Named below to the Authorized Persons or Organization Named below for the Tax Types Specified below 2014

What is the Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below

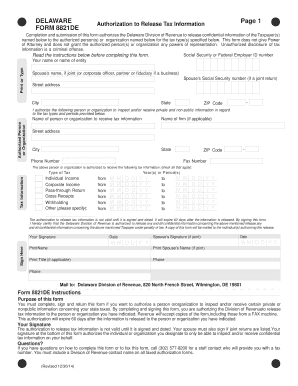

The form named below to the authorized persons or organization named below for the tax types specified below is a critical document used in various tax-related situations. This form allows individuals or entities to designate specific persons or organizations to handle tax matters on their behalf. It can be particularly important for businesses, tax professionals, and individuals who need to ensure that their tax obligations are managed accurately and efficiently.

This form typically includes essential information such as the names of the authorized persons or organizations, the specific tax types they are authorized to manage, and any relevant identification numbers. By completing this form, the signer grants permission for the designated parties to act in their stead regarding tax-related issues, which can streamline processes and enhance compliance.

Steps to complete the Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below

Completing the named below to the authorized persons or organization named below for the tax types specified below form involves several straightforward steps. Following these steps can help ensure accuracy and compliance:

- Begin by gathering all necessary information, including the names and contact details of the authorized persons or organizations.

- Clearly specify the tax types for which authorization is granted, ensuring that all relevant categories are included.

- Provide any required identification numbers, such as Social Security numbers or Employer Identification Numbers (EINs).

- Review the completed form for accuracy and completeness to prevent delays or issues.

- Sign and date the form to validate the authorization.

Once completed, the form can be submitted to the relevant tax authority or organization as required.

Legal use of the Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below

The legal use of the named below to the authorized persons or organization named below for the tax types specified below form is crucial for ensuring that the document is recognized by tax authorities. For the form to be legally binding, it must be filled out correctly and signed by the individual granting the authorization.

Compliance with federal and state regulations is essential. The form must adhere to the guidelines set forth by the Internal Revenue Service (IRS) and any applicable state tax agencies. This ensures that the designated persons or organizations have the legal authority to act on behalf of the signer regarding the specified tax types.

Key elements of the Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below

Several key elements must be included in the named below to the authorized persons or organization named below for the tax types specified below form to ensure its effectiveness:

- Authorized Persons or Organizations: Clearly list the names and contact information of those granted authority.

- Tax Types: Specify the exact tax types for which the authorization applies, such as income tax, payroll tax, or sales tax.

- Identification Numbers: Include any necessary identification numbers to verify the identity of the signer and the authorized parties.

- Signature and Date: The form must be signed and dated by the individual granting authorization to validate the document.

IRS Guidelines

Understanding IRS guidelines related to the named below to the authorized persons or organization named below for the tax types specified below form is vital for compliance. The IRS provides specific instructions on how to complete the form and what information is required. These guidelines help ensure that the form is filled out correctly and that the authorization is legally recognized.

It is important to consult the IRS website or relevant publications to stay updated on any changes to the requirements or procedures associated with this form. Following these guidelines can help prevent issues with tax filings and ensure that the authorized parties can effectively manage tax matters on behalf of the signer.

Required Documents

When completing the named below to the authorized persons or organization named below for the tax types specified below form, several documents may be required to support the information provided. These documents can include:

- Proof of identity, such as a government-issued ID or Social Security card.

- Tax identification numbers for both the signer and the authorized parties, such as Social Security numbers or EINs.

- Any previous correspondence with tax authorities that may be relevant to the authorization.

Having these documents ready can facilitate a smoother completion process and ensure that all necessary information is accurately provided.

Quick guide on how to complete named below to the authorized persons or organization named below for the tax types specified below

Effortlessly Prepare Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below on Any Device

The online management of documents has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below on any device using airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to Modify and Electronically Sign Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below with Ease

- Locate Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors requiring new document prints. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below and ensure outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct named below to the authorized persons or organization named below for the tax types specified below

Create this form in 5 minutes!

People also ask

-

What does 'Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below' mean?

This phrase refers to the specific individuals or organizations authorized to manage particular tax types as outlined in tax documentation. Understanding this term is crucial for compliance and ensures that your documents are correctly executed and processed.

-

How does airSlate SignNow facilitate document signing for tax purposes?

AirSlate SignNow allows businesses to send documents for eSigning to designated individuals. By utilizing our platform, users can easily ensure that documents are executed 'Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below,' fostering accuracy and efficiency.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing structure allows small businesses to utilize electronic signatures while ensuring they remain compliant with tax documentation requirements, like the 'Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below.'

-

What features does airSlate SignNow offer for tax document management?

AirSlate SignNow provides several features, including templates for common tax documents and automated workflows. This streamlines document management and ensures that the documentation meets the criteria for being 'Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below.'

-

Can I integrate airSlate SignNow with other tools for tax filing?

Absolutely! AirSlate SignNow integrates seamlessly with various platforms, allowing for efficient tax filing processes. This ensures that the documents are correctly assigned 'Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below' for timely and accurate submissions.

-

What benefits does airSlate SignNow provide for tax compliance?

Using airSlate SignNow helps businesses maintain compliance by ensuring all documents are electronically signed and securely stored. It drastically reduces the risk of errors that can occur in manual processes, especially when addressing who is 'Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below.'

-

How secure is the data when using airSlate SignNow for tax documents?

Security is a top priority for airSlate SignNow. We employ strong encryption protocols to protect sensitive information, ensuring that only the authorized individuals 'Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below' can access or sign the documents.

Get more for Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below

- Form h1205 texas streamlined applicationtexas health

- Dwc form 121 claim administration contact information dwc form 121 claim administration contact information

- Fint09 form

- Before your upcoming appointment i want to say thank you for allowing me the privilege of taking care of you form

- Application for division approval of change form

- Tdi texas form

- Workers compensation complaint form texas department of

- Designated doctor examination data report designated doctor examination data report form

Find out other Named Below To The Authorized Persons Or Organization Named Below For The Tax Types Specified Below

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast