Register for VATSouth African Revenue Service 2021

Steps to complete the VAT 1 registration

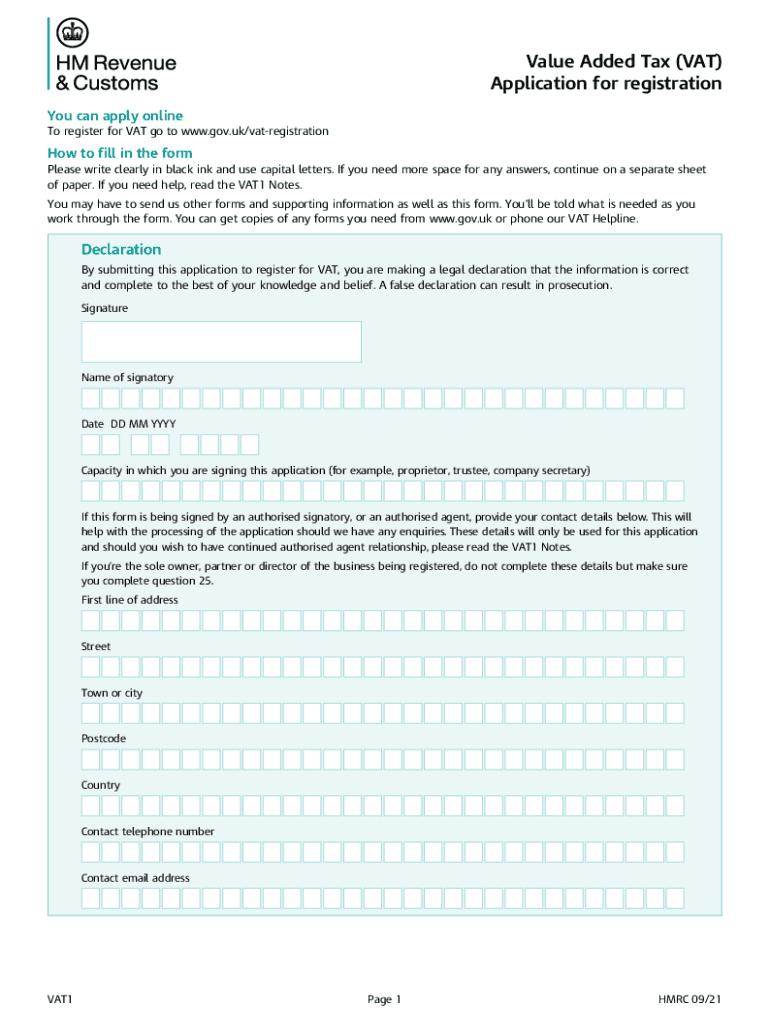

Completing the VAT 1 registration involves several key steps to ensure compliance with tax regulations. Start by gathering the necessary information about your business, including the legal name, address, and tax identification number. This information will be essential for filling out the form accurately.

Next, access the VAT 1 form, which can typically be downloaded as a PDF. Fill out the form carefully, ensuring that all sections are completed. Pay special attention to any specific instructions related to your business type, as different entities may have unique requirements.

Once the form is completed, review it for any errors or omissions. It is crucial to ensure that all information is accurate to avoid delays in processing. After confirming the details, you can submit the form either online or by mail, depending on the submission methods available in your state.

Required Documents for VAT 1 registration

When registering for VAT using the VAT 1 form, several documents are typically required to support your application. These may include:

- Proof of business registration, such as articles of incorporation or a business license.

- Tax identification number (TIN) or employer identification number (EIN).

- Financial statements or business plans that demonstrate your business activities.

- Any additional documentation specific to your business type or industry.

Having these documents ready can streamline the registration process and help ensure that your application is processed without delays.

Legal use of the VAT 1 form

The VAT 1 form is a legally binding document that requires careful handling to ensure compliance with tax laws. When filled out correctly, it serves as an official request for VAT registration, allowing businesses to collect and remit value-added tax as required by law.

It is important to understand the legal implications of submitting the VAT 1 form. Providing false information or failing to comply with VAT regulations can result in penalties or legal consequences. Therefore, ensure that all information provided is accurate and truthful, reflecting your business's actual operations.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for maintaining compliance with VAT regulations. Typically, businesses must submit the VAT 1 form within a specific timeframe after reaching the threshold for VAT registration. This timeframe may vary by state, so it is essential to check local regulations.

