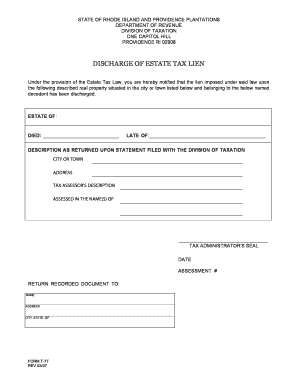

Rhode Island Inheritance Tax Waiver Form 2007

What is the Rhode Island Inheritance Tax Waiver Form

The Rhode Island inheritance tax waiver form is a legal document that allows beneficiaries to request a waiver of inheritance tax on assets received from a deceased individual. This form is crucial for ensuring that the transfer of assets occurs without unnecessary tax burdens. It is typically required when the estate is subject to Rhode Island inheritance tax, which applies to the value of the estate left behind by the deceased.

How to use the Rhode Island Inheritance Tax Waiver Form

Using the Rhode Island inheritance tax waiver form involves several key steps. First, beneficiaries must accurately fill out the form with all required information, including the decedent's details and the value of the assets. Once completed, the form must be signed and dated by the appropriate parties. It is essential to ensure that all information is correct to avoid delays in processing. After signing, the form should be submitted to the Rhode Island Division of Taxation for review.

Steps to complete the Rhode Island Inheritance Tax Waiver Form

Completing the Rhode Island inheritance tax waiver form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the Rhode Island Division of Taxation.

- Provide the decedent's full name, date of death, and Social Security number.

- List all beneficiaries and their respective shares of the inheritance.

- Include the total value of the estate and any applicable deductions.

- Sign and date the form to validate it.

- Submit the completed form to the appropriate tax authority.

Legal use of the Rhode Island Inheritance Tax Waiver Form

The legal use of the Rhode Island inheritance tax waiver form is essential for ensuring compliance with state tax laws. This form serves as a formal request to exempt certain assets from inheritance tax, provided that the necessary criteria are met. It is important to understand that failure to properly use this form can result in tax liabilities for the beneficiaries. Therefore, it is advisable to consult with a legal professional or tax advisor when completing and submitting the form.

Key elements of the Rhode Island Inheritance Tax Waiver Form

Several key elements must be included in the Rhode Island inheritance tax waiver form to ensure its validity:

- Decedent's full name and date of death.

- Beneficiary information, including names and addresses.

- Total value of the estate and itemized assets.

- Signatures of all relevant parties.

- Any supporting documentation that may be required.

Required Documents

When submitting the Rhode Island inheritance tax waiver form, certain documents may be required to support the application. These typically include:

- A copy of the death certificate.

- Proof of relationship to the decedent, such as a marriage certificate or birth certificate.

- Documentation of the value of the estate, including appraisals or bank statements.

Quick guide on how to complete rhode island inheritance tax waiver form

Effortlessly Prepare Rhode Island Inheritance Tax Waiver Form on Any Device

Digital document management has become increasingly common among businesses and individuals. It offers a perfect environmentally friendly substitute to conventional printed and signed documents, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Rhode Island Inheritance Tax Waiver Form across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and eSign Rhode Island Inheritance Tax Waiver Form with Ease

- Locate Rhode Island Inheritance Tax Waiver Form and click on Get Form to begin.

- Employ the tools we provide to fill out your form.

- Emphasize applicable sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your selected device. Edit and eSign Rhode Island Inheritance Tax Waiver Form to ensure effective communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rhode island inheritance tax waiver form

Create this form in 5 minutes!

People also ask

-

What is the estate tax exemption for 2024 in Rhode Island?

For decedents dying on or after January 1, 2024, it will be $83,370. This new credit amount is an increase from the 2023 amount of $80,395. The Rhode Island Estate Tax threshold is similarly adjusted. For decedents dying on or after January 1, 2024, the threshold will be $1,774,583.

-

Do you have to declare inheritance money on your taxes?

If you received a gift or inheritance, do not include it in your income. However, if the gift or inheritance later produces income, you will need to pay tax on that income.

-

What is the inheritance law in Rhode Island?

Who Gets What in Rhode Island? If you die with:here's what happens: spouse and descendants Spouse has the right to use your intestate real estate for life and inherits 1/2 of your intestate personal property outright descendants inherit everything else parents but no spouse or descendants parents inherit everything3 more rows

-

What is the meaning of inheritance tax waiver?

Such waivers are often employed in jurisdictions with inheritance taxes, allowing potential beneficiaries to sidestep the tax implications or responsibilities associated with certain inherited properties or assets.

-

How to avoid Rhode Island estate tax?

The Rhode Island estate tax exemption, like the federal exemption, is a tax exemption that reduces the amount of estate taxes that must be paid. At the state level, the exemption is $1,774,583; in other words, you will pay no Rhode Island estate tax on estate transfers up to that value.

-

Do I have to pay taxes on an inheritance in RI?

While there is no inheritance tax in Rhode Island, a deceased person's estate may be subject to state and federal estate taxes. Unlike inheritance tax, estate taxes are paid by the estate of the person who died, not by the heirs and beneficiaries.

-

How do you avoid inheritance tax?

A common way to avoid Inheritance Tax, or reduce the amount eventually payable, is to give money or assets to the beneficiaries of your estate while you're still alive. This will not only reduce the value of your estate once you die, but also help the assets signNow your loved ones tax-free.

-

What is the most you can inherit without paying taxes?

In 2024, the first $13,610,000 of an estate is exempt from taxes, up from $12,920,000 in 2023. Estate taxes are based on the size of the estate. It's a progressive tax, just like our federal income tax. That means that the larger the estate, the higher the tax rate it is subject to.

Get more for Rhode Island Inheritance Tax Waiver Form

Find out other Rhode Island Inheritance Tax Waiver Form

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT