PROPERTY TAX DEDUCTION CLAIM by VETERAN NJ Gov 2024-2026

What is the PROPERTY TAX DEDUCTION CLAIM BY VETERAN NJ gov

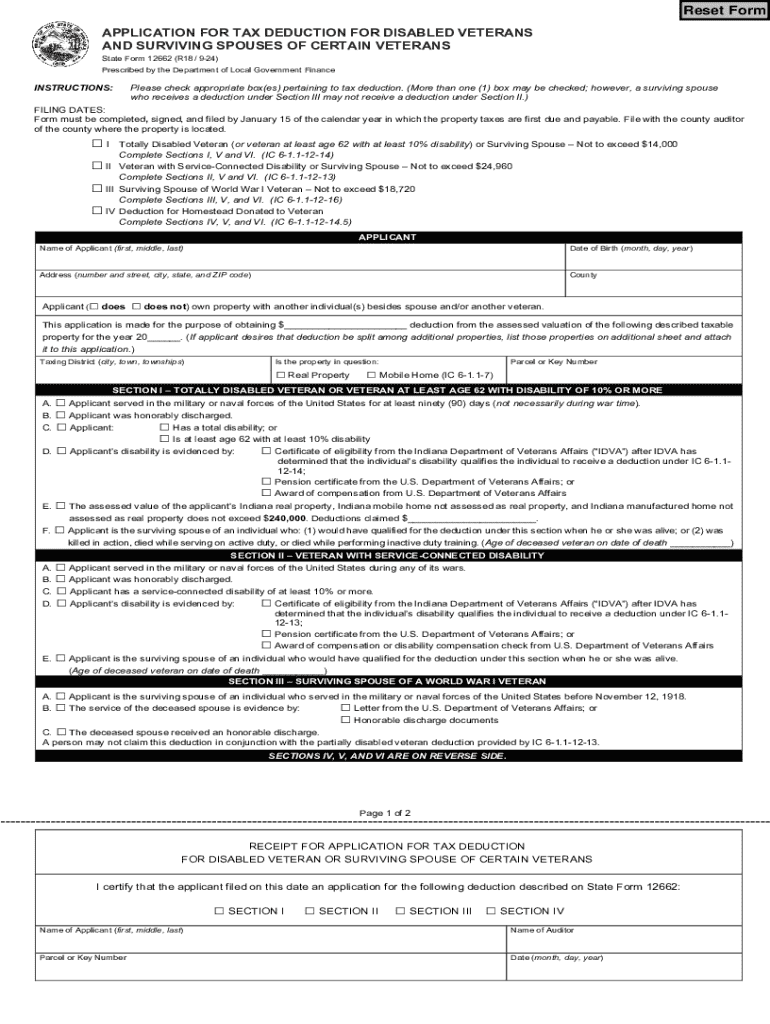

The PROPERTY TAX DEDUCTION CLAIM BY VETERAN in New Jersey is a program designed to provide property tax relief to eligible veterans. This claim allows qualified veterans to receive a deduction on their property taxes, thereby reducing their overall tax burden. The program is part of the state's efforts to honor veterans for their service and to support them financially. Eligibility typically requires proof of military service, residency in New Jersey, and ownership of the property for which the deduction is claimed.

Eligibility Criteria

To qualify for the PROPERTY TAX DEDUCTION CLAIM BY VETERAN, applicants must meet specific criteria. Veterans must have served in active duty in the U.S. Armed Forces and received an honorable discharge. Additionally, the property must be the veteran's primary residence, and the veteran must be a New Jersey resident. There may also be income limits and other requirements that vary by municipality, so it is essential to check local guidelines.

Steps to complete the PROPERTY TAX DEDUCTION CLAIM BY VETERAN NJ gov

Completing the PROPERTY TAX DEDUCTION CLAIM involves several key steps:

- Gather necessary documentation, including proof of military service and residency.

- Obtain the official claim form from your local tax assessor's office or the New Jersey Division of Taxation.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the completed form to your local tax assessor by the specified deadline, which is typically April 1 of the tax year.

Required Documents

When filing the PROPERTY TAX DEDUCTION CLAIM BY VETERAN, several documents are necessary to support your claim:

- Proof of military service, such as a DD-214 form.

- Identification verifying New Jersey residency, like a driver's license or utility bill.

- Any additional documentation required by your local tax assessor, which may vary by municipality.

Form Submission Methods

The PROPERTY TAX DEDUCTION CLAIM can be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission through your local tax assessor's website, if available.

- Mailing the completed form to the local tax assessor's office.

- In-person delivery to the tax assessor's office during business hours.

Filing Deadlines / Important Dates

Filing deadlines for the PROPERTY TAX DEDUCTION CLAIM BY VETERAN are crucial to ensure eligibility for the deduction. Typically, the claim must be submitted by April 1 of the tax year for which the deduction is sought. It is advisable to check for any changes or specific deadlines that may apply in your municipality, as these can vary.

Create this form in 5 minutes or less

Find and fill out the correct property tax deduction claim by veteran nj gov

Create this form in 5 minutes!

How to create an eSignature for the property tax deduction claim by veteran nj gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PROPERTY TAX DEDUCTION CLAIM BY VETERAN NJ gov?

The PROPERTY TAX DEDUCTION CLAIM BY VETERAN NJ gov is a benefit available to eligible veterans in New Jersey that allows them to reduce their property tax burden. This deduction can signNowly lower the amount of property taxes owed, providing financial relief to those who have served in the military.

-

How can airSlate SignNow assist with the PROPERTY TAX DEDUCTION CLAIM BY VETERAN NJ gov?

airSlate SignNow simplifies the process of submitting your PROPERTY TAX DEDUCTION CLAIM BY VETERAN NJ gov by allowing you to easily eSign and send necessary documents. Our platform ensures that your claims are processed quickly and securely, helping you take advantage of this valuable benefit.

-

What documents are needed for the PROPERTY TAX DEDUCTION CLAIM BY VETERAN NJ gov?

To file a PROPERTY TAX DEDUCTION CLAIM BY VETERAN NJ gov, you typically need proof of military service, such as a DD-214 form, and documentation of your property ownership. airSlate SignNow can help you gather and eSign these documents efficiently, ensuring you have everything you need for a successful claim.

-

Is there a fee to use airSlate SignNow for the PROPERTY TAX DEDUCTION CLAIM BY VETERAN NJ gov?

airSlate SignNow offers a cost-effective solution for managing your PROPERTY TAX DEDUCTION CLAIM BY VETERAN NJ gov. While there may be subscription fees, the savings from reduced property taxes can outweigh these costs, making it a valuable investment for veterans.

-

What features does airSlate SignNow offer for veterans filing claims?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for veterans filing their PROPERTY TAX DEDUCTION CLAIM BY VETERAN NJ gov. These tools streamline the process, making it easier to manage and submit your claims.

-

Can I track the status of my PROPERTY TAX DEDUCTION CLAIM BY VETERAN NJ gov with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your submitted documents, including your PROPERTY TAX DEDUCTION CLAIM BY VETERAN NJ gov. This feature provides peace of mind, ensuring you know when your claim has been received and processed.

-

Are there any integrations available with airSlate SignNow for veterans?

airSlate SignNow integrates with various platforms, enhancing your experience while filing the PROPERTY TAX DEDUCTION CLAIM BY VETERAN NJ gov. These integrations allow you to connect with other tools you may already be using, making document management even more seamless.

Get more for PROPERTY TAX DEDUCTION CLAIM BY VETERAN NJ gov

Find out other PROPERTY TAX DEDUCTION CLAIM BY VETERAN NJ gov

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile