Ohio Universal Sales Tax Return UST 1 Instructions Form

What is the Ohio Universal Sales Tax Return UST 1 Instructions

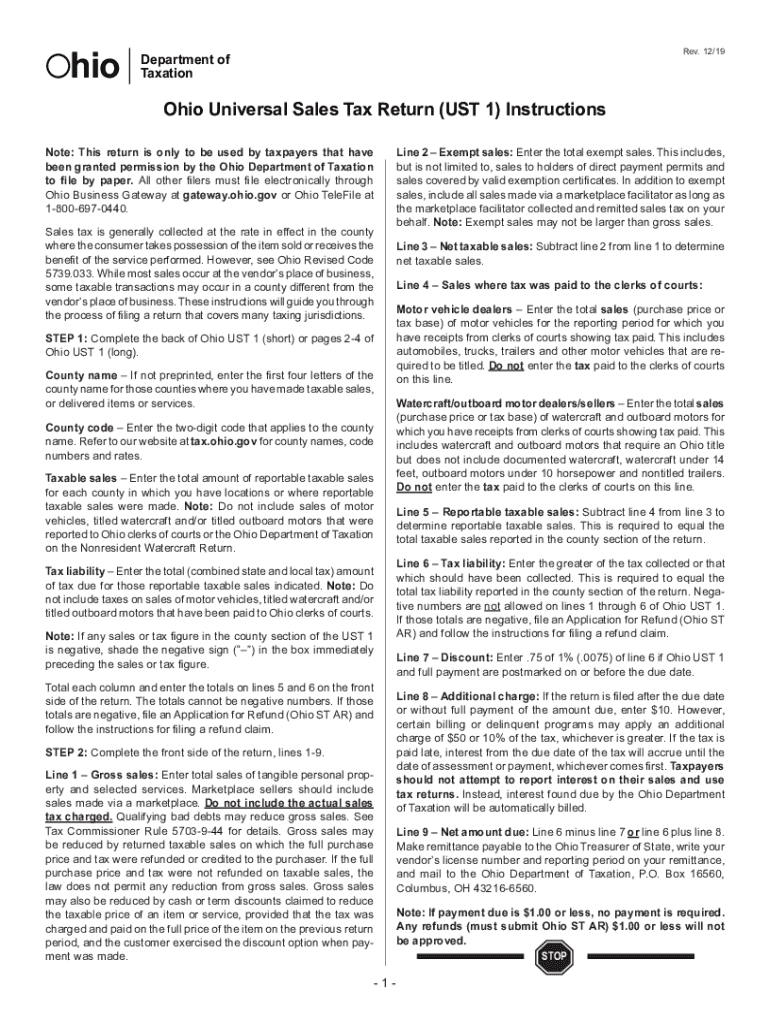

The Ohio Universal Sales Tax Return UST 1 Instructions provide essential guidance for businesses required to report and remit sales tax in Ohio. This form is designed for various types of businesses, including retailers and service providers, to ensure compliance with state tax regulations. Understanding the UST 1 instructions is crucial for accurate reporting and timely submission, helping businesses avoid penalties and maintain good standing with the Ohio Department of Taxation.

Steps to complete the Ohio Universal Sales Tax Return UST 1 Instructions

Completing the Ohio Universal Sales Tax Return UST 1 involves several key steps:

- Gather Necessary Information: Collect all relevant sales data, including gross sales, taxable sales, and any exemptions.

- Fill Out the Form: Input the required information into the UST 1 form, ensuring accuracy in all entries.

- Calculate the Tax Due: Use the provided tax rates to determine the total sales tax owed based on your taxable sales.

- Review Your Entries: Double-check all information for accuracy to prevent errors that could lead to penalties.

- Submit the Form: Choose your submission method—online, by mail, or in person—and ensure it is sent by the filing deadline.

Legal use of the Ohio Universal Sales Tax Return UST 1 Instructions

The legal use of the Ohio Universal Sales Tax Return UST 1 Instructions is governed by state tax laws. It is important for businesses to understand that the form must be completed accurately and submitted on time to comply with Ohio's sales tax regulations. Failure to adhere to these instructions can result in penalties, including fines and interest on unpaid taxes. Utilizing a reliable digital platform for e-signatures can enhance the legal validity of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio Universal Sales Tax Return UST 1 are crucial for compliance. Generally, the form must be submitted on a monthly or quarterly basis, depending on the business's sales volume. Key dates to remember include:

- Monthly Filers: Due by the 23rd of the following month.

- Quarterly Filers: Due by the 23rd of the month following the end of the quarter.

Staying informed about these deadlines helps businesses avoid late fees and maintain compliance with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

Businesses can submit the Ohio Universal Sales Tax Return UST 1 through various methods, providing flexibility based on their preferences:

- Online Submission: Utilizing the Ohio Department of Taxation's online portal for a quick and efficient filing process.

- Mail Submission: Sending the completed form via postal service to the designated tax office.

- In-Person Submission: Delivering the form directly to a local tax office for immediate processing.

Each method has its advantages, and businesses should choose the one that best fits their operational needs.

Key elements of the Ohio Universal Sales Tax Return UST 1 Instructions

Understanding the key elements of the Ohio Universal Sales Tax Return UST 1 Instructions is vital for accurate completion. Essential components include:

- Business Identification: Information about the business, including name, address, and tax identification number.

- Sales Information: Detailed reporting of gross sales, taxable sales, and any exemptions claimed.

- Tax Calculation: The total sales tax due based on the reported taxable sales.

Familiarity with these elements helps ensure that the form is filled out correctly and submitted in compliance with state regulations.

Quick guide on how to complete ohio universal sales tax return ust 1 instructions

Effortlessly prepare Ohio Universal Sales Tax Return UST 1 Instructions on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Ohio Universal Sales Tax Return UST 1 Instructions on any platform using airSlate SignNow’s Android or iOS applications and enhance your document-related processes today.

The easiest way to modify and eSign Ohio Universal Sales Tax Return UST 1 Instructions with ease

- Obtain Ohio Universal Sales Tax Return UST 1 Instructions and click on Get Form to begin.

- Take advantage of the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive details using tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Ohio Universal Sales Tax Return UST 1 Instructions to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the Ohio UST 1 instructions for filing?

The Ohio UST 1 instructions provide clear guidelines on how to file your Underground Storage Tank registration. Make sure to adhere to the state's requirements to ensure compliance and avoid potential fines. Detailed step-by-step instructions can help streamline the process of submitting your registration.

-

How can airSlate SignNow assist with Ohio UST 1 instructions?

airSlate SignNow simplifies the process of signing and sending documents related to Ohio UST 1 instructions. Our platform allows users to electronically sign and manage their documents efficiently, ensuring compliance with all relevant regulations. This enhances your workflow and saves time when dealing with important filings.

-

Are there costs associated with following Ohio UST 1 instructions?

Yes, there may be fees involved when filing Ohio UST 1 instructions, including registration fees or late payment penalties. Using airSlate SignNow can help you manage these costs by expediting document processes, therefore reducing potential delays and associated fees. Always consult the Ohio EPA for the latest fee schedule.

-

What features does airSlate SignNow offer for Ohio UST 1 instructions?

airSlate SignNow provides robust features like template creation, document tracking, and secure eSigning, specifically useful for Ohio UST 1 instructions. These features ensure that all your important documents are organized and easily accessible. Additionally, the platform enhances collaboration through shared access.

-

Can airSlate SignNow integrate with other software for Ohio UST 1 instructions?

Absolutely! airSlate SignNow seamlessly integrates with various software applications that may be used alongside Ohio UST 1 instructions, like document storage and project management tools. This integration enables a more streamlined workflow, allowing you to manage your paperwork without switching between multiple platforms.

-

How does airSlate SignNow improve compliance with Ohio UST 1 instructions?

With airSlate SignNow, you can ensure full compliance with Ohio UST 1 instructions by utilizing features such as audit trails and secure storage. This helps you maintain a comprehensive record of your submissions and eSignatures, thus minimizing the risk of non-compliance. Being organized reduces confusion when reporting to state authorities.

-

What are the benefits of using airSlate SignNow for Ohio UST 1 instructions?

Using airSlate SignNow for Ohio UST 1 instructions provides signNow benefits such as efficiency and cost savings. The user-friendly interface helps you navigate the filing process seamlessly, while the electronic signature feature reduces turnaround time on document approvals. Overall, it allows you to focus on other critical business operations.

Get more for Ohio Universal Sales Tax Return UST 1 Instructions

- Transfer adjust form

- Printable 2020 pennsylvania form rev 1630 underpayment of estimated tax by individuals

- Pa schedule nrh compensation apportionment pa 40 nrh formspublications

- Ok 8 es form

- Investmentnew jobs tax credit packageoklahoma department form

- Ok form 511tx credit for taxes paid to another state

- Payment agreement 40 templates amp contracts form

- Sample creditors form

Find out other Ohio Universal Sales Tax Return UST 1 Instructions

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement