out other Form 12508 Rev 6 Questionnaire For Non Requesting Spouse

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure