De Form 8821de 2006

What is the De Form 8821de

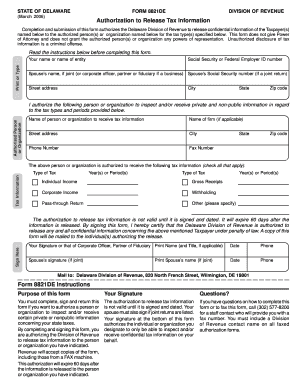

The De Form 8821de is a tax form used to authorize the disclosure of a taxpayer's information to a third party. This form is particularly useful for individuals who wish to allow someone else, such as a family member or tax professional, to access their tax records. By completing this form, taxpayers can ensure that their designated representative can obtain necessary information from the IRS on their behalf. The form serves as a formal request for the IRS to release specific tax information, making it an essential tool for effective tax management.

How to use the De Form 8821de

Using the De Form 8821de involves a straightforward process. First, download the form from the IRS website or obtain a physical copy. Next, fill out the required fields, including the taxpayer's information, the representative's details, and the specific tax information being requested. It is important to clearly define the scope of the authorization to avoid any confusion. Once completed, the form can be submitted to the IRS either by mail or electronically, depending on the instructions provided. Maintaining a copy of the submitted form is advisable for personal records.

Steps to complete the De Form 8821de

Completing the De Form 8821de requires careful attention to detail. Follow these steps for accurate submission:

- Download the form: Access the De Form 8821de from the IRS website.

- Fill in taxpayer information: Provide your name, address, and taxpayer identification number.

- Designate a representative: Include the name, address, and phone number of the person you are authorizing.

- Specify the tax information: Clearly indicate what information you wish to disclose, such as tax years or specific forms.

- Sign and date the form: Ensure that you sign and date the form to validate the authorization.

- Submit the form: Send the completed form to the IRS via the method specified in the instructions.

Legal use of the De Form 8821de

The De Form 8821de is legally binding when executed properly. It complies with federal regulations that govern the disclosure of taxpayer information. To ensure its legal validity, the form must be signed by the taxpayer and must clearly outline the scope of the authorization. This includes specifying what information can be disclosed and to whom. It is crucial for taxpayers to understand that this form does not authorize the representative to act on their behalf in tax matters; it only allows access to information.

Key elements of the De Form 8821de

Several key elements are essential to the De Form 8821de. These include:

- Taxpayer information: Accurate details of the taxpayer, including name and identification number.

- Representative information: Clear identification of the authorized individual or entity.

- Scope of authorization: Specific details about the tax information being disclosed.

- Signature: The taxpayer's signature is required to validate the form.

- Date: The date of signing is also necessary for record-keeping purposes.

Form Submission Methods (Online / Mail / In-Person)

The De Form 8821de can be submitted through various methods. Taxpayers have the option to send the completed form by mail to the appropriate IRS address, which can be found in the form instructions. Additionally, some taxpayers may be able to submit the form electronically, depending on the IRS guidelines. In-person submission is generally not required but may be an option for those seeking immediate assistance at local IRS offices. It is important to check the latest IRS guidelines for the most current submission methods.

Quick guide on how to complete de form 8821de

Accomplish De Form 8821de effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without delays. Manage De Form 8821de on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign De Form 8821de effortlessly

- Locate De Form 8821de and then click Obtain Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Finish button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign De Form 8821de to ensure effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct de form 8821de

Create this form in 5 minutes!

People also ask

-

What is the de form 8821de?

The de form 8821de, also known as the Tax Information Authorization form, is used by taxpayers to authorize third parties to receive or inspect their tax information. This form helps streamline communication between tax professionals and the IRS, ensuring confidentiality while allowing access to required documents.

-

How can airSlate SignNow assist with the de form 8821de?

airSlate SignNow makes it easy to eSign and send the de form 8821de securely and quickly. Our platform simplifies the process, allowing users to complete the form electronically and store it for future reference, reducing the need for paper documentation.

-

What are the pricing options for using airSlate SignNow for the de form 8821de?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are a small business or a large enterprise, you can choose a plan that best fits your budget while providing access to features that facilitate the signing and management of the de form 8821de.

-

What features does airSlate SignNow offer for the de form 8821de?

With airSlate SignNow, you can enjoy features such as customizable templates, tracking capabilities, and automated reminders for the de form 8821de. These tools enhance efficiency and ensure that all necessary steps are completed in a timely manner.

-

Can I integrate airSlate SignNow with other applications to manage the de form 8821de?

Yes, airSlate SignNow offers seamless integrations with various software applications such as Google Drive, Salesforce, and more. This allows for better management of the de form 8821de and ensures that your workflow remains uninterrupted across platforms.

-

Is airSlate SignNow secure for handling the de form 8821de?

Absolutely! airSlate SignNow prioritizes security and uses advanced encryption methods to protect your documents, including the de form 8821de. Our compliance with industry standards such as GDPR and HIPAA helps ensure that your sensitive information remains safe.

-

How does using airSlate SignNow for the de form 8821de benefit my business?

By using airSlate SignNow for the de form 8821de, your business can streamline document handling, reduce processing time, and ensure compliance with tax regulations. This efficiency not only saves time and resources but also enhances customer trust and satisfaction.

Get more for De Form 8821de

- Form tc 01 sars

- Sad 505 customs declartion form bond transit control sars

- Download tc 01 form corporate traveller

- Form da 1854a7 sars

- New zealand citizen application form

- Application for child new zealand citizenshipnew zealand passport application form for renewals what you need to renew or apply

- Trip ticket sample form

- Please fill out the flag request form senator ted cruz

Find out other De Form 8821de

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors