Va Tax Form 760pmt

What is the 760 payment form?

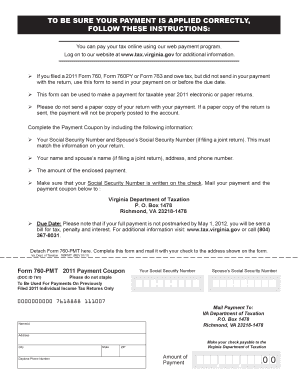

The 760 payment form is a tax document used in Virginia for individuals to report and pay their state income taxes. It is specifically designed for residents and non-residents who have income sourced from Virginia. This form is essential for ensuring compliance with state tax laws and is part of the annual tax filing process. The 760 payment form allows taxpayers to calculate their tax liability based on their income and applicable deductions or credits.

How to use the 760 payment form

Using the 760 payment form involves several steps to ensure accurate reporting of income and taxes owed. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, income details, and any deductions you may qualify for. After completing the form, review it for accuracy before submitting it to the Virginia Department of Taxation. You can file the form electronically or by mail, depending on your preference.

Steps to complete the 760 payment form

Completing the 760 payment form requires careful attention to detail. Follow these steps:

- Gather your income documents, such as W-2s and 1099s.

- Provide your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and dividends.

- Claim any eligible deductions or credits to reduce your taxable income.

- Calculate your total tax liability based on the provided tax tables.

- Review the form for any errors or omissions.

- Submit the completed form electronically or by mail to the appropriate state office.

Legal use of the 760 payment form

The 760 payment form is legally binding when completed and submitted according to Virginia tax laws. It must be signed by the taxpayer, confirming that the information provided is accurate and complete. Failure to file or inaccuracies in the form can result in penalties, interest, or legal action by the state. Therefore, it is crucial to ensure compliance with all applicable regulations when using this form.

Filing deadlines for the 760 payment form

Filing deadlines for the 760 payment form typically align with the federal tax filing schedule. Generally, the form must be submitted by May 1 of the tax year, although extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, as late submissions can incur penalties and interest. Mark your calendar to ensure timely filing and avoid complications with your tax obligations.

Required documents for the 760 payment form

To accurately complete the 760 payment form, several documents are required:

- W-2 forms from employers detailing annual wages.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as interest or dividends.

- Documentation of any deductions, such as mortgage interest or student loan interest.

- Previous year’s tax return for reference.

Who issues the 760 payment form?

The 760 payment form is issued by the Virginia Department of Taxation. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides resources and guidance to help individuals understand their tax obligations and correctly complete the form. For any questions or assistance, taxpayers can contact the department directly or visit their official website for more information.

Quick guide on how to complete va tax form 760pmt

Complete Va Tax Form 760pmt effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Va Tax Form 760pmt on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to edit and eSign Va Tax Form 760pmt with ease

- Obtain Va Tax Form 760pmt and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing additional document copies. airSlate SignNow fulfills your document management needs with just a few clicks from your chosen device. Modify and eSign Va Tax Form 760pmt and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a 760 payment form?

The 760 payment form is a crucial document used in transactions, especially in the context of tax payments. With airSlate SignNow, you can easily create, send, and eSign the 760 payment form, ensuring that your documents are processed swiftly and securely.

-

How can airSlate SignNow help me with the 760 payment form?

airSlate SignNow streamlines the process of handling your 760 payment form by offering an intuitive platform for electronic signatures. This allows users to complete and submit the form quickly while maintaining compliance and security in their transactions.

-

Is there a cost associated with using the 760 payment form on airSlate SignNow?

While airSlate SignNow provides a cost-effective solution for document management, the exact pricing may vary based on the features you require for the 760 payment form. It’s best to check our pricing page for detailed options tailored to different business needs.

-

What features are available for the 760 payment form on airSlate SignNow?

When using the 760 payment form on airSlate SignNow, you benefit from features like customizable templates, real-time collaboration, and advanced security options. These features enhance efficiency and ensure that your documents are always secure and accessible.

-

Can I integrate the 760 payment form with other tools?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, making it easy to incorporate the 760 payment form into your existing workflows. This interoperability enhances productivity and keeps all your essential tools connected.

-

What are the benefits of using airSlate SignNow for the 760 payment form?

Using airSlate SignNow for the 760 payment form provides numerous benefits, including increased speed, reduced paperwork, and enhanced security. These advantages help businesses streamline their operations, ensuring that documents are processed efficiently and correctly.

-

Is airSlate SignNow secure for handling the 760 payment form?

Absolutely! airSlate SignNow employs advanced encryption and security measures to protect your 760 payment form and other documents. Our commitment to security ensures that your sensitive information remains confidential and safe from unauthorized access.

Get more for Va Tax Form 760pmt

- Family assessment questionnaire form

- Sss educational loan form

- 3 day notice to pay or quit california pdf form

- Blank temporary license plate form

- Vinayaka mission university salem degree verification form

- Gulbarga university convocation certificate form

- Creek nation stimulus 2021 form

- Florida voter registration application part 1 instructions form

Find out other Va Tax Form 760pmt

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter