Dor Ri GovRhode Island WelcomeRI Department of Revenue 2013-2026

Understanding the Rhode Island Sales Tax Exemption Form

The Rhode Island sales tax exemption form is a crucial document for businesses and individuals seeking to make tax-exempt purchases. This form allows eligible entities, such as non-profit organizations, to avoid paying sales tax on qualifying items. Understanding the purpose and requirements of this form is essential for ensuring compliance with state tax laws.

Eligible entities typically include government agencies, certain educational institutions, and non-profit organizations that meet specific criteria. It is important to review the guidelines set by the Rhode Island Department of Revenue to determine eligibility and ensure proper use of the exemption form.

Steps to Complete the Rhode Island Sales Tax Exemption Form

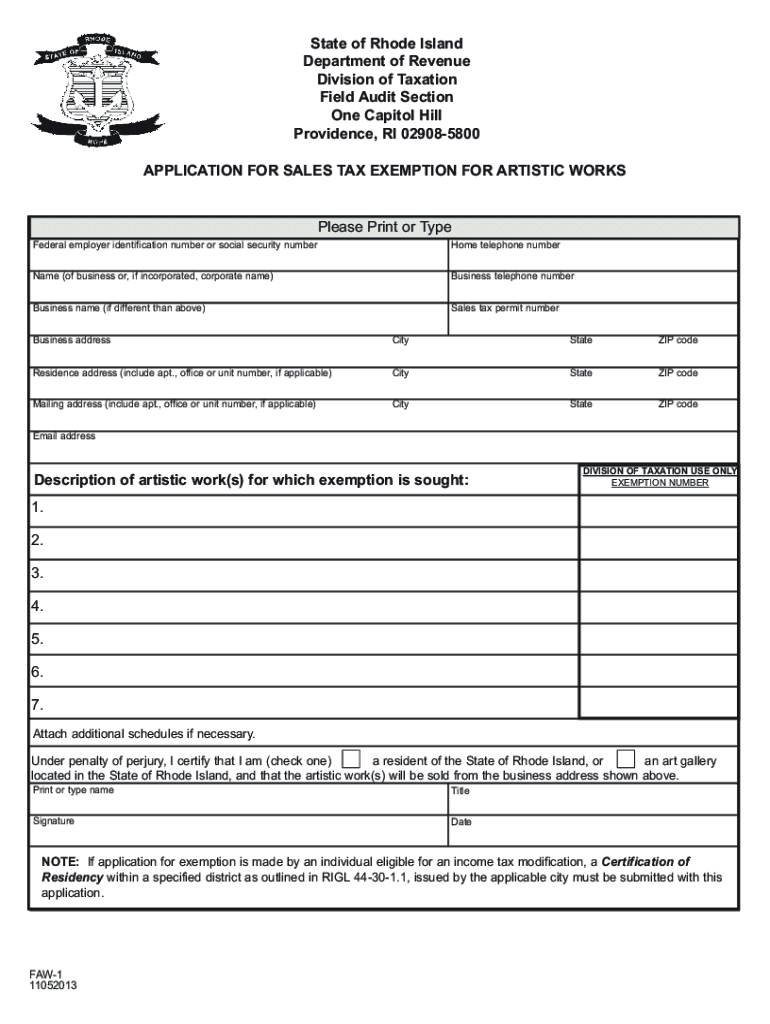

Completing the Rhode Island sales tax exemption form involves several straightforward steps. First, gather all necessary information, including the name and address of the purchaser, the seller's information, and a description of the items being purchased. Next, accurately fill out the form, ensuring all fields are completed to avoid delays or rejections.

Once the form is filled out, it should be signed by an authorized representative of the purchasing entity. This signature is crucial, as it verifies the legitimacy of the exemption claim. After signing, keep a copy for your records and provide the completed form to the seller at the time of purchase.

Key Elements of the Rhode Island Sales Tax Exemption Form

The Rhode Island sales tax exemption form contains several key elements that must be understood for proper use. These include:

- Purchaser Information: This section requires the name, address, and tax identification number of the entity claiming the exemption.

- Seller Information: The seller's name and address must be included to establish the transaction context.

- Description of Goods: A detailed description of the items being purchased under the exemption must be provided.

- Signature: An authorized signature from the purchaser is necessary to validate the form.

Eligibility Criteria for the Rhode Island Sales Tax Exemption Form

To qualify for the Rhode Island sales tax exemption, entities must meet specific eligibility criteria. Generally, non-profit organizations, government entities, and certain educational institutions are eligible. Each category has unique requirements, such as proof of tax-exempt status or documentation demonstrating the purpose of the purchase.

It is advisable to consult the Rhode Island Department of Revenue's guidelines to ensure that all eligibility criteria are met before submitting the exemption form. Failure to comply with these criteria may result in the denial of the exemption and potential tax liabilities.

Form Submission Methods for the Rhode Island Sales Tax Exemption Form

The Rhode Island sales tax exemption form can be submitted in various ways, depending on the seller's preferences. Typically, the form is presented in person at the time of purchase. However, some sellers may allow forms to be submitted via email or fax. It is essential to confirm the preferred submission method with the seller to ensure the exemption is honored.

Maintaining a copy of the submitted form is crucial for record-keeping and future reference, especially in case of audits or inquiries from tax authorities.

Quick guide on how to complete dorrigovrhode island welcomeri department of revenue

Complete Dor ri govRhode Island WelcomeRI Department Of Revenue effortlessly on any device

Online document management has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Dor ri govRhode Island WelcomeRI Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Dor ri govRhode Island WelcomeRI Department Of Revenue with ease

- Obtain Dor ri govRhode Island WelcomeRI Department Of Revenue and click on Get Form to begin.

- Use the tools we offer to finalize your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Dor ri govRhode Island WelcomeRI Department Of Revenue and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dorrigovrhode island welcomeri department of revenue

Create this form in 5 minutes!

How to create an eSignature for the dorrigovrhode island welcomeri department of revenue

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the Rhode Island tax exempt form?

The Rhode Island tax exempt form is a document that allows eligible businesses and organizations to claim tax exemption on specific purchases. It's important for non-profits and government entities to have this form to avoid unnecessary tax charges. By using the Rhode Island tax exempt form, entities can streamline their purchasing processes and ensure compliance.

-

How can airSlate SignNow help me manage the Rhode Island tax exempt form?

airSlate SignNow provides an efficient platform to create, sign, and manage the Rhode Island tax exempt form digitally. This eliminates the need for physical paperwork and allows for expedited processing. With our user-friendly interface, you can quickly send the form for eSignature and keep track of its status in real-time.

-

Is there a cost associated with using the Rhode Island tax exempt form through airSlate SignNow?

While airSlate SignNow offers various pricing plans, the use of the Rhode Island tax exempt form itself is free. However, our subscription plans provide additional features such as unlimited document sending and advanced workflows. This ensures you can manage your tax-exempt transactions effectively while being cost-efficient.

-

Can I integrate airSlate SignNow with other software for the Rhode Island tax exempt form?

Yes, airSlate SignNow supports integrations with various CRM and accounting software, enabling seamless management of the Rhode Island tax exempt form. This integration allows you to automate workflows and efficiently handle tax-exempt purchases within your existing systems, saving you time and reducing errors.

-

What features does airSlate SignNow offer for the Rhode Island tax exempt form?

airSlate SignNow offers features like eSigning, document templates, and real-time tracking for the Rhode Island tax exempt form. Users can easily customize templates to meet their specific needs and ensure fast turnaround times. Additionally, our platform provides a secure environment for sensitive documents, maintaining compliance with legal standards.

-

How secure is my Rhode Island tax exempt form with airSlate SignNow?

Security is a priority at airSlate SignNow. Each Rhode Island tax exempt form is protected with advanced encryption and access controls. We comply with industry-standard security protocols, ensuring that your sensitive information remains confidential and secure throughout the signing process.

-

What benefits can I expect from using airSlate SignNow for the Rhode Island tax exempt form?

Using airSlate SignNow for the Rhode Island tax exempt form brings numerous benefits, including faster processing times and reduced paper usage. You can save money and time while increasing efficiency in document management. Additionally, the electronic signature feature ensures that your forms are completed legally and quickly.

Get more for Dor ri govRhode Island WelcomeRI Department Of Revenue

- Living trust for husband and wife with minor and or adult children georgia form

- Amendment to living trust georgia form

- Living trust property record georgia form

- Financial account transfer to living trust georgia form

- Assignment to living trust georgia form

- Notice of assignment to living trust georgia form

- Revocation of living trust georgia form

- Letter to lienholder to notify of trust georgia form

Find out other Dor ri govRhode Island WelcomeRI Department Of Revenue

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer