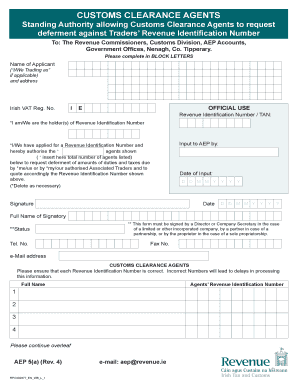

Aep5 Revenue Form

What is the Aep5 Revenue

The Aep5 revenue form is a critical document used in the United States for reporting specific financial information to the Internal Revenue Service (IRS). It is primarily utilized by individuals and businesses to declare income, deductions, and credits that affect their tax obligations. Understanding the Aep5 revenue form is essential for compliance with federal tax laws, ensuring that all necessary information is accurately reported to avoid potential penalties.

How to use the Aep5 Revenue

Using the Aep5 revenue form involves several steps to ensure accurate completion. First, gather all necessary financial documents, such as income statements, receipts for deductions, and any relevant tax records. Next, carefully fill out the form, ensuring that all fields are completed accurately. It is crucial to double-check calculations and ensure that all supporting documents are attached. Once completed, the form can be submitted electronically or via mail, depending on the preferred submission method.

Steps to complete the Aep5 Revenue

Completing the Aep5 revenue form requires attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents.

- Read the instructions provided with the form thoroughly.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income accurately.

- List all deductions and credits that apply.

- Review the form for accuracy and completeness.

- Submit the form by the designated deadline.

Legal use of the Aep5 Revenue

The Aep5 revenue form must be filled out in compliance with IRS regulations to be considered legally valid. This includes adhering to specific guidelines regarding income reporting, deductions, and submission timelines. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is advisable to consult with a tax professional if there are uncertainties regarding the legal requirements associated with the Aep5 revenue form.

Filing Deadlines / Important Dates

Filing deadlines for the Aep5 revenue form are crucial for taxpayers to avoid penalties. Typically, the form must be submitted by April 15 of the tax year, although extensions may be available under certain circumstances. It is important to stay informed about any changes to filing dates, especially in light of potential legislative updates or natural disasters that may affect tax deadlines.

Required Documents

To complete the Aep5 revenue form accurately, several documents are required. These may include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Receipts for deductible expenses.

- Records of any tax credits claimed.

- Previous year’s tax return for reference.

Penalties for Non-Compliance

Failing to file the Aep5 revenue form on time or providing inaccurate information can result in significant penalties. These may include monetary fines, interest on unpaid taxes, and potential audits by the IRS. Understanding the importance of compliance and the consequences of non-compliance is essential for all taxpayers to ensure they meet their obligations and avoid unnecessary complications.

Quick guide on how to complete aep5 revenue

Effortlessly Prepare Aep5 Revenue on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and efficiently. Manage Aep5 Revenue on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Method to Edit and Electronically Sign Aep5 Revenue

- Find Aep5 Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Alter and eSign Aep5 Revenue and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the aep5 form and how is it used?

The aep5 form is a critical document used for various official purposes, especially in financial and governmental transactions. It serves as proof of information and is often required for applications and registrations. Using airSlate SignNow, you can easily send, eSign, and manage aep5 forms securely and efficiently.

-

How does airSlate SignNow simplify the process of handling the aep5 form?

AirSlate SignNow simplifies the handling of the aep5 form by providing a user-friendly interface where you can upload, edit, and send your documents effortlessly. The platform allows for real-time collaboration, so you can get your aep5 form signed faster. Additionally, automated reminders ensure that signers don’t forget to complete the process.

-

Is there a free trial available for using airSlate SignNow for the aep5 form?

Yes, airSlate SignNow offers a free trial period that allows you to explore its features for processing the aep5 form without any commitment. During this trial, you can test out eSigning capabilities, document management, and integrations. It's a great way to see if it meets your needs before making a purchase.

-

What pricing plans does airSlate SignNow offer for aep5 form processing?

AirSlate SignNow offers several pricing plans tailored for different business needs, starting from basic to premium features. Depending on your volume of aep5 form transactions, you can choose a plan that provides the best value and includes essential features like document templates and advanced security options.

-

Can I integrate airSlate SignNow with other software to work on the aep5 form?

Absolutely! AirSlate SignNow provides seamless integration with various software applications, allowing you to manage your aep5 form alongside other business tools. Whether you're using CRM systems, cloud storage, or productivity platforms, the integrations enhance your workflow and improve efficiency.

-

What security measures does airSlate SignNow have for the aep5 form?

AirSlate SignNow prioritizes security for your aep5 form by employing top-notch encryption, secure cloud storage, and compliance with legal standards. Your documents are protected throughout the signing process, ensuring that sensitive information remains confidential. You can trust that your aep5 forms are safe with airSlate SignNow.

-

Can I access the aep5 form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow has a mobile app that enables you to access, eSign, and send your aep5 form from any mobile device. This flexibility allows you to handle documents while on the go, making it convenient to manage your paperwork anywhere at any time. The mobile app ensures you never miss a signing opportunity.

Get more for Aep5 Revenue

- Mission statement university receivables and collections form

- 2018 2019 dependent verification worksheet form

- Email uscbfinauscb form

- Application for verification of enrollment jefferson county form

- Independent verification worksheet raritan valley community bb raritanval form

- To request a transcript complete this form and return it by postal mail or as an email

- Maildrop off form

- Portal and form

Find out other Aep5 Revenue

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT