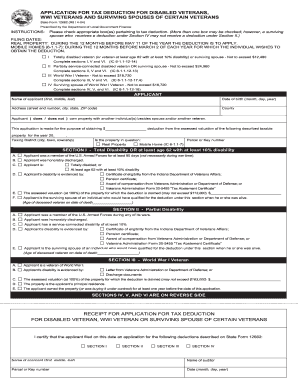

Indiana State Form 12662 2004

What is the Indiana State Form 12662

The Indiana State Form 12662 is a specific document required for certain state-level processes in Indiana. This form is often used for tax-related purposes, particularly in relation to the income tax filings of individuals and businesses. Understanding the purpose of this form is crucial for ensuring compliance with state regulations and for accurately reporting financial information to the Indiana Department of Revenue.

How to use the Indiana State Form 12662

Using the Indiana State Form 12662 involves several steps to ensure that all required information is accurately filled out. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, carefully complete each section of the form, ensuring that all figures are accurate and that you provide any required signatures. Once completed, the form can be submitted electronically or via mail, depending on your preference and the specific requirements outlined by the Indiana Department of Revenue.

Steps to complete the Indiana State Form 12662

Completing the Indiana State Form 12662 involves a systematic approach:

- Gather all necessary documentation, including income records and deduction details.

- Carefully read the instructions provided with the form to understand each section.

- Fill out the form, ensuring accuracy in all figures and personal information.

- Review the completed form for any errors or omissions.

- Sign the form as required, either digitally or by hand.

- Submit the form through the designated method, either online or by mail.

Legal use of the Indiana State Form 12662

The legal use of the Indiana State Form 12662 is governed by state regulations. To ensure that the form is legally binding, it must be completed accurately and submitted according to the guidelines set forth by the Indiana Department of Revenue. This includes adhering to deadlines and ensuring that all required signatures are present. Utilizing a reliable electronic signature platform can enhance the legal validity of the form, as it provides a secure method for signing and storing documents.

Key elements of the Indiana State Form 12662

Key elements of the Indiana State Form 12662 include personal identification information, income details, and any applicable deductions or credits. Each section of the form is designed to capture specific financial information that is essential for accurate tax reporting. It is important to pay attention to every detail, as discrepancies can lead to delays or penalties.

Form Submission Methods (Online / Mail / In-Person)

The Indiana State Form 12662 can be submitted through various methods, providing flexibility for users. Options include:

- Online Submission: Many users prefer to submit the form electronically via the Indiana Department of Revenue's online portal, which offers a streamlined process.

- Mail: The form can also be printed and mailed to the appropriate address provided in the instructions.

- In-Person: For those who prefer personal assistance, the form can be submitted in person at designated state offices.

Quick guide on how to complete indiana state form 12662

Complete Indiana State Form 12662 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Indiana State Form 12662 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Indiana State Form 12662 easily

- Obtain Indiana State Form 12662 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Indiana State Form 12662 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana state form 12662

Create this form in 5 minutes!

People also ask

-

What is the Indiana State Form 12662?

The Indiana State Form 12662 is a tax form used for reporting specific financial information to the state tax office. It is essential for businesses and individuals needing to comply with state regulations. Utilizing airSlate SignNow to manage this form streamlines the submission process, ensuring accuracy and efficiency.

-

How can airSlate SignNow help with Indiana State Form 12662?

airSlate SignNow offers features that simplify the completion and submission of Indiana State Form 12662. With our electronic signature capabilities, you can securely sign and send the form directly to the appropriate state authorities. This not only saves time but also enhances the reliability of your submissions.

-

Is there a cost associated with using airSlate SignNow for Indiana State Form 12662?

Yes, while airSlate SignNow provides a cost-effective solution for document management, there are various pricing plans available that accommodate different business needs. By choosing the right plan, you can efficiently manage your Indiana State Form 12662 along with other documents without overspending.

-

What features does airSlate SignNow offer for managing forms like Indiana State Form 12662?

airSlate SignNow includes versatile features such as template creation, document tracking, and secure cloud storage, making it ideal for managing Indiana State Form 12662. These features ensure that you can easily customize, send, and keep track of all your forms, enhancing overall productivity.

-

Can I integrate airSlate SignNow with other applications to manage Indiana State Form 12662?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications, allowing you to combine your workflow with tools you already use. This ensures that you can manage Indiana State Form 12662 and other documents in a centralized manner, enhancing efficiency across your operations.

-

What are the benefits of using airSlate SignNow for Indiana State Form 12662?

Using airSlate SignNow for Indiana State Form 12662 offers multiple benefits, including increased speed in processing forms and improved accuracy of submissions. Additionally, the platform’s secure e-signature technology ensures that your documents are compliant and legally binding.

-

Is airSlate SignNow compliant with state regulations for Indiana State Form 12662?

Yes, airSlate SignNow adheres to all relevant state regulations for electronic signatures, making it compliant for use with Indiana State Form 12662. This compliance provides peace of mind when electronically submitting your documents to the state.

Get more for Indiana State Form 12662

- Passive activity loss internal revenue service form

- Printable 2020 new york form it 602 claim for ez capital tax credit

- Innovation hot spot deduction it 223 department of taxation form

- Instructions for form it 219 credit for new york city new york city department of finance instructions for form instructions

- Instructions for form ct 607 claim for excelsior jobs

- Form it 212 att2020claim for historic barn rehabilitation

- Facts about disability related tax provisionsus equal form

- Department of taxation and finance instructions for form department of taxation and finance instructions for form allocation of

Find out other Indiana State Form 12662

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free