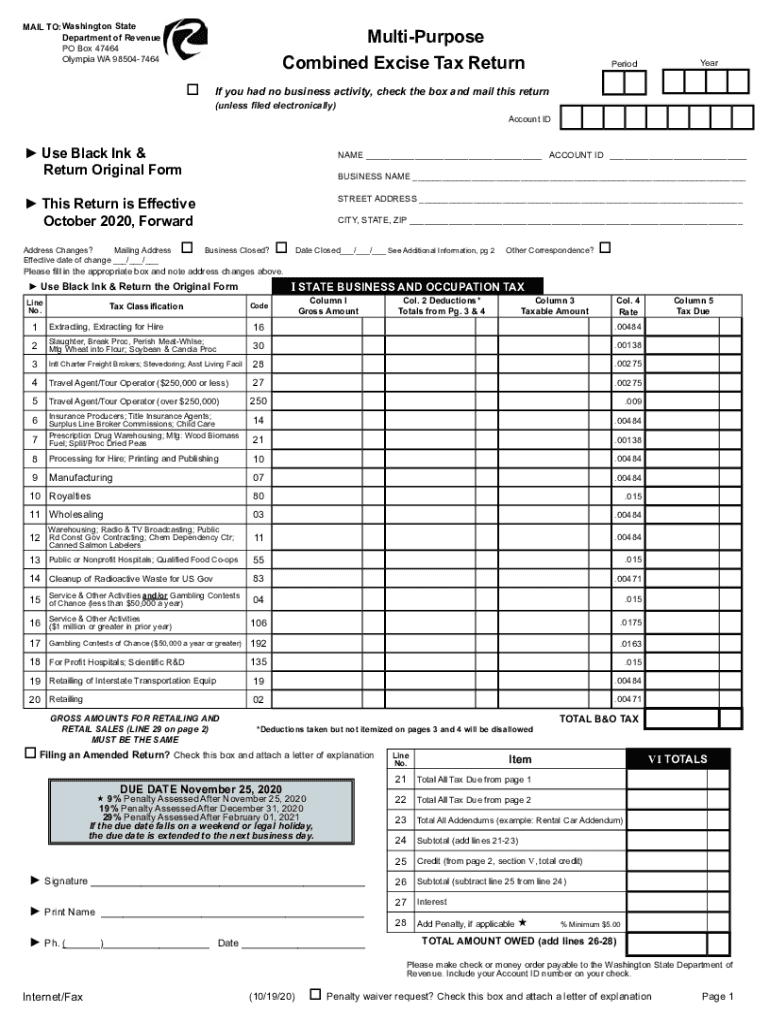

MAIL TOWashington State Multi Purpose Combined Excise Tax Return Form

What is the combined excise tax return 2020?

The combined excise tax return 2020 is a crucial document for businesses operating in Washington State. This form consolidates various excise taxes, including retail sales tax, use tax, and other specific taxes applicable to different business activities. It simplifies the filing process by allowing businesses to report multiple tax obligations on a single form, ensuring compliance with state tax regulations. Understanding this form is essential for accurate tax reporting and avoiding potential penalties.

Steps to complete the combined excise tax return 2020

Completing the combined excise tax return 2020 involves several key steps:

- Gather all necessary financial records, including sales figures, purchase records, and any relevant tax documents.

- Access the combined excise tax return form, ensuring you have the correct version for the year 2020.

- Fill in the required information, including your business details, tax identification number, and specific tax calculations based on your sales and purchases.

- Review the completed form for accuracy, ensuring that all figures are correct and all necessary sections are filled out.

- Sign and date the form electronically, if applicable, to ensure it is legally binding.

- Submit the completed form by the designated deadline, either electronically or by mail, depending on your preference.

Filing deadlines / Important dates

Filing deadlines for the combined excise tax return 2020 are critical to avoid penalties. Generally, the return is due on the last day of the month following the end of the reporting period. For example, if you are filing quarterly, the due dates would typically be April 30, July 31, October 31, and January 31 of the following year. It is essential to stay informed about these deadlines to ensure timely submission and compliance with state regulations.

Legal use of the combined excise tax return 2020

The combined excise tax return 2020 is legally binding when completed correctly and submitted on time. To ensure its legal validity, businesses must adhere to specific regulations, including accurate reporting of financial information and proper eSignature protocols. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws is crucial for the electronic submission of this form, making it essential to use a reliable eSignature platform that meets legal standards.

Who issues the combined excise tax return 2020?

The combined excise tax return 2020 is issued by the Washington State Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within its jurisdiction. The department provides resources and guidance to help businesses understand their tax obligations and complete the return accurately.

Penalties for non-compliance

Failure to file the combined excise tax return 2020 on time or inaccurately can result in significant penalties. Common penalties include late fees, interest on unpaid taxes, and potential audits by the state. Businesses may also face additional scrutiny if they consistently fail to comply with tax regulations. It is crucial to prioritize timely and accurate filing to avoid these consequences and maintain good standing with the Washington State Department of Revenue.

Quick guide on how to complete mail towashington state multi purpose combined excise tax return

Complete MAIL TOWashington State Multi Purpose Combined Excise Tax Return effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents swiftly and without interruptions. Manage MAIL TOWashington State Multi Purpose Combined Excise Tax Return on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign MAIL TOWashington State Multi Purpose Combined Excise Tax Return seamlessly

- Find MAIL TOWashington State Multi Purpose Combined Excise Tax Return and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to deliver your form, whether by email, SMS, an invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign MAIL TOWashington State Multi Purpose Combined Excise Tax Return and ensure excellent communication at any point in the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a combined excise tax return 2020?

A combined excise tax return 2020 is a tax form used to report various excise taxes to federal and state authorities on behalf of businesses. This return consolidates multiple excise tax liabilities into a single document, streamlining the filing process and improving compliance. Understanding this return is crucial for accurate tax reporting.

-

How can airSlate SignNow help with the combined excise tax return 2020?

airSlate SignNow simplifies the process of electronically signing and sending your combined excise tax return 2020. With our user-friendly platform, you can ensure that your documents are signed quickly and securely, reducing the time spent on tax preparation and submission. This efficiency can signNowly enhance your tax compliance strategy.

-

What are the pricing options for airSlate SignNow when submitting the combined excise tax return 2020?

airSlate SignNow offers flexible pricing plans that cater to different business needs, allowing you to manage your combined excise tax return 2020 cost-effectively. You can choose from monthly or annual subscriptions, with options suitable for both small businesses and enterprises. Our transparent pricing ensures you get value for your investment.

-

Is there customer support available for the combined excise tax return 2020 process?

Yes, airSlate SignNow provides dedicated customer support to assist you with all your questions regarding the combined excise tax return 2020. Our team is available through various channels, including chat, email, and phone, ensuring that you receive timely and effective assistance when you need it most. We are committed to your success in navigating complex tax filings.

-

What features does airSlate SignNow offer for handling the combined excise tax return 2020?

Our platform offers a suite of features designed to facilitate the handling of the combined excise tax return 2020. These include customizable templates, real-time status tracking, and automated reminders for signatures. These features make the submission process efficient and reduce the risk of errors.

-

Can airSlate SignNow integrate with my accounting software for the combined excise tax return 2020?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your combined excise tax return 2020 workflow. By connecting your accounts, you can ensure that all necessary tax data is accurate and readily available for filing, enhancing your overall tax management process.

-

What benefits does airSlate SignNow provide for e-signing the combined excise tax return 2020?

Using airSlate SignNow for e-signing the combined excise tax return 2020 offers several benefits, including enhanced security and reduced turnaround times. Electronic signatures are legally recognized, ensuring compliance while expediting the approval process. Additionally, you can easily track who signed and when, providing transparency throughout your tax filing workflow.

Get more for MAIL TOWashington State Multi Purpose Combined Excise Tax Return

- Life plan worksheet pdf form

- Vanderbilt forms 2020

- Pain assessment and documentation tool form

- New restaurant pre opening checklist excel form

- Invitation letter for visa italy form

- Affidavit of naturalization after the expiry of indian passport form

- Iscrizione allaire consolato perth form

- Superior court of california county of los form

Find out other MAIL TOWashington State Multi Purpose Combined Excise Tax Return

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word