Tennessee Individual Income Tax Return Application for Extension Form

What is the Tennessee Individual Income Tax Return Application for Extension

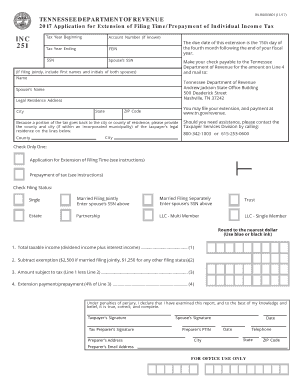

The Tennessee Individual Income Tax Return Application for Extension is a formal request submitted by taxpayers seeking additional time to file their state income tax returns. This application is essential for individuals who may need more time to gather necessary documentation or complete their tax filings accurately. By submitting this application, taxpayers can avoid penalties associated with late filings while ensuring compliance with state tax regulations.

Steps to Complete the Tennessee Individual Income Tax Return Application for Extension

Completing the Tennessee Individual Income Tax Return Application for Extension involves several key steps:

- Gather personal information, including your Social Security number and filing status.

- Determine the estimated tax liability for the year to ensure accurate reporting.

- Fill out the application form with the required details, ensuring all information is accurate.

- Review the completed application for any errors or omissions.

- Submit the application by the designated deadline, either online or via mail.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Tennessee Individual Income Tax Return Application for Extension is crucial for compliance. Generally, the application must be submitted by the original due date of the tax return, which is typically April 15. Taxpayers should note that the extension only applies to the filing of the return, not to the payment of any taxes owed, which are still due by the original deadline.

Required Documents

When completing the Tennessee Individual Income Tax Return Application for Extension, certain documents may be necessary to support your application. These documents include:

- Previous year’s tax return for reference.

- W-2 forms and 1099s that report income.

- Records of any deductions or credits you plan to claim.

- Documentation of estimated tax payments made throughout the year.

Legal Use of the Tennessee Individual Income Tax Return Application for Extension

The Tennessee Individual Income Tax Return Application for Extension is legally binding when completed and submitted according to state regulations. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or legal issues. The application must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that electronic submissions are recognized as valid.

Who Issues the Form

The Tennessee Department of Revenue is the authoritative body responsible for issuing the Tennessee Individual Income Tax Return Application for Extension. This department oversees the administration of state tax laws and provides the necessary forms and guidelines for taxpayers to comply with their obligations.

Quick guide on how to complete tennessee individual income tax return application for extension

Manage Tennessee Individual Income Tax Return Application For Extension effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Tennessee Individual Income Tax Return Application For Extension on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Tennessee Individual Income Tax Return Application For Extension with minimal effort

- Find Tennessee Individual Income Tax Return Application For Extension and click on Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and then click the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Tennessee Individual Income Tax Return Application For Extension and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is TN inc tax, and how does it affect my business?

TN inc tax refers to the tax obligations businesses must meet in Tennessee. Understanding TN inc tax is crucial for compliance and financial planning. It can vary based on your business structure and income, so it's important to consult with a tax professional to ensure you're meeting all requirements.

-

How can airSlate SignNow help with TN inc tax documentation?

airSlate SignNow simplifies the eSigning and document management process, allowing you to efficiently handle all your TN inc tax documents. With our platform, you can easily create, send, and sign important tax forms electronically, ensuring a streamlined workflow. This helps reduce paperwork and improves compliance with tax requirements.

-

What are the pricing plans for airSlate SignNow related to TN inc tax services?

airSlate SignNow offers competitive pricing plans suitable for businesses looking to manage their TN inc tax documentation efficiently. With plans tailored for different business sizes, you can choose the one that best fits your budget and needs. Each plan includes essential features to help you stay compliant with your tax obligations.

-

Can airSlate SignNow integrate with accounting software for TN inc tax?

Yes, airSlate SignNow can integrate seamlessly with various accounting software, making it easier to manage your TN inc tax documentation. By connecting your eSignature solution with your accounting tools, you can automate workflows and ensure that your tax documents are always up-to-date. This integration can save you time and enhance accuracy in your tax reporting.

-

What features does airSlate SignNow offer for efficient TN inc tax management?

airSlate SignNow provides a range of features that are beneficial for managing TN inc tax documentation. Key features include customizable templates for tax forms, advanced security protocols, and easy collaboration with teams. These tools help ensure that your tax management processes are both efficient and compliant.

-

Is airSlate SignNow suitable for small businesses handling TN inc tax?

Absolutely, airSlate SignNow is designed to cater to businesses of all sizes, including small businesses managing TN inc tax. Our cost-effective solution provides essential features without overwhelming costs, enabling small businesses to streamline their documentation processes. This helps them focus on growth while maintaining compliance.

-

How does airSlate SignNow enhance the eSigning experience for TN inc tax documents?

airSlate SignNow enhances the eSigning experience with user-friendly features that make signing TN inc tax documents simple and quick. The platform ensures that all signatures are legally binding and secure, giving you peace of mind. Additionally, you can track the status of your documents in real-time for better organization.

Get more for Tennessee Individual Income Tax Return Application For Extension

Find out other Tennessee Individual Income Tax Return Application For Extension

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later