Federal & Idaho Tax Withholding Form 2020

What is the Federal & Idaho Tax Withholding Form

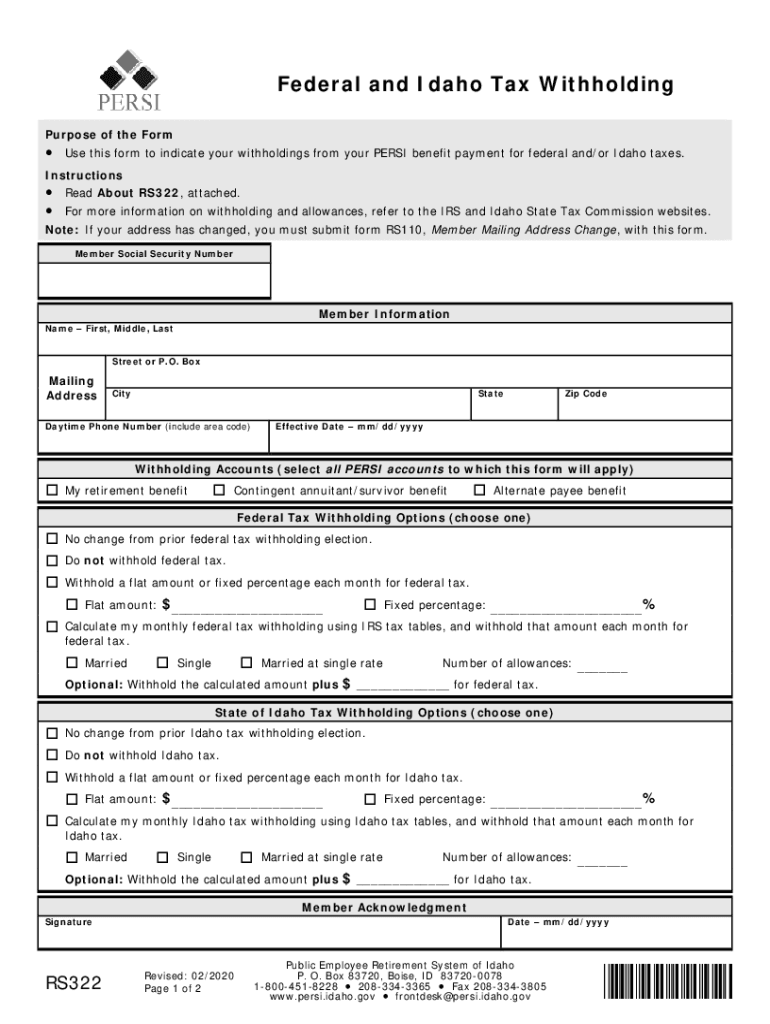

The Federal & Idaho Tax Withholding Form is a crucial document used by employers and employees to determine the amount of federal and state income tax to withhold from an employee's paycheck. This form ensures that the correct amount is deducted based on the employee's earnings and tax situation. The form combines federal guidelines with specific Idaho state requirements, making it essential for compliance with both tax jurisdictions.

How to use the Federal & Idaho Tax Withholding Form

To use the Federal & Idaho Tax Withholding Form, individuals must first obtain the form, which can typically be found on the IRS website or the Idaho State Tax Commission website. Once the form is acquired, the employee must fill out personal information, including name, Social Security number, and filing status. Additionally, the employee should indicate any allowances or additional amounts they wish to withhold. After completing the form, it should be submitted to the employer, who will use the information to adjust payroll deductions accordingly.

Steps to complete the Federal & Idaho Tax Withholding Form

Completing the Federal & Idaho Tax Withholding Form involves several steps:

- Gather personal information, including your name, address, and Social Security number.

- Determine your filing status, such as single, married, or head of household.

- Calculate the number of allowances you are eligible for based on your financial situation.

- Indicate any additional withholding amounts if desired.

- Review the completed form for accuracy before submitting it to your employer.

Key elements of the Federal & Idaho Tax Withholding Form

The Federal & Idaho Tax Withholding Form contains several key elements that must be accurately filled out to ensure proper tax withholding:

- Personal Information: This includes your full name, address, and Social Security number.

- Filing Status: You must select your appropriate filing status to determine tax rates.

- Allowances: The number of allowances you claim affects the amount withheld from your paycheck.

- Additional Withholding: You can specify any extra amount to be withheld if necessary.

Legal use of the Federal & Idaho Tax Withholding Form

The legal use of the Federal & Idaho Tax Withholding Form is governed by federal and state tax laws. Proper completion of the form ensures compliance with IRS regulations and Idaho tax requirements. It is essential for both employers and employees to understand that inaccurate information can lead to penalties or under-withholding, which may result in tax liabilities. Therefore, it is important to fill out the form carefully and keep it updated with any changes in your financial situation.

Who Issues the Form

The Federal & Idaho Tax Withholding Form is issued jointly by the Internal Revenue Service (IRS) and the Idaho State Tax Commission. Employers are responsible for providing this form to their employees, ensuring that they have the necessary information to complete it accurately. Employees should also be aware of their responsibility to submit the completed form to their employer to facilitate correct tax withholding.

Quick guide on how to complete federal ampamp idaho tax withholding form

Complete Federal & Idaho Tax Withholding Form effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents promptly without delays. Manage Federal & Idaho Tax Withholding Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Federal & Idaho Tax Withholding Form with ease

- Find Federal & Idaho Tax Withholding Form and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Select relevant portions of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Federal & Idaho Tax Withholding Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal ampamp idaho tax withholding form

Create this form in 5 minutes!

People also ask

-

What is the Federal & Idaho Tax Withholding Form and why do I need it?

The Federal & Idaho Tax Withholding Form is a crucial document that employees need to submit to outline their tax withholding preferences. This form helps employers determine the correct amount of state and federal taxes to withhold from an employee's paycheck. Properly completing this form ensures compliance with tax regulations and can help prevent tax-related issues at year-end.

-

How can airSlate SignNow assist with the Federal & Idaho Tax Withholding Form?

airSlate SignNow streamlines the process of completing and submitting the Federal & Idaho Tax Withholding Form by providing a user-friendly eSigning platform. This allows users to fill out the form electronically, ensuring accuracy and convenience. With our secure platform, you can sign and send your forms quickly, saving time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for the Federal & Idaho Tax Withholding Form?

Yes, airSlate SignNow offers flexible pricing plans to meet various business needs when processing forms like the Federal & Idaho Tax Withholding Form. We have several subscription options, including monthly and annual plans, that allow you to choose what best suits your requirements. Additionally, you can take advantage of our free trial to explore all our features before committing to a plan.

-

What features does airSlate SignNow offer for managing the Federal & Idaho Tax Withholding Form?

airSlate SignNow provides several features to enhance your experience with the Federal & Idaho Tax Withholding Form. These include customizable templates, automated reminders for signers, data security measures, and document tracking. Our platform ensures that all signatory actions are seamless, helping you manage your tax forms efficiently.

-

Can I integrate airSlate SignNow with other software for the Federal & Idaho Tax Withholding Form?

Absolutely! airSlate SignNow supports various integrations with popular applications and software that can enhance your workflow for the Federal & Idaho Tax Withholding Form. Whether it’s CRM tools, accounting software, or cloud storage solutions, our platform is designed to synchronize with your existing systems for a smooth experience.

-

What are the benefits of using airSlate SignNow for my Federal & Idaho Tax Withholding Form?

Using airSlate SignNow for your Federal & Idaho Tax Withholding Form offers numerous benefits, including improved efficiency through electronic signing and reduced turnaround time. You'll also enjoy enhanced security features that protect sensitive data during the signing process. Overall, our platform simplifies compliance and helps streamline your document management.

-

Is support available if I encounter issues with the Federal & Idaho Tax Withholding Form?

Yes, airSlate SignNow provides comprehensive customer support if you face any issues with the Federal & Idaho Tax Withholding Form. Our support team is available through multiple channels, including live chat, email, and phone, to assist you with any technical difficulties or questions. We aim to ensure your experience is as smooth and stress-free as possible.

Get more for Federal & Idaho Tax Withholding Form

- Application for a parking permit for persons with severe disabilities form

- Free prior prescription rx authorization forms pdf word

- 08 484 articles of organization formdoc

- State farm car insurance light therapy codes chiropractic form

- California state athletic commission application for professional promoter california state athletic commission application for form

- California state athletic commission promoter original application form

- City of pomona business license form

- Fillable online corp delaware stock certificate of form

Find out other Federal & Idaho Tax Withholding Form

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document