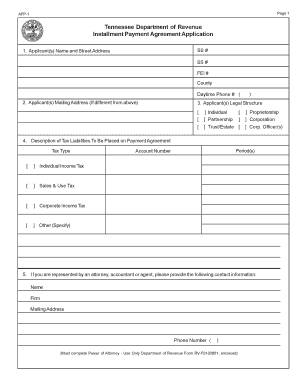

Installment Payment Agreement Program Form

What is the Installment Payment Agreement Program

The Installment Payment Agreement Program is a structured payment plan that allows individuals and businesses to pay their tax liabilities over time. This program is particularly beneficial for those who may face financial difficulties but still wish to meet their tax obligations. By entering into this agreement, taxpayers can avoid immediate payment in full, thereby easing their financial burden while remaining compliant with tax regulations.

How to use the Installment Payment Agreement Program

Using the Installment Payment Agreement Program involves several steps. First, taxpayers must determine their eligibility based on their current tax situation and outstanding liabilities. Next, they need to complete the necessary forms, which include providing personal and financial information. Once the forms are submitted, the Internal Revenue Service (IRS) will review the application and notify the taxpayer of approval or any required adjustments. Upon acceptance, the taxpayer can begin making scheduled payments as outlined in the agreement.

Steps to complete the Installment Payment Agreement Program

Completing the Installment Payment Agreement Program involves the following steps:

- Assess your tax liability and determine if you qualify for an installment agreement.

- Gather required financial information, including income, expenses, and assets.

- Fill out the appropriate forms, such as Form 9465, which is specifically for requesting an installment agreement.

- Submit the forms to the IRS either online, by mail, or in person, depending on your preference.

- Await confirmation from the IRS regarding the acceptance of your agreement.

Legal use of the Installment Payment Agreement Program

The legal use of the Installment Payment Agreement Program is governed by IRS regulations. Taxpayers must adhere to the terms of the agreement, which includes making timely payments. Failure to comply with the agreement can result in penalties, interest, and potential enforcement actions by the IRS. It is essential for taxpayers to understand their rights and obligations under this program to maintain compliance and avoid complications.

Key elements of the Installment Payment Agreement Program

Several key elements define the Installment Payment Agreement Program:

- The total amount owed must be within specified limits set by the IRS.

- Taxpayers must agree to make regular payments over a designated period.

- Interest and penalties may continue to accrue on the unpaid balance until it is fully paid.

- Taxpayers must remain compliant with all future tax obligations during the agreement period.

Eligibility Criteria

To qualify for the Installment Payment Agreement Program, taxpayers must meet specific eligibility criteria. These include having a tax liability that does not exceed a certain threshold, being current with all tax filings, and demonstrating the ability to make regular payments. Additionally, individuals who have previously defaulted on an installment agreement may face stricter eligibility requirements.

Quick guide on how to complete installment payment agreement program

Complete Installment Payment Agreement Program effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, amend, and eSign your documents quickly without delays. Manage Installment Payment Agreement Program on any device with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to modify and eSign Installment Payment Agreement Program with ease

- Find Installment Payment Agreement Program and click on Obtain Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Completed button to save your changes.

- Choose how you wish to share your form, by email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Installment Payment Agreement Program and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Installment Payment Agreement Program?

The Installment Payment Agreement Program allows businesses to manage payments over time through structured agreements. This program is designed to provide flexibility and ease for both businesses and their clients, allowing for a smoother transaction process.

-

How does the Installment Payment Agreement Program benefit my business?

Using the Installment Payment Agreement Program can enhance your cash flow management by enabling more clients to afford your services. It also encourages customer loyalty and satisfaction as clients appreciate having the option to spread payments over time.

-

What are the costs associated with the Installment Payment Agreement Program?

The costs associated with the Installment Payment Agreement Program vary based on the features you select and the volume of transactions. It's important to contact our sales team for a customized quote that fits your business needs and budget.

-

Can I customize payment plans in the Installment Payment Agreement Program?

Yes, the Installment Payment Agreement Program offers customizable payment plans that can be tailored to fit your specific requirements. You can set the payment amounts, due dates, and the overall duration of the installment plan.

-

What integrations are available with the Installment Payment Agreement Program?

The Installment Payment Agreement Program integrates seamlessly with various popular software applications, making it easy to sync your data and streamline operations. These integrations help in automating workflows and enhancing overall efficiency.

-

Is the Installment Payment Agreement Program suitable for all business sizes?

Absolutely, the Installment Payment Agreement Program is designed to cater to businesses of all sizes, from small startups to large enterprises. Our flexible features ensure that you can adapt the program to your specific business model.

-

How secure is the Installment Payment Agreement Program?

Security is a top priority for the Installment Payment Agreement Program. We utilize the latest encryption technologies and comply with all regulatory standards to ensure that your transaction data remains safe and secure.

Get more for Installment Payment Agreement Program

- Ncat verification form

- Permanent 4 h horse identification and health record extension uidaho form

- Application diploma form

- Undergraduate non matriculated student application undergraduate non matriculated student application form

- Documents ampamp forms bowling green state university

- Adjunct non clinical appointment packet checklist form

- Enrollment history verification form

- Clinical student teaching tcu college of education form

Find out other Installment Payment Agreement Program

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free