Additionally, keep track of any important dates related to VAT filing, such as quarterly or annual submission deadlines. Missing these deadlines can lead to penalties and interest on unpaid taxes, making it vital to stay organized and proactive in your tax obligations.

Form Submission Methods (Online / Mail / In-Person)

When it comes to submitting the VAT 1 form, there are various methods available. Depending on your location and the specific requirements of your state, you may have the option to submit the form online, by mail, or in person.

Online submission is often the most efficient method, allowing for quicker processing times. Ensure that you have a reliable internet connection and that your documents are in the correct format. If you choose to submit by mail, consider using a trackable service to confirm delivery. In-person submissions may be required in certain situations, so check local guidelines for any specific instructions.

Eligibility Criteria for VAT 1 registration

Eligibility for VAT registration using the VAT 1 form typically depends on your business's annual turnover and the nature of your goods or services. Generally, businesses that exceed a certain revenue threshold must register for VAT to comply with tax laws.

It is important to assess your business operations and financials to determine if you meet the eligibility criteria. If you are unsure, consulting with a tax professional can provide clarity and ensure that you are meeting all necessary requirements.

Quick guide on how to complete register for vatsouth african revenue service

Effortlessly prepare Register For VATSouth African Revenue Service on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without complications. Manage Register For VATSouth African Revenue Service on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Register For VATSouth African Revenue Service with ease

- Locate Register For VATSouth African Revenue Service and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching through forms, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Edit and eSign Register For VATSouth African Revenue Service and ensure effective communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct register for vatsouth african revenue service

Create this form in 5 minutes!

How to create an eSignature for the register for vatsouth african revenue service

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an e-signature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The best way to generate an e-signature for a PDF file on Android devices

People also ask

-

What is the basic process of how to vat 1 using airSlate SignNow?

To begin, log in to your airSlate SignNow account and upload your document. Once uploaded, you can add signature fields and other necessary information. After setting everything up, you can send the document out for eSigning, which streamlines your workflow and ensures a secure process.

-

How does airSlate SignNow help businesses with how to vat 1?

airSlate SignNow simplifies the process of how to vat 1 by providing an intuitive platform for managing document workflows. It allows users to create, send, and track documents quickly, reducing the time spent on manual tasks. This efficiency can lead to faster decision-making and improved overall productivity.

-

What are the pricing options for using airSlate SignNow for how to vat 1?

airSlate SignNow offers flexible pricing plans to suit various business needs when learning how to vat 1. These plans range from basic to advanced, allowing you to choose one that fits your budget and feature requirements. Additionally, they often provide a free trial to explore the platform before committing.

-

Can airSlate SignNow integrate with other software for how to vat 1?

Yes, airSlate SignNow seamlessly integrates with various third-party applications that can assist in how to vat 1. Whether you are using CRM software or other document management systems, these integrations can help streamline your processes further. This ensures that all your business tools work in harmony to improve efficiency.

-

What features does airSlate SignNow offer for how to vat 1?

Some of the notable features of airSlate SignNow that aid in how to vat 1 include customizable templates, real-time tracking, and automated reminders for signers. These features help ensure that your documents are processed quickly and efficiently, reducing bottlenecks in your operations. Additionally, the user-friendly interface makes it easy for anyone to navigate.

-

Is airSlate SignNow secure when handling how to vat 1?

Absolutely, airSlate SignNow prioritizes security, providing encryption and compliance with industry standards for how to vat 1. Your documents are protected throughout the signing process, ensuring that sensitive information remains confidential. This makes it a reliable choice for businesses concerned about data privacy and security.

-

What benefits can users expect by adopting airSlate SignNow for how to vat 1?

Users adopting airSlate SignNow for how to vat 1 can expect enhanced efficiency, cost savings, and improved document management. The platform reduces the time spent on paperwork and manual processes, enabling teams to focus on core activities. Overall, it contributes to better collaboration and faster turnaround times for document procedures.

Get more for Register For VATSouth African Revenue Service

- Nevada notarial certificates form

- Election of method of payment of compensation for form

- Wage calculation form for claims agents use d 5pdf

- Request for hearing uninsured employer d 12bpdf form

- Justia injured employees right to reopen a claim which form

- Municipal pensions oversight board disability claim packet form

- D 16 worddoc form

- Colorado workers compensation claim handling guidelines 490202464 form

Find out other Register For VATSouth African Revenue Service

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself