Texas Direct Payment Exemption Certification Form

What is the Texas Direct Payment Exemption Certification Form

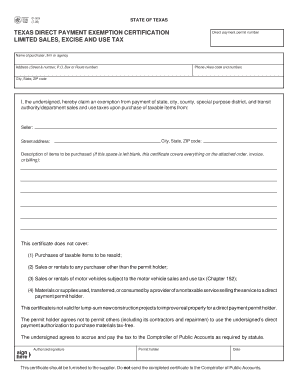

The Texas Direct Payment Exemption Certification Form is a crucial document used by businesses to claim exemption from sales tax on certain purchases. This form is particularly relevant for entities that qualify under specific criteria, allowing them to make tax-exempt purchases directly. The exemption typically applies to items that will be resold or incorporated into a product that will be sold. Understanding the purpose and implications of this form is essential for businesses looking to manage their tax liabilities effectively.

How to Use the Texas Direct Payment Exemption Certification Form

To utilize the Texas Direct Payment Exemption Certification Form, businesses must first ensure they meet the eligibility criteria set by the Texas Comptroller. Once eligibility is confirmed, the form must be filled out accurately, detailing the nature of the purchases and the reason for the exemption. After completion, the form should be presented to the vendor at the time of purchase. This allows the vendor to keep the form on file as proof of the tax-exempt status for audit purposes.

Steps to Complete the Texas Direct Payment Exemption Certification Form

Completing the Texas Direct Payment Exemption Certification Form involves several key steps:

- Gather necessary information, including your business name, address, and Texas taxpayer number.

- Clearly specify the type of items you are purchasing and the reason for the exemption.

- Review the form for accuracy to ensure all required fields are completed.

- Sign and date the form to validate it.

- Provide the completed form to the vendor at the time of purchase.

Legal Use of the Texas Direct Payment Exemption Certification Form

The legal use of the Texas Direct Payment Exemption Certification Form is governed by state tax laws. For the form to be valid, it must be filled out correctly and used in accordance with Texas regulations. Misuse or submission of incomplete forms can lead to penalties, including back taxes owed and potential fines. It is essential for businesses to maintain compliance with all legal requirements to avoid complications during audits.

Eligibility Criteria for the Texas Direct Payment Exemption Certification Form

Eligibility for the Texas Direct Payment Exemption Certification Form is determined by specific criteria outlined by the Texas Comptroller. Generally, businesses that intend to resell the purchased items or incorporate them into a product for sale qualify for the exemption. Additionally, certain nonprofit organizations and government entities may also be eligible. It is important to review the eligibility guidelines thoroughly to ensure compliance and proper use of the form.

Form Submission Methods

The Texas Direct Payment Exemption Certification Form can be submitted in various ways, depending on the vendor's preferences. Typically, businesses present the completed form directly to the vendor at the time of purchase. Some vendors may also accept forms submitted via email or fax. However, it is crucial to confirm the vendor's submission preferences to ensure the form is accepted and properly processed.

Key Elements of the Texas Direct Payment Exemption Certification Form

Key elements of the Texas Direct Payment Exemption Certification Form include:

- Business name and address

- Texas taxpayer number

- Description of the items being purchased

- Reason for claiming the exemption

- Signature and date of the authorized representative

Each of these elements must be accurately completed to ensure the form's validity and compliance with Texas tax regulations.

Quick guide on how to complete texas direct payment exemption certification form

Complete Texas Direct Payment Exemption Certification Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents promptly without delays. Manage Texas Direct Payment Exemption Certification Form on any device with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Texas Direct Payment Exemption Certification Form with ease

- Obtain Texas Direct Payment Exemption Certification Form and click Get Form to begin.

- Utilize the resources we provide to complete your form.

- Highlight important sections of the documents or black out sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Revise and eSign Texas Direct Payment Exemption Certification Form to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Texas Comptroller Direct?

The Texas Comptroller Direct is a platform that offers businesses a streamlined way to manage state contracts and records. By utilizing the Texas Comptroller Direct, organizations can simplify compliance and access essential information more efficiently.

-

How does airSlate SignNow integrate with Texas Comptroller Direct?

airSlate SignNow provides seamless integration with Texas Comptroller Direct, allowing users to eSign and manage documents directly linked to their state-related contracts. This integration ensures that all necessary documentation is easily accessible and manageable within one platform.

-

What are the pricing options for airSlate SignNow when using Texas Comptroller Direct?

The pricing for airSlate SignNow is competitive and flexible, catering to businesses of all sizes using Texas Comptroller Direct. We offer various plans that can be tailored to meet your specific needs and budget, ensuring you receive the best value for your eSigning requirements.

-

What features does airSlate SignNow offer for Texas Comptroller Direct users?

airSlate SignNow includes a variety of features for Texas Comptroller Direct users, including customizable templates, real-time tracking, and mobile access. These features enhance productivity and streamline the document signing process for compliance with state regulations.

-

What are the benefits of using airSlate SignNow with Texas Comptroller Direct?

Using airSlate SignNow with Texas Comptroller Direct allows businesses to enhance efficiency by reducing paperwork and speeding up the signature process. This not only saves time and resources but also ensures compliance with state requirements effortlessly.

-

Can airSlate SignNow help with the compliance requirements related to Texas Comptroller Direct?

Absolutely! airSlate SignNow is designed to support businesses in maintaining compliance with Texas Comptroller Direct regulations. The platform's features, such as audit trails and secure storage, help ensure that your documents meet all legal requirements.

-

Is airSlate SignNow user-friendly for new users of Texas Comptroller Direct?

Yes, airSlate SignNow is specifically designed to be user-friendly, making it accessible for new users of Texas Comptroller Direct. With an intuitive interface and comprehensive support resources, getting started and navigating the platform is easy.

Get more for Texas Direct Payment Exemption Certification Form

- Dsdfr9pdf illinois secretary of state form

- Department of motor vehicles received junk ctgov form

- Small pdf for android apk download apkpurecom form

- 10 off lockout service new york call 844 786 5625 fast form

- R j new or renew amp transfer form

- Civil service exams malone telegram form

- Tc 95 303b reviewdocx form

- Salvage branding of new york state registered vehicles form

Find out other Texas Direct Payment Exemption Certification Form

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament