Billing & LiabilityCorporate Card Programme Form

What is the Billing & Liability Corporate Card Programme

The Billing & Liability Corporate Card Programme is designed to streamline the management of corporate expenses while ensuring accountability and compliance. This programme allows businesses to issue corporate cards to employees, enabling them to make purchases on behalf of the company. The cards are linked to a central account, allowing for easier tracking of expenditures and simplifying the billing process. By using this programme, organizations can enhance financial oversight and reduce the administrative burden associated with managing employee expenses.

How to use the Billing & Liability Corporate Card Programme

Utilizing the Billing & Liability Corporate Card Programme involves several straightforward steps. First, businesses must establish a central account with the card issuer. After the account is set up, companies can issue cards to employees based on their roles and spending needs. Employees can then use these cards for approved business expenses, such as travel, office supplies, and client entertainment. It's essential for employees to keep receipts and document expenses accurately to ensure compliance with company policies and facilitate the reconciliation process.

Steps to complete the Billing & Liability Corporate Card Programme

Completing the Billing & Liability Corporate Card Programme requires a few key steps. Initially, businesses should assess their needs and determine the number of cards required. Next, they must select a card issuer that aligns with their financial goals and compliance requirements. Once the cards are issued, employees should be trained on proper usage and reporting procedures. Finally, ongoing monitoring and auditing of transactions are crucial to maintain compliance and ensure that expenditures align with the company's budget and policies.

Legal use of the Billing & Liability Corporate Card Programme

The legal use of the Billing & Liability Corporate Card Programme is governed by various regulations that ensure transparency and accountability. Organizations must adhere to financial regulations, including maintaining accurate records of all transactions and ensuring that expenditures are for legitimate business purposes. Additionally, companies should implement policies that outline acceptable use of the corporate cards, including limits on spending and required documentation for purchases. This legal framework helps protect both the organization and its employees from potential misuse of funds.

Key elements of the Billing & Liability Corporate Card Programme

Several key elements define the effectiveness of the Billing & Liability Corporate Card Programme. These include a clear policy outlining card usage, a robust tracking system for monitoring expenditures, and regular audits to ensure compliance. Additionally, employee training on the proper use of corporate cards is vital. Companies should also establish a process for reporting and resolving discrepancies in billing or unauthorized transactions, which helps maintain trust and accountability within the organization.

Eligibility Criteria

Eligibility for the Billing & Liability Corporate Card Programme typically depends on the nature of the business and its financial standing. Generally, companies must demonstrate a stable financial history and a clear need for corporate cards. Additionally, businesses may need to provide information regarding their employees who will be issued cards, including their roles and spending authority. This ensures that only qualified personnel have access to corporate funds, promoting responsible spending practices.

Form Submission Methods

Submitting the necessary forms for the Billing & Liability Corporate Card Programme can be done through various methods. Businesses often have the option to submit forms online, which is typically the fastest and most efficient method. Alternatively, forms can be mailed or delivered in person to the card issuer's designated office. It's important for businesses to follow the specific submission guidelines provided by the card issuer to ensure timely processing and approval of their application.

Quick guide on how to complete billing ampampamp liabilitycorporate card programme

Complete Billing & LiabilityCorporate Card Programme effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documentation, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the features required to create, edit, and eSign your documents swiftly without delays. Manage Billing & LiabilityCorporate Card Programme on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign Billing & LiabilityCorporate Card Programme effortlessly

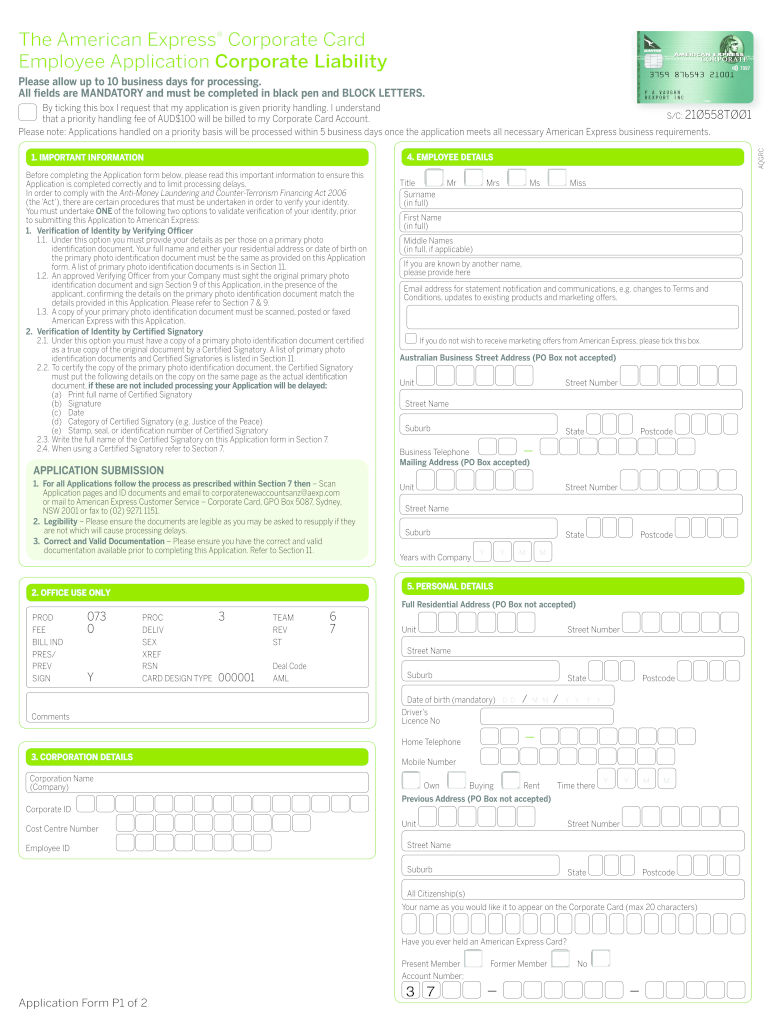

- Obtain Billing & LiabilityCorporate Card Programme and click Get Form to begin.

- Utilize the features we offer to finish your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to preserve your modifications.

- Choose how you want to deliver your form, via email, SMS, or an invite link, or download it to your computer.

Leave behind the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document administration needs in just a few clicks from any device of your preference. Modify and eSign Billing & LiabilityCorporate Card Programme and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Billing & LiabilityCorporate Card Programme?

The Billing & LiabilityCorporate Card Programme is designed to facilitate corporate spending while managing expenses effectively. It enables businesses to issue corporate cards that streamline billing processes and enhance budget tracking. With this program, companies can maintain oversight over their financial liabilities and ensure a transparent billing process.

-

How does the Billing & LiabilityCorporate Card Programme work?

The Billing & LiabilityCorporate Card Programme allows businesses to issue corporate cards to employees, which can be used for various expenditures. Each transaction made with the card is automatically tracked and billed, simplifying the reconciliation process. This system helps in maintaining clear visibility over spending and contributes to better financial management.

-

What are the pricing options for the Billing & LiabilityCorporate Card Programme?

Pricing for the Billing & LiabilityCorporate Card Programme typically varies based on the number of cards issued and the features included. airSlate SignNow offers flexible pricing plans to cater to businesses of all sizes. To get a detailed quote, it's best to contact our sales team for personalized assistance.

-

What benefits does the Billing & LiabilityCorporate Card Programme provide?

The Billing & LiabilityCorporate Card Programme offers several key benefits, including improved control over company spending and easier tracking of expenses. Additionally, it helps reduce administrative overhead by automating billing processes. By using this program, businesses can enhance financial accountability and transparency across their teams.

-

Can the Billing & LiabilityCorporate Card Programme integrate with other software?

Yes, the Billing & LiabilityCorporate Card Programme is designed to integrate seamlessly with various accounting and financial management software. This ensures that all expenses are automatically synchronized, making it easier for businesses to maintain accurate financial records. These integrations enhance the usability and efficiency of the program for managing billing and liabilities.

-

Who can benefit from the Billing & LiabilityCorporate Card Programme?

The Billing & LiabilityCorporate Card Programme is beneficial for businesses of all sizes looking to streamline their expense management. Companies that require multiple employees to incur expenses for business purposes will particularly find this program useful. It empowers organizations to oversee spending in real-time, ultimately leading to better financial control.

-

How can I enroll in the Billing & LiabilityCorporate Card Programme?

Enrolling in the Billing & LiabilityCorporate Card Programme is straightforward. Interested businesses can begin by visiting our website or contacting our customer service team for guidance. We will provide you with all the necessary information and assist you through the onboarding process for a smooth enrollment experience.

Get more for Billing & LiabilityCorporate Card Programme

- February 2021 s 103 application for wisconsin sales and use tax certificate of exempt status ces and instructions fillable form

- Wwwrevenuewigovpagesfaqsdor wage attachments wisconsin department of revenue form

- February 2021 s 211 wisconsin sales and use tax exemption certificate fillable form

- Ir595 form

- 001 form fill up online

- No relation certificate for exam form

- Kccq score calculator form

- Muhs transfer form

Find out other Billing & LiabilityCorporate Card Programme

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement