APPLICATION for TAX DEDUCTION for DISABLED VETERANS 2020

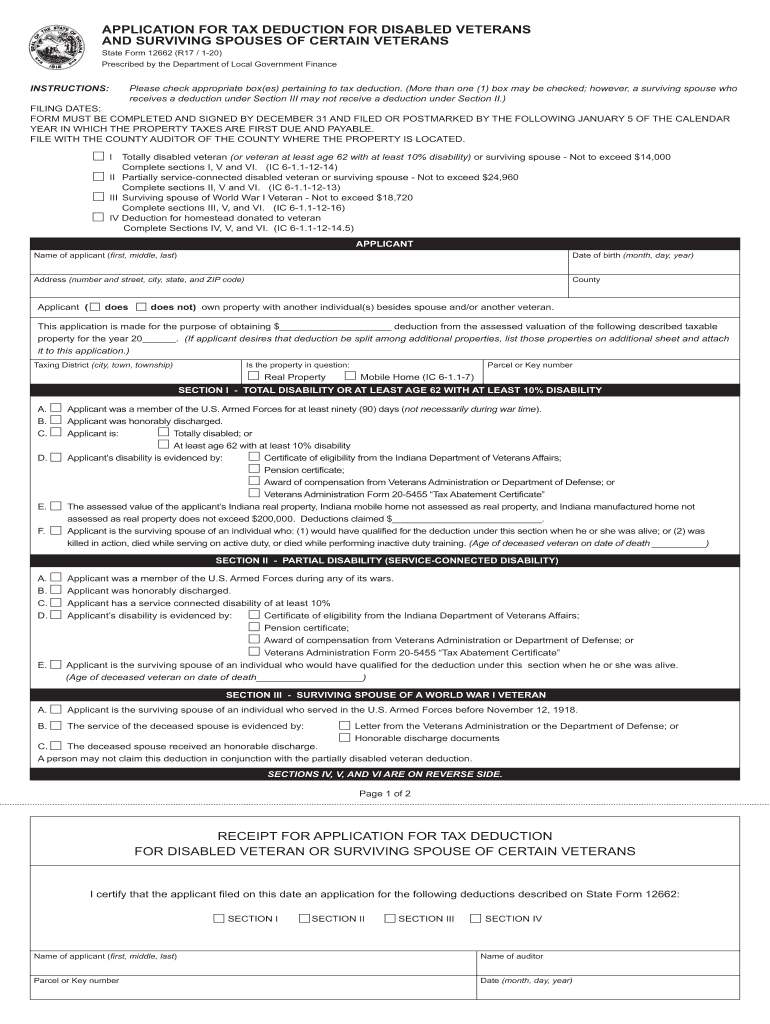

What is the Indiana State Form 12662?

The Indiana State Form 12662 is an official document used to apply for a tax deduction specifically for disabled veterans. This form is essential for veterans who wish to claim property tax deductions available to them under Indiana law. By completing this form, eligible veterans can reduce their property tax liability, providing financial relief and recognition for their service. Understanding the purpose and requirements of Form 12662 is crucial for veterans looking to benefit from these tax deductions.

Eligibility Criteria for Form 12662

To qualify for the Indiana State Form 12662, applicants must meet specific eligibility criteria. Generally, the applicant must be a veteran who has been honorably discharged from military service. Additionally, the veteran must demonstrate a service-connected disability as recognized by the U.S. Department of Veterans Affairs. It is important for applicants to review the criteria carefully to ensure they meet all requirements before submitting the form.

Steps to Complete the Indiana State Form 12662

Completing the Indiana State Form 12662 involves several important steps. First, gather all necessary documentation, including proof of military service and any relevant medical records that confirm the disability. Next, accurately fill out the form, ensuring that all personal information is correct. After completing the form, review it for any errors or omissions. Finally, submit the form to the appropriate local government office by the specified deadline to ensure consideration for the tax deduction.

Required Documents for Submission

When applying with the Indiana State Form 12662, certain documents must accompany the application. These typically include:

- Proof of military service, such as a DD-214 form.

- Documentation of the service-connected disability from the U.S. Department of Veterans Affairs.

- Identification, such as a driver’s license or state ID.

Having these documents ready will facilitate a smoother application process and help verify eligibility for the tax deduction.

Form Submission Methods

The Indiana State Form 12662 can be submitted through various methods. Applicants may choose to submit the form online, by mail, or in person at their local county assessor's office. Each method has its own advantages, such as convenience for online submissions or direct assistance when submitting in person. It is advisable to check the local guidelines for any specific submission requirements or preferences.

Legal Use of Form 12662

The Indiana State Form 12662 is legally binding once completed and submitted in accordance with state laws. This means that the information provided must be accurate and truthful, as any false statements could lead to penalties or denial of the tax deduction. Understanding the legal implications of submitting this form is vital for ensuring compliance and protecting one’s rights as a veteran.

Quick guide on how to complete application for tax deduction for disabled veterans

Complete APPLICATION FOR TAX DEDUCTION FOR DISABLED VETERANS easily on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can locate the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Manage APPLICATION FOR TAX DEDUCTION FOR DISABLED VETERANS on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign APPLICATION FOR TAX DEDUCTION FOR DISABLED VETERANS effortlessly

- Locate APPLICATION FOR TAX DEDUCTION FOR DISABLED VETERANS and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only a few seconds and possesses the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign APPLICATION FOR TAX DEDUCTION FOR DISABLED VETERANS and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for tax deduction for disabled veterans

Create this form in 5 minutes!

People also ask

-

What is the Indiana state form 12662?

The Indiana state form 12662 is a document used for specific state tax purposes in Indiana. It provides essential information for filing state taxes correctly. Understanding the role of this form helps ensure compliance and avoid penalties.

-

How can I complete the Indiana state form 12662 using airSlate SignNow?

You can easily complete the Indiana state form 12662 using airSlate SignNow by uploading the form to our platform. Our intuitive interface allows you to fill in the necessary fields and add your electronic signature. Once completed, you can securely send it to relevant parties.

-

Is there a cost associated with using airSlate SignNow for the Indiana state form 12662?

Yes, while airSlate SignNow offers various pricing plans, users can efficiently handle the Indiana state form 12662 at a competitive rate. Our flexible pricing allows businesses to choose a plan that best fits their needs and budget. Consider adding this cost-effective eSigning solution to your workflow.

-

What features does airSlate SignNow offer for processing the Indiana state form 12662?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and an easy-to-navigate interface for handling the Indiana state form 12662. Users can track document status and receive notifications, ensuring a seamless signing process. These features enhance efficiency and ease of use.

-

Can I integrate airSlate SignNow with other applications for using Indiana state form 12662?

Yes, airSlate SignNow offers various integrations with popular applications that can streamline the process of using the Indiana state form 12662. This includes integrations with CRM systems, cloud storage solutions, and productivity tools. Such integrations make it easier to manage documents without switching between different platforms.

-

What are the benefits of using airSlate SignNow for the Indiana state form 12662?

Using airSlate SignNow for the Indiana state form 12662 provides several benefits, including time savings, reduced paperwork, and enhanced security. The electronic signing process speeds up approvals and minimizes delays. Additionally, your documents are securely stored and easily accessible.

-

Is electronic signing of the Indiana state form 12662 legally binding?

Yes, electronic signatures made through airSlate SignNow on the Indiana state form 12662 are legally binding. According to federal and state laws, electronic signatures have the same legal standing as handwritten ones. This ensures that your signed documents are valid and enforceable.

Get more for APPLICATION FOR TAX DEDUCTION FOR DISABLED VETERANS

- Printable 2020 louisiana form r 210nr nonresident and part year resident underpayment penalty computation worksheet

- Nj form 2210 underpayment of estimated tax by individuals

- Form nj 2440 download fillable pdf or fill online statement

- New york form it 59 tax forgiveness for victims of the

- Instructions for form it 203 nonresident and part year

- Form it 245 claim for volunteer firefighters and ambulance workers credit tax year 2020

- Form it 255 claim for solar energy system equipment credit tax year 2020

- Form it 603 ampquotclaim for ez investment tax credit and ez

Find out other APPLICATION FOR TAX DEDUCTION FOR DISABLED VETERANS

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy