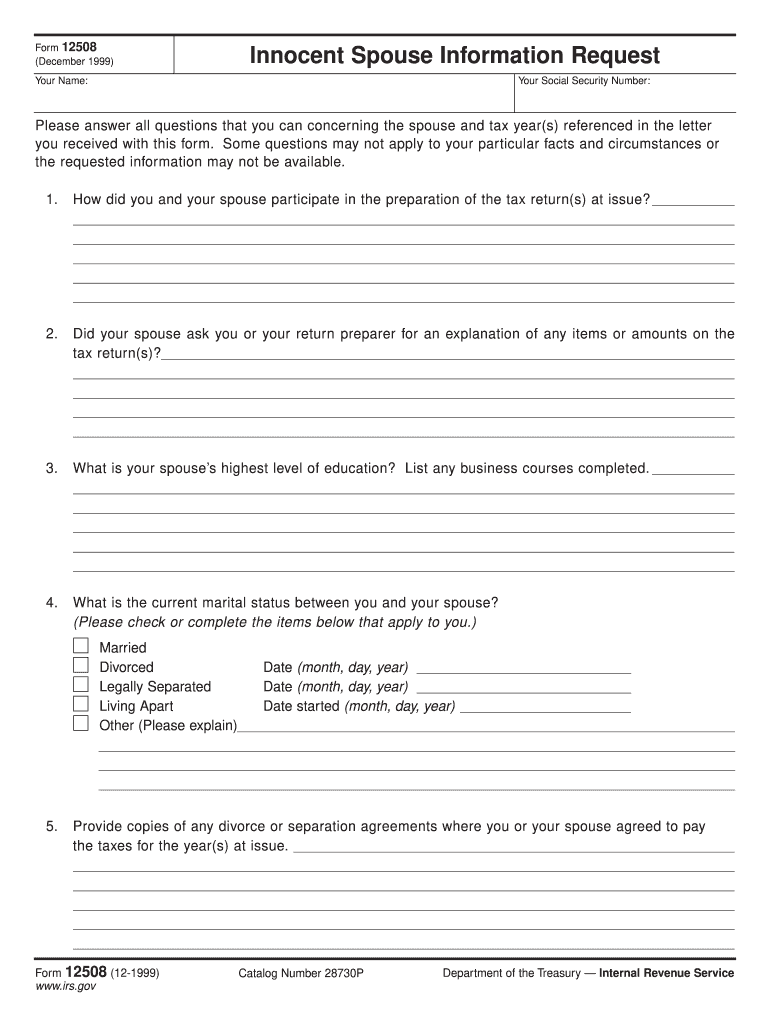

Form 12508 1999

What is the Form 12508

The IRS Form 12508 is a tax-related document used primarily to request a refund of certain taxes. This form is essential for taxpayers who believe they have overpaid their taxes or are eligible for a refund due to various tax credits or deductions. Understanding the purpose of Form 12508 is crucial for ensuring accurate tax reporting and compliance with IRS regulations.

How to use the Form 12508

Using IRS Form 12508 involves several steps to ensure that the information provided is accurate and complete. Taxpayers must fill out the form with relevant personal information, including their name, Social Security number, and the specific tax year for which they are requesting a refund. It is important to follow the instructions carefully to avoid delays in processing. Once completed, the form can be submitted to the IRS for review.

Steps to complete the Form 12508

Completing IRS Form 12508 requires attention to detail. Here are the steps to follow:

- Gather all necessary documentation, including previous tax returns and any supporting documents related to your claim.

- Fill in your personal information at the top of the form, ensuring accuracy in your name and Social Security number.

- Specify the tax year for which you are requesting a refund.

- Detail the reasons for your refund request, citing any applicable tax credits or deductions.

- Review the form for completeness and accuracy before submission.

Legal use of the Form 12508

IRS Form 12508 is legally binding when completed and submitted according to IRS guidelines. To ensure its legal standing, the form must be signed and dated by the taxpayer. Electronic signatures are accepted, provided they comply with the legal standards set forth by the IRS. This ensures that the request for a refund is legitimate and can be processed without legal complications.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with IRS Form 12508 to avoid penalties or delays in receiving your refund. Generally, the form should be submitted within three years from the date the original tax return was filed or within two years from the date the tax was paid, whichever is later. Staying informed about these deadlines can help ensure timely processing of your refund request.

Form Submission Methods (Online / Mail / In-Person)

IRS Form 12508 can be submitted through various methods, providing flexibility for taxpayers. The form can be mailed directly to the IRS at the address specified in the instructions. Additionally, for those who prefer digital solutions, the form can be completed and submitted electronically through authorized e-filing services. In-person submissions are also possible at designated IRS offices, although this may require an appointment.

Quick guide on how to complete form 12508

Effortlessly Manage Form 12508 on Any Device

Digital document management has gained traction among companies and individuals. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your files swiftly without delays. Handle Form 12508 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Alter and eSign Form 12508 with Ease

- Locate Form 12508 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all information and click on the Done button to save your modifications.

- Select how you prefer to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your requirements in document management with just a few clicks from any device you choose. Modify and eSign Form 12508 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 12508

Create this form in 5 minutes!

How to create an eSignature for the form 12508

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is IRS Form 12508?

IRS Form 12508 is a request for a ruling regarding the tax treatment of certain transactions. Utilizing airSlate SignNow, you can easily prepare and eSign IRS Form 12508, ensuring a smooth compliance process. This form is particularly beneficial for businesses seeking clarity on their tax obligations.

-

How can airSlate SignNow help with IRS Form 12508?

With airSlate SignNow, businesses can efficiently fill out and electronically sign IRS Form 12508 without the hassle of paper documents. The platform streamlines the process, allowing you to save time and reduce the risk of errors. Utilizing our eSigning capabilities, you can ensure that your submissions are compliant and properly documented.

-

What features does airSlate SignNow offer for IRS Form 12508 processing?

airSlate SignNow offers several features tailored for processing IRS Form 12508, including easy document creation, templates, and secure eSigning. You can track the document's status in real time and store it securely in the cloud. These features provide a seamless experience for preparing crucial tax-related documents.

-

Is there a cost associated with using airSlate SignNow for IRS Form 12508?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs for handling documents like IRS Form 12508. Our plans are designed to be cost-effective, providing excellent value for the features included. It's a small investment that can enhance your document management processes signNowly.

-

Can I integrate airSlate SignNow with other software for IRS Form 12508?

Absolutely! airSlate SignNow supports integration with various applications to help you manage IRS Form 12508 efficiently. You can connect it with your CRM, accounting software, or cloud storage systems, ensuring a cohesive workflow that enhances productivity and streamlines document handling.

-

What are the benefits of using airSlate SignNow for tax-related documents like IRS Form 12508?

Using airSlate SignNow provides numerous benefits for tax-related documents such as IRS Form 12508, including enhanced security, ease of use, and accessibility. The platform helps reduce paperwork and allows for quick turnaround times, ensuring you meet your filing deadlines with confidence. Additionally, eSigning improves the overall efficiency of the document submission process.

-

How secure is airSlate SignNow when handling IRS Form 12508?

airSlate SignNow takes security seriously, implementing encryption and compliance measures to protect sensitive information like IRS Form 12508. We adhere to industry standards and regulations to ensure your documents are safe from unauthorized access. You can trust that your eSigned tax forms are securely handled throughout the process.

Get more for Form 12508

Find out other Form 12508

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe