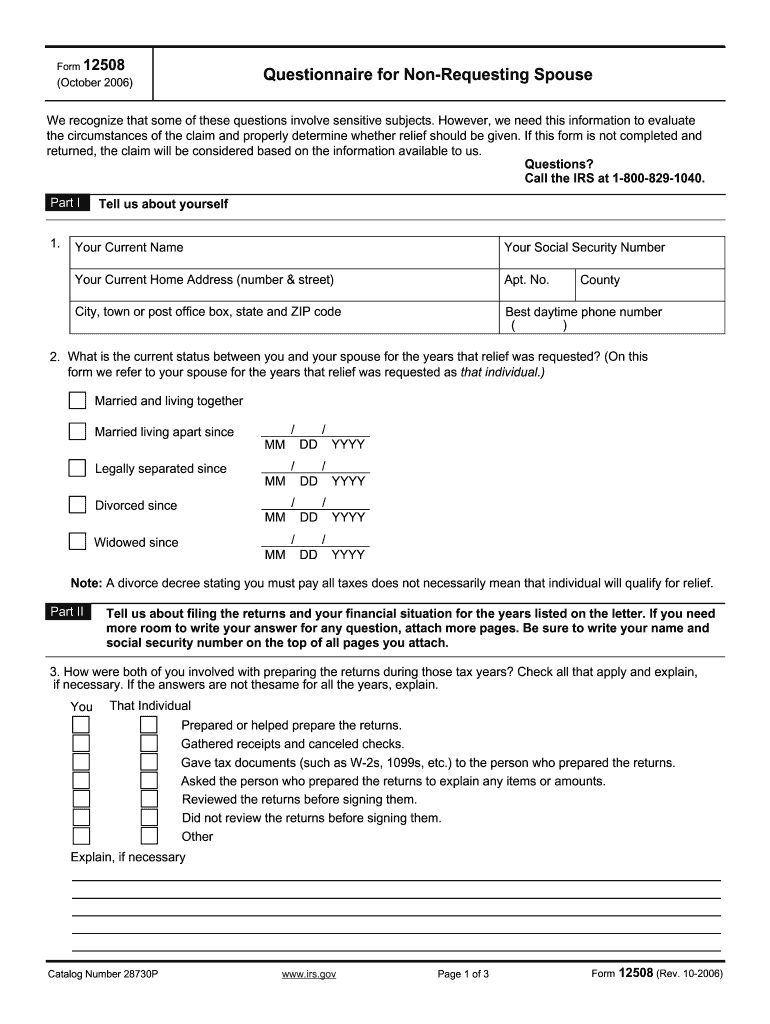

Irs Form 12508 2006

What is the IRS Form 12508

The IRS Form 12508 is a document used by taxpayers to request a refund of overpaid taxes. This form is particularly relevant for individuals who have made estimated tax payments or have had taxes withheld from their income but later determine that they are eligible for a refund. It serves as a formal request to the Internal Revenue Service (IRS) to initiate the refund process. Understanding the purpose of this form is crucial for ensuring that taxpayers can reclaim their funds efficiently.

How to use the IRS Form 12508

Using the IRS Form 12508 involves several straightforward steps. First, taxpayers must accurately fill out the form, providing necessary personal information such as name, address, and Social Security number. Next, they should detail the reason for the refund request, including the specific tax year and the amount overpaid. After completing the form, it should be signed and dated before submission. Utilizing electronic signature solutions can streamline this process, ensuring that the form is submitted quickly and securely.

Steps to complete the IRS Form 12508

Completing the IRS Form 12508 requires careful attention to detail. Follow these steps:

- Gather necessary documents, including previous tax returns and records of payments made.

- Fill out your personal information accurately at the top of the form.

- Indicate the tax year for which you are requesting a refund.

- Provide a clear explanation of the reason for the refund request.

- Calculate the total amount you are claiming as a refund.

- Sign and date the form to certify that the information provided is true and accurate.

Legal use of the IRS Form 12508

The legal use of the IRS Form 12508 is governed by tax laws and regulations. When completed and submitted correctly, this form is a legitimate request for a tax refund. It is essential that all information provided is accurate and truthful, as any discrepancies can lead to delays in processing or potential penalties. Taxpayers should also retain copies of the submitted form and any supporting documents for their records.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 12508 can vary based on the tax year and specific circumstances. Generally, taxpayers should submit this form as soon as they determine an overpayment has occurred. It is advisable to file within three years from the original due date of the tax return to ensure eligibility for a refund. Keeping track of these deadlines is important for maximizing potential refunds.

Form Submission Methods

The IRS Form 12508 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the IRS e-file system, which is the fastest method.

- Mailing a paper copy of the form to the appropriate IRS address, as indicated in the form instructions.

- In-person submission at designated IRS offices, although this may require an appointment.

Quick guide on how to complete irs form 12508 2006

Effortlessly Prepare Irs Form 12508 on Any Device

The management of documents online has gained traction among both businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly and without interruptions. Manage Irs Form 12508 across any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related procedure today.

The easiest method to modify and electronically sign Irs Form 12508 effortlessly

- Find Irs Form 12508 and click Get Form to initiate the process.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using specific tools that airSlate SignNow provides for that purpose.

- Generate your electronic signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click the Done button to save your edits.

- Choose your preferred method to submit your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Irs Form 12508 to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 12508 2006

Create this form in 5 minutes!

How to create an eSignature for the irs form 12508 2006

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is Irs Form 12508, and why is it important?

Irs Form 12508 is used to request an automatic extension of time to file a return for a partner in a partnership. Understanding the significance of Irs Form 12508 is crucial as it helps ensure compliance with IRS regulations, avoiding potential penalties for late filing.

-

How can airSlate SignNow assist with completing Irs Form 12508?

airSlate SignNow makes it easy to fill out and eSign Irs Form 12508 digitally. Our user-friendly platform allows users to complete the form quickly and securely, streamlining the process and ensuring that your request is submitted on time.

-

Is there a cost associated with using airSlate SignNow for Irs Form 12508?

airSlate SignNow offers a variety of pricing plans tailored to suit different needs, including free trials. Whether you need to fill out Irs Form 12508 frequently or just occasionally, our cost-effective solutions provide excellent value for your business.

-

What features does airSlate SignNow offer for managing Irs Form 12508?

With airSlate SignNow, you can eSign, share, and store Irs Form 12508 securely in the cloud. Our robust features include templates, real-time tracking, and team collaboration tools, making document management more efficient than ever.

-

Can I integrate airSlate SignNow with other applications for Irs Form 12508?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to enhance your workflow while handling Irs Form 12508. This enables you to sync data across platforms, simplifying the document preparation and signing process.

-

Is airSlate SignNow secure for eSigning Irs Form 12508?

Absolutely! airSlate SignNow uses industry-standard encryption and security protocols to ensure your Irs Form 12508 and other documents are safe. We prioritize your privacy and data security while providing a reliable eSigning solution.

-

Can multiple users collaborate on the Irs Form 12508 using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on Irs Form 12508 documents. Our platform enables team members to review, edit, and eSign the form in a secure environment, promoting efficient collaboration.

Get more for Irs Form 12508

- Notice of assignment to living trust illinois form

- Revocation of living trust illinois form

- Letter to lienholder to notify of trust illinois form

- Il contract 497306356 form

- Illinois forest products timber sale contract illinois form

- Assumption agreement of mortgage and release of original mortgagors illinois form

- Il foreign judgment form

- Illinois estates form

Find out other Irs Form 12508

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form