T 77 Discharge of Estate Tax Lien 622016Layout 1 Rhode 2016

What is the T 77 Discharge of Estate Tax Lien 622016Layout 1 Rhode

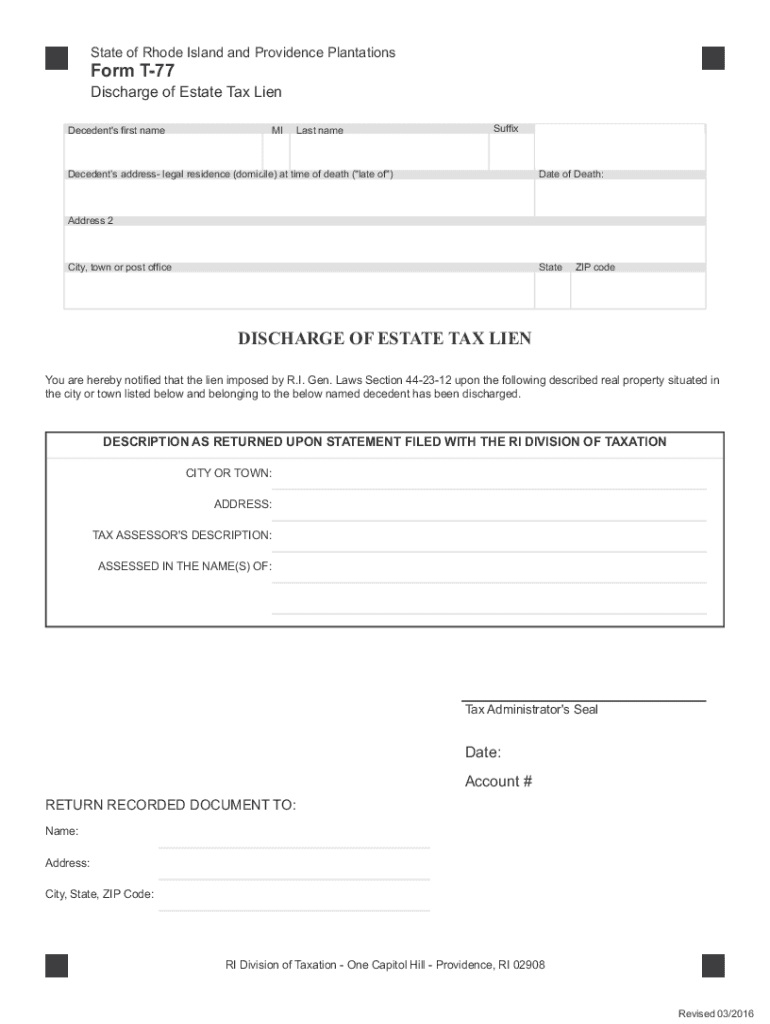

The T 77 Discharge of Estate Tax Lien is a specific form used in Rhode Island to release an estate from a tax lien imposed due to unpaid estate taxes. This form is essential for the executor or administrator of an estate to clear any tax obligations that may hinder the transfer of assets to heirs or beneficiaries. By filing this form, the estate can formally notify the state that all estate taxes have been settled, allowing for a smooth transition of property ownership.

How to Obtain the T 77 Discharge of Estate Tax Lien 622016Layout 1 Rhode

To obtain the T 77 Discharge of Estate Tax Lien, the executor or administrator must first ensure that all estate taxes have been paid in full. Once payment is confirmed, the form can be requested from the Rhode Island Division of Taxation. It is advisable to check the official state website or contact the division directly for any specific requirements or documentation needed to accompany the form. This may include proof of payment and identification details of the estate representative.

Steps to Complete the T 77 Discharge of Estate Tax Lien 622016Layout 1 Rhode

Completing the T 77 Discharge of Estate Tax Lien involves several key steps:

- Verify that all estate taxes have been paid.

- Gather necessary documentation, including proof of payment and identification.

- Fill out the T 77 form accurately, ensuring all required fields are completed.

- Submit the completed form to the Rhode Island Division of Taxation, either online or by mail.

- Keep a copy of the submitted form and any confirmation received for your records.

