62A500 W TANGIBLE PERSONAL PROPERTY TAX RETURN Form

What is the 62A500 W Tangible Personal Property Tax Return

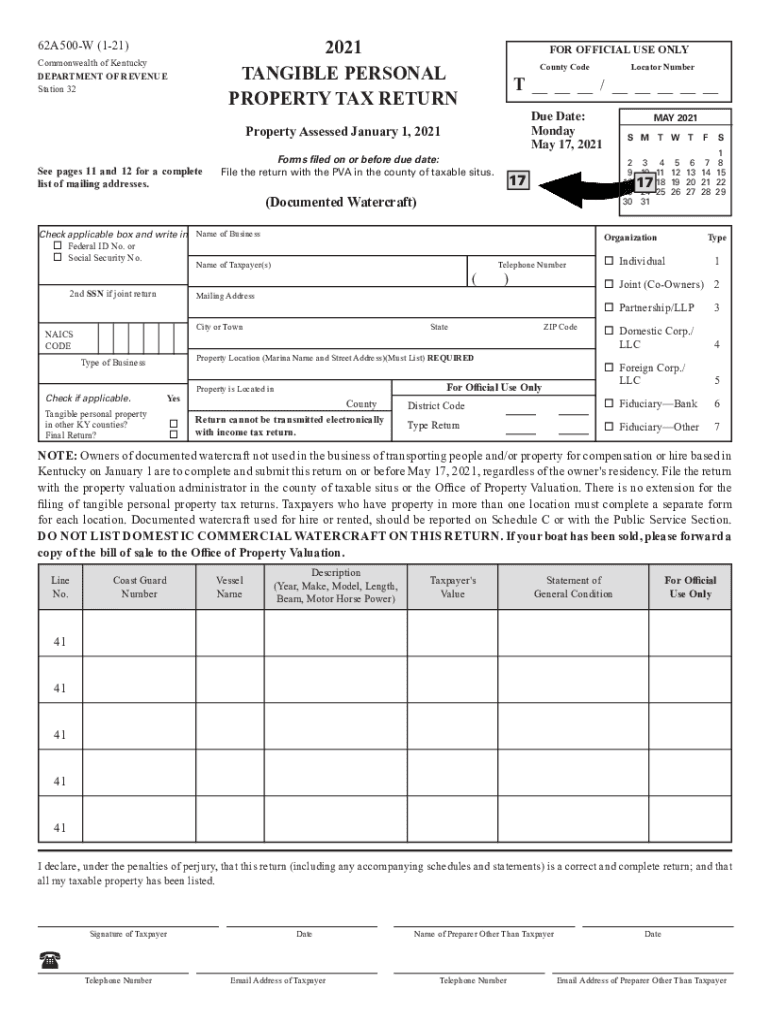

The 62A500 W Tangible Personal Property Tax Return is a form used in Kentucky for reporting tangible personal property owned by businesses and individuals. This form is essential for calculating the property tax owed on items such as machinery, equipment, and furniture. By accurately completing the 62A500 form, taxpayers ensure compliance with state tax regulations and help local governments assess property values for taxation purposes.

How to Use the 62A500 W Tangible Personal Property Tax Return

Using the 62A500 form involves several steps to ensure accurate reporting of tangible personal property. First, gather all necessary information regarding the property owned, including purchase dates, values, and descriptions. Next, fill out the form by providing details about each item, ensuring that all values are reported accurately. It is important to review the completed form for any errors before submission to avoid potential penalties.

Steps to Complete the 62A500 W Tangible Personal Property Tax Return

Completing the 62A500 form requires careful attention to detail. Follow these steps:

- Obtain the 62A500 form, which can be downloaded as a PDF from the Kentucky Department of Revenue website.

- List all tangible personal property owned as of January first of the tax year, including descriptions and values.

- Calculate the total value of all reported items to determine the assessed value for tax purposes.

- Sign and date the form to certify that the information provided is accurate and complete.

- Submit the form by the designated deadline to the appropriate local tax authority.

Key Elements of the 62A500 W Tangible Personal Property Tax Return

Several key elements must be included when completing the 62A500 form:

- Taxpayer Information: Include your name, address, and contact details.

- Property Description: Provide detailed descriptions of each item, including make, model, and year.

- Value Reporting: Report the acquisition cost or fair market value of each item.

- Signature: Ensure that the form is signed and dated to validate the information.

Required Documents

To successfully complete the 62A500 form, certain documents may be required:

- Purchase invoices or receipts for tangible personal property.

- Previous year’s tax return for reference.

- Any documentation supporting the valuation of property, such as appraisals.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the 62A500 form. Typically, the form must be submitted by May first of each year. Failure to file by this date may result in penalties or interest on unpaid taxes. Taxpayers should also keep track of any changes in deadlines that may occur due to state regulations or special circumstances.

Quick guide on how to complete 62a500 w tangible personal property tax return

Complete 62A500 W TANGIBLE PERSONAL PROPERTY TAX RETURN effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage 62A500 W TANGIBLE PERSONAL PROPERTY TAX RETURN on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign 62A500 W TANGIBLE PERSONAL PROPERTY TAX RETURN without hassle

- Locate 62A500 W TANGIBLE PERSONAL PROPERTY TAX RETURN and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign 62A500 W TANGIBLE PERSONAL PROPERTY TAX RETURN and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Kentucky tangible form?

A Kentucky tangible form is a legal document used in the state of Kentucky to declare the ownership of tangible personal property. These forms are crucial for the proper transfer and management of assets, ensuring that ownership is clearly understood and documented. Utilizing a Kentucky tangible form can help prevent disputes and simplify asset management.

-

How can airSlate SignNow help with Kentucky tangible forms?

airSlate SignNow offers an efficient platform for creating, sending, and eSigning Kentucky tangible forms. The user-friendly interface allows businesses to manage their documents effortlessly, ensuring compliance with Kentucky regulations. Additionally, real-time tracking features keep you informed of the signing status, making document management seamless.

-

What are the benefits of using airSlate SignNow for Kentucky tangible forms?

Using airSlate SignNow for your Kentucky tangible forms streamlines the process of document handling. Benefits include reduced turnaround times due to efficient eSigning, enhanced security through encrypted transmissions, and easy access to templates for quicker setup. With airSlate SignNow, businesses save time and improve their workflow, making it a smart choice for managing tangible forms.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to various business needs, including options suitable for users handling Kentucky tangible forms. Plans are available for individuals, teams, and enterprises, with transparent pricing structures to ensure you find the right fit. Each plan also offers features that enhance document security and streamline workflows.

-

Are there any integrations available with airSlate SignNow for Kentucky tangible forms?

Yes, airSlate SignNow supports numerous integrations with popular applications that can simplify the process of managing Kentucky tangible forms. You can easily integrate with services like Google Drive, Salesforce, and Dropbox, allowing for seamless document storage and management. These integrations enhance productivity by connecting your existing tools with airSlate SignNow's functionality.

-

Is it easy to create a Kentucky tangible form with airSlate SignNow?

Absolutely! Creating a Kentucky tangible form with airSlate SignNow is straightforward, thanks to our intuitive template tools. Users can customize existing templates or create new forms from scratch, ensuring that all necessary information is captured accurately. The platform's simplicity allows anyone to create legally binding documents without extensive training.

-

Can I track the status of my Kentucky tangible forms in airSlate SignNow?

Yes, airSlate SignNow provides robust tracking features that allow you to monitor the status of your Kentucky tangible forms in real-time. You will receive notifications when documents are sent, viewed, and signed, helping manage your workflow efficiently. This transparency ensures you stay informed throughout the entire process.

Get more for 62A500 W TANGIBLE PERSONAL PROPERTY TAX RETURN

- Monitoring device driving permit mddp terms ampamp conditions form

- Calvcb in home supportive services billing form

- Pdf pharmacy form ph210 office of the professions new york state

- Inclusion form for sole proprietors and partners election c15r 92019 election pursuant listed laws version september 2019

- Get and sign the attached personal history statement phs form

- Fillable online form prd 1 california fax email print pdffiller

- Rsa 20710 c form

- Inz 1027 supplementary form for chinese visitors workers and students

Find out other 62A500 W TANGIBLE PERSONAL PROPERTY TAX RETURN

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now