Form ALC37 'Ohio Wine and Mixed Beverage Tax Return for a

What is the Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A

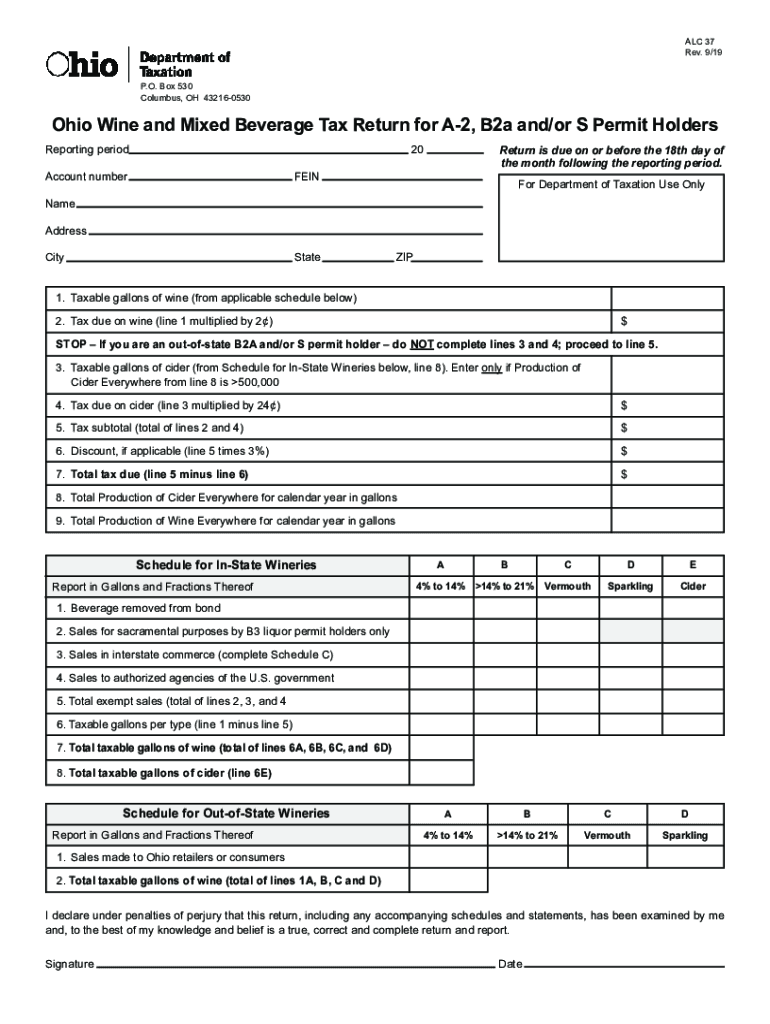

The Form ALC37, known as the Ohio Wine And Mixed Beverage Tax Return, is a tax document required for businesses involved in the sale of wine and mixed beverages in Ohio. This form is essential for reporting the sales and excise taxes associated with these products. It serves as a means for the state to collect revenue from the sale of alcoholic beverages and ensures compliance with state tax regulations. Businesses must accurately complete and submit this form to avoid penalties and maintain good standing with the Ohio Department of Taxation.

Steps to complete the Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A

Completing the Form ALC37 involves several key steps to ensure accuracy and compliance. First, gather all necessary sales data, including the total amount of wine and mixed beverages sold during the reporting period. Next, calculate the applicable excise taxes based on the sales figures. Fill out the form by entering the required information, ensuring that all figures are accurate and match your records. After reviewing the completed form for errors, submit it to the Ohio Department of Taxation through the designated filing method, which can include online submission or mailing a hard copy.

Key elements of the Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A

The Form ALC37 includes several critical elements that must be filled out correctly. Key sections typically include the business name, address, and tax identification number. Additionally, the form requires detailed reporting of sales figures, including the quantity of wine and mixed beverages sold. It also necessitates calculations for the excise tax owed. Finally, the form includes a declaration section where the business owner or authorized representative must sign, affirming the accuracy of the information provided.

Legal use of the Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A

The legal use of Form ALC37 is crucial for businesses operating within Ohio's alcoholic beverage industry. This form must be completed and submitted in accordance with state tax laws to avoid legal repercussions. Failure to file the form or inaccuracies in reporting can lead to penalties, including fines and potential legal action. Businesses must ensure that they adhere to the specific filing deadlines and maintain records of their submissions for compliance purposes.

Filing Deadlines / Important Dates

Filing deadlines for the Form ALC37 are set by the Ohio Department of Taxation and are typically aligned with quarterly or annual reporting periods. It is essential for businesses to be aware of these dates to avoid late fees or penalties. Generally, the form must be submitted by the last day of the month following the end of the reporting period. Keeping a calendar of these important dates can help ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form ALC37 can be submitted through various methods, providing flexibility for businesses. Online submission is often the most efficient option, allowing for immediate processing and confirmation. Alternatively, businesses can mail a hard copy of the completed form to the appropriate tax office. In-person submissions may also be possible at designated tax offices, although this option may vary based on local regulations and office hours. Each method has its own processing times, so businesses should choose the one that best suits their needs.

Quick guide on how to complete form alc37 ampquotohio wine and mixed beverage tax return for a

Easily prepare Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A on any device

Online document management has gained traction among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without interruptions. Manage Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based activity today.

How to modify and electronically sign Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A effortlessly

- Find Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns over missing or lost files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A'?

Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A' is a tax return form specifically designed for businesses involved in the production and sale of wine and mixed beverages in Ohio. It allows businesses to report and pay their applicable taxes efficiently while ensuring compliance with state regulations.

-

How can airSlate SignNow help with Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A'?

airSlate SignNow streamlines the eSignature process for Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A', allowing you to easily send, sign, and manage your documents from anywhere. Our platform simplifies the workflow, ensuring your tax returns are processed promptly and securely.

-

Is there a cost associated with using airSlate SignNow for Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A'?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. We provide cost-effective solutions that ensure you can efficiently manage and eSign Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A' without breaking the bank.

-

What features does airSlate SignNow offer for managing Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A'?

Our platform includes features like customizable templates, in-app signing, real-time tracking, and integration capabilities with other software. These features enhance your experience when filling out and submitting Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A', making the process smoother and more efficient.

-

Are there any integrations available with airSlate SignNow for Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A'?

Yes, airSlate SignNow integrates seamlessly with various business tools and software, allowing you to streamline your operations. By integrating with your existing systems, you can easily manage data related to Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A' and improve overall productivity.

-

Can I track the status of my Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A' submissions through airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all your documents, including Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A'. You’ll receive updates on the signing status and document completion, ensuring that you never miss an important deadline.

-

How secure is airSlate SignNow for submitting Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A'?

Security is a top priority at airSlate SignNow. We employ advanced encryption processes and adhere to industry standards to ensure that your documents, including Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A', are kept safe and confidential throughout the eSigning process.

Get more for Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A

- Life coach templates form

- Vehicle ownership transfer form bahrain

- 1099 nec form 2021

- Direction of pay form 37253278

- South austin trauma surgeons medical records release south austin trauma surgeons medical records release form

- Beneficiary designation form sdcera

- Altcs miller trust and poa order from arizona care alliance form

- Irs w 2 form

Find out other Form ALC37 'Ohio Wine And Mixed Beverage Tax Return For A

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast