Schedule REG 1 C, Cigarette and Tobacco Products Information Tax Illinois 2016

What is the Schedule REG 1 C, Cigarette And Tobacco Products Information Tax Illinois

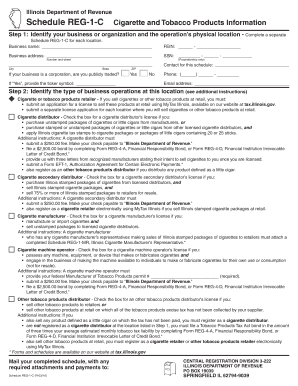

The Schedule REG 1 C is a form used in Illinois to report and pay the state cigarette tax and tobacco products tax. This form is essential for businesses that manufacture, distribute, or sell cigarettes and tobacco products within the state. It provides the state with necessary information regarding the quantity of products sold and the corresponding tax owed. Understanding this form is crucial for compliance with Illinois tax laws.

Steps to complete the Schedule REG 1 C, Cigarette And Tobacco Products Information Tax Illinois

Completing the Schedule REG 1 C involves several key steps:

- Gather necessary information, including business details and sales data for cigarettes and tobacco products.

- Fill out the form accurately, ensuring all quantities and tax calculations are correct.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or via mail.

Each step is vital to ensure compliance and avoid potential penalties.

How to obtain the Schedule REG 1 C, Cigarette And Tobacco Products Information Tax Illinois

The Schedule REG 1 C can be obtained from the Illinois Department of Revenue website. It is typically available in a downloadable PDF format, which can be filled out electronically or printed for manual completion. Businesses should ensure they are using the most current version of the form to comply with any recent changes in tax law.

Legal use of the Schedule REG 1 C, Cigarette And Tobacco Products Information Tax Illinois

The legal use of the Schedule REG 1 C is governed by Illinois tax regulations. This form must be completed accurately and submitted on time to avoid penalties. It is important to understand that the information provided on this form is subject to audit, and any discrepancies could lead to legal consequences. Using a reliable eSignature solution can help ensure that the form is signed and submitted legally.

Penalties for Non-Compliance

Failing to file the Schedule REG 1 C on time or providing inaccurate information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to adhere to filing deadlines and ensure the accuracy of their submissions to avoid these consequences.

Form Submission Methods (Online / Mail / In-Person)

The Schedule REG 1 C can be submitted through various methods to accommodate different business needs:

- Online: Many businesses prefer to file electronically through the Illinois Department of Revenue's online portal, which allows for quicker processing.

- Mail: The form can be printed and mailed to the appropriate state office. Ensure that it is sent well before the deadline to allow for processing time.

- In-Person: Businesses may also choose to submit the form in person at designated state offices, which can provide immediate confirmation of receipt.

Quick guide on how to complete schedule reg 1 c cigarette and tobacco products information tax illinois

Complete Schedule REG 1 C, Cigarette And Tobacco Products Information Tax Illinois effortlessly on any device

Online document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the proper format and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without issues. Manage Schedule REG 1 C, Cigarette And Tobacco Products Information Tax Illinois on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

The simplest way to modify and eSign Schedule REG 1 C, Cigarette And Tobacco Products Information Tax Illinois with ease

- Obtain Schedule REG 1 C, Cigarette And Tobacco Products Information Tax Illinois and click Get Form to begin.

- Utilize the features we offer to submit your document.

- Emphasize pertinent sections of the documents or redact sensitive details using tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your adjustments.

- Choose how you wish to deliver your document, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, the tiring search for forms, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Adjust and eSign Schedule REG 1 C, Cigarette And Tobacco Products Information Tax Illinois and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule reg 1 c cigarette and tobacco products information tax illinois

Create this form in 5 minutes!

People also ask

-

What is the current Illinois cigarette tax rate?

The current Illinois cigarette tax rate is an important consideration for consumers and businesses involved in the sale of cigarettes. As of 2023, the tax per pack is $2.98, which impacts pricing and revenue for retailers. Understanding the Illinois cigarette tax is essential for compliance and budget planning.

-

How does the Illinois cigarette tax affect e-signatures for tobacco businesses?

The Illinois cigarette tax can influence the documentation process for tobacco businesses, requiring accurate record-keeping for compliance. Using airSlate SignNow, businesses can efficiently manage e-signatures for tax documents and customer agreements, ensuring they stay compliant with Illinois cigarette tax regulations.

-

Are there any benefits to using electronic signatures in relation to the Illinois cigarette tax?

Yes, utilizing electronic signatures can streamline the process of tax documentation related to the Illinois cigarette tax. With airSlate SignNow, businesses can quickly e-sign required documents, reducing turnaround times and enhancing efficiency, thus allowing businesses to focus more on compliance and less on paperwork.

-

How can airSlate SignNow help with compliance to the Illinois cigarette tax?

airSlate SignNow helps businesses ensure compliance with the Illinois cigarette tax by providing a secure and organized way to store and manage documents related to tax responsibilities. Our platform supports easy tracking and retrieval of e-signed documents, which is crucial for audits and tax reporting.

-

What features does airSlate SignNow offer for managing documents affected by the Illinois cigarette tax?

airSlate SignNow offers features such as templates for tax documentation, automated workflows, and comprehensive audit trails that facilitate managing documents associated with the Illinois cigarette tax. These features ensure that all signatures are tracked and submitted efficiently, which is vital for regulatory compliance.

-

How does the Illinois cigarette tax impact the pricing of airSlate SignNow?

The Illinois cigarette tax may indirectly impact the pricing strategies of businesses, potentially affecting their operational costs. By leveraging airSlate SignNow's cost-effective solution for document management, businesses can minimize overhead related to compliance, including those influenced by the Illinois cigarette tax.

-

Can airSlate SignNow integrate with other financial software for tracking the Illinois cigarette tax?

Yes, airSlate SignNow integrates seamlessly with various financial software, making it easier to track transactions affected by the Illinois cigarette tax. This integration enables businesses to streamline their operations, ensuring that all financial records, including those related to the Illinois cigarette tax, are accurate and up to date.

Get more for Schedule REG 1 C, Cigarette And Tobacco Products Information Tax Illinois

- County health family planning form

- Sample school based stay away agreement louisiana believes form

- Da 82 loan authorization form

- Da 82 loan authorization report form

- Employee data form aacps

- People living with hivaids in maine form

- Michigan notary public application form michigan notary public application form

- Macomb county notary form

Find out other Schedule REG 1 C, Cigarette And Tobacco Products Information Tax Illinois

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document