Legal Use of the T 77 Discharge of Estate Tax Lien 622016Layout 1 Rhode

The legal use of the T 77 Discharge of Estate Tax Lien is critical for ensuring that an estate can be transferred without encumbrances. This form serves as proof that the estate has fulfilled its tax obligations, which is necessary for the lawful distribution of assets. Failure to obtain this discharge can lead to complications in the estate settlement process, including potential legal disputes among heirs or beneficiaries.

Key Elements of the T 77 Discharge of Estate Tax Lien 622016Layout 1 Rhode

Key elements of the T 77 Discharge of Estate Tax Lien include:

- Identification of the estate: The form must clearly identify the estate and the executor or administrator.

- Proof of tax payment: Documentation confirming that all estate taxes have been settled is essential.

- Signature: The form must be signed by the authorized representative of the estate.

- Submission details: Information on how and where to submit the form must be accurately provided.

Filing Deadlines / Important Dates

It is important to be aware of filing deadlines associated with the T 77 Discharge of Estate Tax Lien. Generally, the form should be filed promptly after all estate taxes have been paid to avoid any delays in the estate settlement process. Executors should consult the Rhode Island Division of Taxation for specific deadlines that may apply, especially if there are unique circumstances surrounding the estate.

Quick guide on how to complete t 77 discharge of estate tax lien 622016layout 1 rhode

Complete T 77 Discharge Of Estate Tax Lien 622016Layout 1 Rhode effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delay. Handle T 77 Discharge Of Estate Tax Lien 622016Layout 1 Rhode on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign T 77 Discharge Of Estate Tax Lien 622016Layout 1 Rhode with ease

- Locate T 77 Discharge Of Estate Tax Lien 622016Layout 1 Rhode and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that function.

- Generate your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to submit your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign T 77 Discharge Of Estate Tax Lien 622016Layout 1 Rhode and ensure seamless communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t 77 discharge of estate tax lien 622016layout 1 rhode

Create this form in 5 minutes!

People also ask

-

What is RI discharge in relation to airSlate SignNow?

RI discharge refers to the process of electronically signing and managing discharge documents using airSlate SignNow. With this solution, businesses can streamline their document workflows, ensuring that RI discharge documents are completed efficiently and securely.

-

How can airSlate SignNow help with the RI discharge process?

airSlate SignNow simplifies the RI discharge process by allowing users to create, send, and eSign documents all in one platform. This reduces the time spent on paperwork and enhances accuracy, making the entire discharge process smoother for both businesses and customers.

-

What are the pricing options for using airSlate SignNow for RI discharge?

airSlate SignNow offers a range of pricing plans suitable for various business sizes that use RI discharge services. You can choose from monthly or annual subscriptions, with options designed to fit both small businesses and larger enterprises, making it a cost-effective choice.

-

Does airSlate SignNow integrate with other tools for RI discharge?

Yes, airSlate SignNow offers integrations with various applications and tools that can enhance the RI discharge workflow. This includes CRM systems, document management platforms, and other business tools, ensuring seamless data exchange and functionality.

-

What features does airSlate SignNow provide for managing RI discharge documents?

airSlate SignNow includes features like customizable templates, real-time tracking, and automated reminders to help manage RI discharge documents. These tools ensure that users can promptly complete and track the status of their documents, improving workflow efficiency.

-

Is airSlate SignNow secure for handling RI discharge documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and compliance with industry standards, to safeguard RI discharge documents. Users can trust that their sensitive information will remain secure throughout the signing process.

-

Can I use airSlate SignNow on mobile devices for RI discharge?

Yes, airSlate SignNow is accessible on mobile devices, allowing users to manage RI discharge documents on the go. The mobile app provides an intuitive interface for sending and signing documents quickly, making it convenient for busy professionals.

Get more for T 77 Discharge Of Estate Tax Lien 622016Layout 1 Rhode

- Wwwsignnowcomfill and sign pdf form99743form csclcd 800 ampampampquotapplication to register a limited

- Csclcd 762 rev 0921 michigan department of licensing form

- Wwwpdffillercom538517124 note in order tofillable online note in order to fill and save this form

- Get the free instructions to form scc544 articles of

- How to fill out form g 1450

- Us passports travelgov form

- Wwwharrishealthorgsitecollectiondocumentseligibilityhow to get your harris health financial assistance form

- Power outage incident action checklist fill online form

Find out other T 77 Discharge Of Estate Tax Lien 622016Layout 1 Rhode

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template