Rhode Island Tax Exempt for Artistic Works Form 2012

What is the Rhode Island Tax Exempt For Artistic Works Form

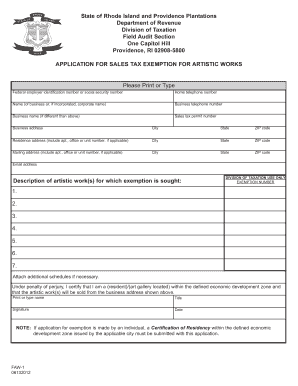

The Rhode Island Tax Exempt For Artistic Works Form is a specific document that allows artists and creators in Rhode Island to apply for tax exemptions related to their artistic works. This form is essential for individuals and businesses engaged in artistic endeavors, such as visual arts, performing arts, and other creative sectors. By completing this form, applicants can demonstrate eligibility for tax benefits, which can significantly reduce financial burdens associated with producing and selling artistic works.

How to use the Rhode Island Tax Exempt For Artistic Works Form

Using the Rhode Island Tax Exempt For Artistic Works Form involves several straightforward steps. First, gather all necessary information, including personal identification details, descriptions of the artistic works, and any relevant financial information. Next, fill out the form accurately, ensuring that all sections are completed to avoid delays. Once completed, the form can be submitted through the designated channels, either online or via traditional mail. It is important to keep copies of the submitted form for your records.

Steps to complete the Rhode Island Tax Exempt For Artistic Works Form

Completing the Rhode Island Tax Exempt For Artistic Works Form requires careful attention to detail. Follow these steps for successful completion:

- Begin by downloading the form from the official Rhode Island government website or obtaining a hard copy.

- Read the instructions thoroughly to understand the requirements and eligibility criteria.

- Fill in your personal information, including name, address, and contact details.

- Provide a detailed description of the artistic works you are claiming exemption for, including their purpose and medium.

- Attach any supporting documents that validate your claim, such as receipts, contracts, or proof of artistic credentials.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the Rhode Island Tax Exempt For Artistic Works Form, applicants must meet specific eligibility criteria. Generally, the applicant must be a resident of Rhode Island or operate a business within the state. The artistic works in question should be original creations that contribute to the cultural landscape of Rhode Island. Additionally, applicants may need to demonstrate that their works have been sold or are intended for sale, thus justifying the need for tax exemption.

Legal use of the Rhode Island Tax Exempt For Artistic Works Form

The legal use of the Rhode Island Tax Exempt For Artistic Works Form is governed by state tax laws and regulations. This form serves as an official declaration of an artist's intent to claim tax exemptions, and it must be completed in compliance with the guidelines set forth by the Rhode Island Department of Revenue. Proper use of this form ensures that artists can benefit from tax relief while adhering to legal requirements, thus avoiding potential penalties or disputes with tax authorities.

Form Submission Methods

The Rhode Island Tax Exempt For Artistic Works Form can be submitted through various methods to accommodate different preferences. Applicants may choose to submit the form online via the Rhode Island Department of Revenue's official website, which offers a streamlined process for electronic submissions. Alternatively, the form can be printed and mailed to the appropriate department. In-person submissions may also be possible at designated state offices, allowing for direct interaction with tax officials.

Quick guide on how to complete rhode island tax exempt for artistic works form

Easily Prepare Rhode Island Tax Exempt For Artistic Works Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage Rhode Island Tax Exempt For Artistic Works Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign Rhode Island Tax Exempt For Artistic Works Form with Ease

- Obtain Rhode Island Tax Exempt For Artistic Works Form and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Rhode Island Tax Exempt For Artistic Works Form and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rhode island tax exempt for artistic works form

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to ri artistic?

airSlate SignNow is a powerful tool that streamlines document signing processes. It offers a user-friendly interface for sending and eSigning documents efficiently, making it a great fit for creative professionals such as those in the 'ri artistic' community.

-

What are the pricing plans available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for freelancers and larger teams. These plans can accommodate any budget, making it an ideal solution for those in the 'ri artistic' sector looking to manage signing workflows cost-effectively.

-

What features does airSlate SignNow offer for enhancing my 'ri artistic' business?

With features like customizable templates, cloud storage integration, and real-time notifications, airSlate SignNow ensures a seamless document management experience. This is particularly beneficial for 'ri artistic' professionals who require timely communication and efficiency in their workflow.

-

How does airSlate SignNow enhance collaboration for 'ri artistic' projects?

airSlate SignNow facilitates collaboration by allowing multiple users to access and eSign documents simultaneously. This feature is especially useful for 'ri artistic' teams that need to work together on contracts and agreements in a timely manner.

-

Are there any integrations available with airSlate SignNow that benefit 'ri artistic' professionals?

Yes, airSlate SignNow integrates seamlessly with popular tools like Google Workspace, Microsoft Office, and Dropbox, making it easier for 'ri artistic' professionals to incorporate document signing into their existing workflows. These integrations help streamline operations and enhance productivity.

-

How secure is airSlate SignNow for handling 'ri artistic' documents?

airSlate SignNow prioritizes security with encryption and compliance with industry standards, ensuring that all 'ri artistic' documents are stored safely. Users can have peace of mind knowing their sensitive creative contracts and agreements are protected.

-

Can I access airSlate SignNow on mobile devices for my 'ri artistic' needs?

Absolutely! airSlate SignNow is available on mobile devices, allowing you to send and eSign documents on the go. This mobile accessibility is particularly beneficial for 'ri artistic' professionals who are frequently traveling or working remotely.

Get more for Rhode Island Tax Exempt For Artistic Works Form

- Vermont resale certificate blank form

- Etfwigovsitesdefaultwisconsin department employee identification etfwigov form

- Fillable online summary plan description for metromont form

- Oregon workers compensation division oregon workers form

- Motion for change of venue graham county az form

- The superior court of california county of ventura court form

- Instructions for joint petition for dissolution of marriage without childrenform 12

- Individualclaiming economic disadvantage mustsubmit form

Find out other Rhode Island Tax Exempt For Artistic Works Form

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement