8821 DE Authorization to Release Tax Information 2017-2026

What is the 8821 DE Authorization To Release Tax Information

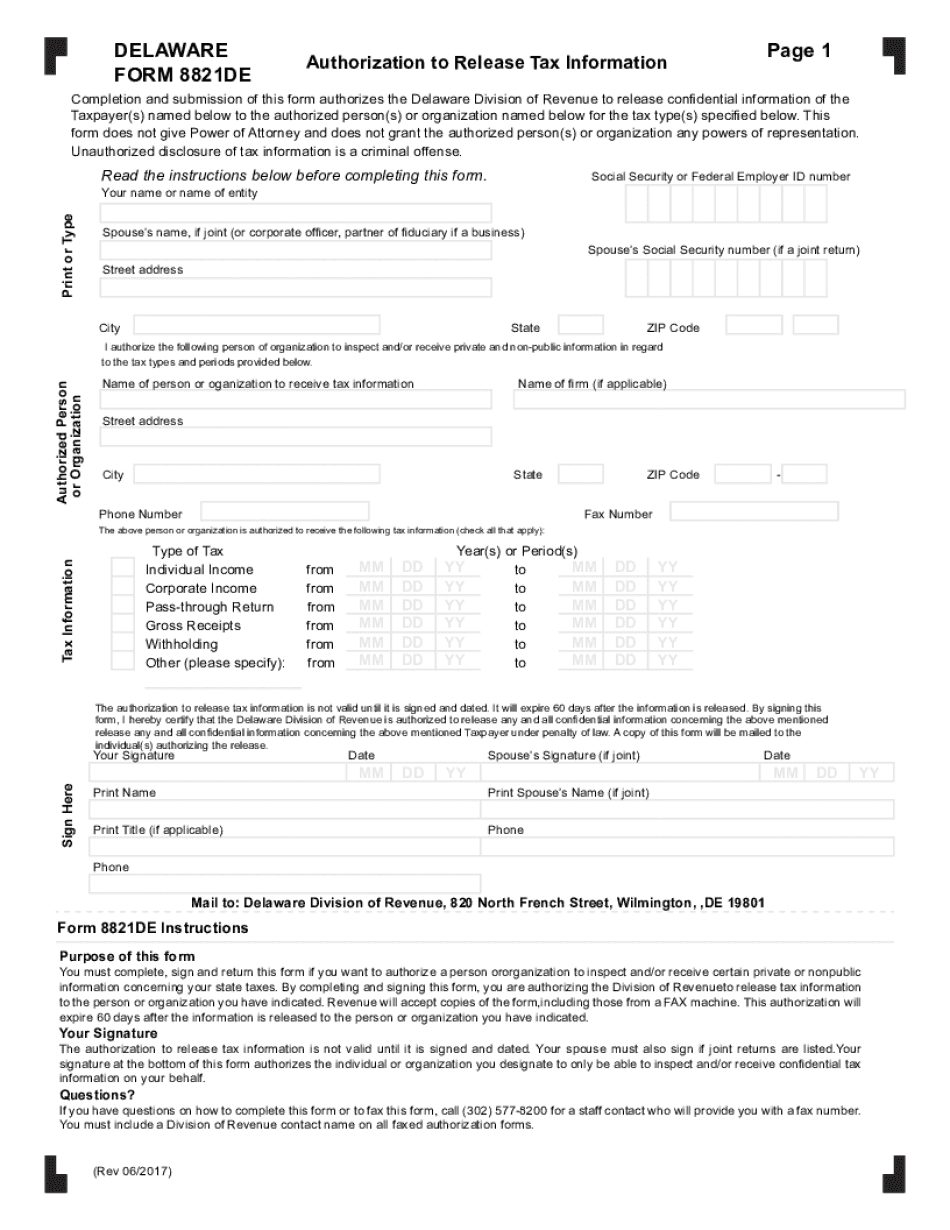

The 8821 DE Authorization To Release Tax Information is an official form used by taxpayers in the United States to authorize the Internal Revenue Service (IRS) to disclose their tax information to a designated third party. This form is particularly useful for individuals who want someone else, such as a tax professional or family member, to handle their tax matters on their behalf. By completing this form, taxpayers can ensure that the designated individual has the necessary access to their tax records, which can facilitate communication and streamline the tax filing process.

How to use the 8821 DE Authorization To Release Tax Information

To use the 8821 DE Authorization To Release Tax Information, a taxpayer must first complete the form by providing their personal information, including their name, address, and Social Security number. They must also specify the name and contact information of the person they are authorizing to receive their tax information. Once the form is filled out, it should be submitted to the IRS. This can be done by mailing the form to the appropriate IRS office or, in some cases, submitting it electronically. It is important to keep a copy of the completed form for personal records.

Steps to complete the 8821 DE Authorization To Release Tax Information

Completing the 8821 DE Authorization To Release Tax Information involves several straightforward steps:

- Obtain the form from the IRS website or through a tax professional.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide the details of the individual you are authorizing, including their name and contact information.

- Sign and date the form to validate your authorization.

- Submit the completed form to the IRS by mail or electronically, if applicable.

Legal use of the 8821 DE Authorization To Release Tax Information

The legal use of the 8821 DE Authorization To Release Tax Information is governed by IRS regulations. This form allows taxpayers to authorize the IRS to share their tax information with a designated third party, ensuring that the authorization is clear and documented. It is essential for the taxpayer to understand that the authorized individual will have access to sensitive tax information, and thus, the selection of this person should be made with care. The form must be signed by the taxpayer to be considered valid, and it remains in effect until revoked or until the IRS is notified of a change.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 8821 DE Authorization To Release Tax Information. Taxpayers must ensure that the form is completed accurately and submitted to the correct IRS office. Additionally, the IRS recommends that taxpayers verify the identity of the person they are authorizing to prevent unauthorized access to their tax information. For detailed instructions, taxpayers can refer to the IRS instructions accompanying the form, which outline the requirements and best practices for its use.

Form Submission Methods (Online / Mail / In-Person)

The 8821 DE Authorization To Release Tax Information can be submitted to the IRS through various methods. Taxpayers may choose to mail the completed form to the appropriate IRS address, which can be found in the form instructions. In some cases, taxpayers may also have the option to submit the form electronically, depending on the IRS's current capabilities. It is important to check the latest IRS guidelines for any updates regarding submission methods. In-person submissions are generally not available for this form, as it is primarily processed through mail or electronic channels.

Quick guide on how to complete 8821 de authorization to release tax information

Execute 8821 DE Authorization To Release Tax Information seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to produce, adjust, and electronically sign your documents efficiently without delays. Handle 8821 DE Authorization To Release Tax Information on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

How to modify and electronically sign 8821 DE Authorization To Release Tax Information effortlessly

- Locate 8821 DE Authorization To Release Tax Information and click Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using features that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign option, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and press the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, the hassle of tedious form searches, or errors that necessitate printing new copies. airSlate SignNow manages all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign 8821 DE Authorization To Release Tax Information and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8821 de authorization to release tax information

Create this form in 5 minutes!

How to create an eSignature for the 8821 de authorization to release tax information

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

How to make an e-signature from your mobile device

The best way to create an e-signature for a PDF document on iOS devices

How to make an e-signature for a PDF file on Android devices

People also ask

-

What is an 8821 form and why is it important?

The 8821 form, officially known as the 'Tax Information Authorization,' is essential for authorizing someone to receive confidential tax information on your behalf. Understanding what is an 8821 form helps you manage your tax-related matters effectively. It is crucial for streamlining communication with the IRS and ensuring that you have a trusted representative handling sensitive information.

-

How can airSlate SignNow help with the 8821 form?

AirSlate SignNow provides a seamless platform for electronically signing the 8821 form. With our user-friendly interface, you can quickly fill out and send the 8821 form, ensuring your tax authorizations are processed promptly. This convenience saves you time and enhances your workflow.

-

Is there a cost associated with using airSlate SignNow for the 8821 form?

Yes, using airSlate SignNow involves a subscription cost, but it offers a cost-effective solution for handling forms like the 8821. We provide flexible pricing plans to cater to different business needs. Investing in our service allows you to benefit from advanced features and enhance your document handling process.

-

What are the benefits of using airSlate SignNow for the 8821 form?

Using airSlate SignNow to handle the 8821 form offers several benefits, including speed, security, and ease of use. You can sign documents from anywhere and on any device while ensuring that your information is protected. Furthermore, our platform facilitates quick tracking and management of your forms.

-

Can I integrate airSlate SignNow with other software for handling the 8821 form?

Absolutely! airSlate SignNow integrates with various software applications, enhancing the efficiency of managing the 8821 form. This integration enables seamless data transfer and improved workflow, making it easier to manage all aspects of your tax-related documents.

-

What features does airSlate SignNow offer for completing the 8821 form?

AirSlate SignNow offers a range of features specifically designed to facilitate the completion of the 8821 form, including customizable templates and secure electronic signatures. These features signNowly speed up the process while ensuring compliance with IRS regulations. With our platform, you can create, send, and track your forms effortlessly.

-

How do I get started with airSlate SignNow for the 8821 form?

To get started with airSlate SignNow for the 8821 form, simply sign up for our service and navigate to the document creation section. Here, you can create your 8821 form using our templates or upload your own. Once prepared, you can send it out for electronic signatures in just a few clicks.

Get more for 8821 DE Authorization To Release Tax Information

- Arkansas commercial rental lease application questionnaire form

- Arkansas order on petition for letters of administration form

- Arkansas waiver of notice of appointment of personal representative by heirs form

- Arkansas deed 481379064 form

- Arkansas arkansas forest products timber sale contract form

- Letters administration form 481379066

- Letters testamentary form

- Petition appointment guardian form

Find out other 8821 DE Authorization To Release Tax Information

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF