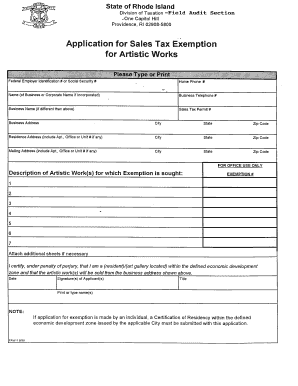

Rhode Island Tax Exempt Form 1998

What is the Rhode Island Tax Exempt Form

The Rhode Island Tax Exempt Form is a crucial document used by organizations and individuals to claim exemption from sales tax on qualifying purchases. This form is particularly relevant for entities that operate under specific exemptions, such as non-profit organizations, governmental bodies, and certain educational institutions. By submitting this form, eligible parties can avoid paying sales tax on items directly related to their exempt activities, thus facilitating their operations and ensuring compliance with state tax regulations.

How to use the Rhode Island Tax Exempt Form

Using the Rhode Island Tax Exempt Form involves several key steps to ensure proper completion and submission. First, the applicant must accurately fill out the form, providing essential information such as the name of the organization, its tax identification number, and the specific reason for the exemption. After completing the form, it should be presented to the vendor at the time of purchase. This allows the vendor to verify the exemption status and avoid charging sales tax on the transaction.

Steps to complete the Rhode Island Tax Exempt Form

Completing the Rhode Island Tax Exempt Form requires attention to detail. Here are the steps to follow:

- Gather necessary information, including your organization’s name, address, and tax ID number.

- Clearly state the reason for the exemption, ensuring it aligns with the categories recognized by the state.

- Review the form for accuracy, confirming that all fields are filled out correctly.

- Sign and date the form to validate it.

- Provide the completed form to the vendor at the time of purchase.

Legal use of the Rhode Island Tax Exempt Form

The legal use of the Rhode Island Tax Exempt Form is governed by state tax laws. It is essential for users to understand that misuse of the form can lead to penalties, including back taxes and fines. The form should only be used for purchases that genuinely qualify for tax exemption, and organizations must maintain proper documentation to support their exempt status. Compliance with state regulations ensures that the benefits of the exemption are preserved.

Eligibility Criteria

Eligibility for using the Rhode Island Tax Exempt Form typically includes non-profit organizations, government entities, and certain educational institutions. To qualify, the organization must demonstrate that it operates under a recognized exemption category. It is advisable for applicants to review the specific criteria outlined by the Rhode Island Division of Taxation to confirm their eligibility before submitting the form.

Who Issues the Form

The Rhode Island Tax Exempt Form is issued by the Rhode Island Division of Taxation. This state agency is responsible for overseeing tax compliance and providing necessary forms to facilitate tax-related processes. Organizations seeking to use the form can obtain it directly from the Division of Taxation’s official resources, ensuring they have the most current version for their needs.

Quick guide on how to complete rhode island tax exempt form

Complete Rhode Island Tax Exempt Form effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Rhode Island Tax Exempt Form on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to modify and eSign Rhode Island Tax Exempt Form without any hassle

- Locate Rhode Island Tax Exempt Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it onto your PC.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Rhode Island Tax Exempt Form and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rhode island tax exempt form

Create this form in 5 minutes!

People also ask

-

What is the RI tax exempt form and why is it important?

The RI tax exempt form is a document that allows individuals and businesses in Rhode Island to purchase products or services without paying sales tax. It is important for saving money on transactions, particularly for exempt organizations like non-profits. Using the RI tax exempt form correctly helps ensure compliance with state tax regulations.

-

How can airSlate SignNow help me with the RI tax exempt form?

airSlate SignNow provides an efficient way to create, send, and eSign the RI tax exempt form. Our platform simplifies the process, ensuring that your documents are signed quickly and securely. You'll enjoy a streamlined workflow that allows for easy tracking and management of your tax-exempt transactions.

-

Are there any costs associated with using airSlate SignNow for the RI tax exempt form?

Yes, while airSlate SignNow offers a range of pricing plans, many users find it to be a cost-effective solution for managing their documents, including the RI tax exempt form. You can choose a plan that fits your business needs, ensuring you'll have access to all necessary features without overspending.

-

What features does airSlate SignNow offer for managing RI tax exempt forms?

airSlate SignNow offers features such as template creation, customizable fields, and automated workflows specifically designed for documents like the RI tax exempt form. You can easily integrate data collection and streamline the signing process, making it simple to manage and store your tax-related documents.

-

Can I integrate airSlate SignNow with other tools for handling the RI tax exempt form?

Absolutely! airSlate SignNow offers integrations with a variety of popular business tools, including CRM and accounting software. This means you can seamlessly incorporate the RI tax exempt form into your existing systems, enhancing efficiency and productivity.

-

How does airSlate SignNow ensure the security of my RI tax exempt form?

Security is a top priority at airSlate SignNow. We implement robust encryption and compliance measures to protect all documents, including the RI tax exempt form. You can rest assured that your sensitive information will remain confidential and secure throughout the signing process.

-

Is it easy to share the RI tax exempt form using airSlate SignNow?

Yes, sharing the RI tax exempt form is very easy with airSlate SignNow. You can send documents via email or generate a link for easy access. This allows for swift collaboration with clients or partners, ensuring that your tax exempt forms are signed without unnecessary delays.

Get more for Rhode Island Tax Exempt Form

- Gv 700 request to renew gun violence restraining order judicial council forms

- General case management order complex litigation docket cld form

- Application for appointment of counselwaiver of feespayment of costs juvenile form

- Judgment form fl 250

- Palm springs ca 92262 form

- Builders certification us department of housing and urban form

- Fillable management review for multifamily housing projects form

- Revenue bonds series 2014a ibba revenue bonds form

Find out other Rhode Island Tax Exempt Form

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast