Indian Bank Kyc Form

What is the Indian Bank KYC Form?

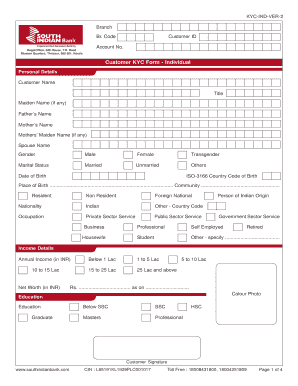

The Indian Bank KYC form is a crucial document used to verify the identity of customers in accordance with regulatory requirements. KYC stands for Know Your Customer, and this form helps banks gather essential information from their clients. It is necessary for both new and existing customers to ensure compliance with anti-money laundering laws and to maintain the integrity of the banking system. The form typically requires personal details such as name, address, date of birth, and identification proof, allowing the bank to establish a customer's identity and assess potential risks.

How to Obtain the Indian Bank KYC Form

To obtain the Indian Bank KYC form, customers can visit their local branch or access the bank's official website. Many banks provide a downloadable version of the form in PDF format, which can be printed and filled out. Additionally, some banks may offer an online option for completing the KYC process, allowing customers to fill out the form digitally. It is essential to ensure that you are using the most recent version of the form to avoid any issues during submission.

Steps to Complete the Indian Bank KYC Form

Completing the Indian Bank KYC form involves several straightforward steps:

- Gather necessary documents, such as proof of identity and address.

- Download or collect the KYC form from the bank's website or branch.

- Fill out the form with accurate personal information, ensuring all fields are completed.

- Attach the required documents as specified in the form.

- Submit the completed form and documents to the bank, either in person or through the designated online channel.

Legal Use of the Indian Bank KYC Form

The Indian Bank KYC form is legally binding and must be completed accurately to comply with financial regulations. The information provided is used to verify the identity of customers and prevent fraudulent activities. Banks are required to maintain records of KYC forms to demonstrate compliance with regulations set forth by financial authorities. Failure to complete the form correctly or submit it on time can result in penalties or restrictions on banking services.

Key Elements of the Indian Bank KYC Form

The Indian Bank KYC form typically includes several key elements that are essential for identity verification:

- Personal Information: Name, date of birth, and gender.

- Contact Details: Address, phone number, and email.

- Identification Proof: Options may include a government-issued ID, passport, or utility bill.

- Signature: Required to validate the information provided.

Form Submission Methods

Customers can submit the Indian Bank KYC form through various methods, depending on the bank's policies:

- In-Person: Visit a local branch to hand in the completed form and documents.

- Online: Use the bank's official website or mobile app to upload the form digitally.

- Mail: Some banks may allow submission via postal service, although this method is less common.

Quick guide on how to complete indian bank kyc form

Effortlessly Prepare Indian Bank Kyc Form on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent environmentally-friendly alternative to traditional printed and signed files, as you can obtain the correct format and securely store it online. airSlate SignNow provides all the essential tools necessary to swiftly create, modify, and eSign your documents without any delays. Manage Indian Bank Kyc Form on any device with airSlate SignNow apps available for Android or iOS and enhance your document-related workflows today.

The Easiest Method to Modify and eSign Indian Bank Kyc Form Effortlessly

- Obtain Indian Bank Kyc Form and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using the specialized tools provided by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes just seconds and carries the same legal authority as a conventional wet signature.

- Verify all details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that require new printed copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Indian Bank Kyc Form while ensuring effective communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an India bank KYC form PDF?

An India bank KYC form PDF is a digital document used by banks in India to collect essential information from customers to verify their identities. This form typically includes personal details like name, address, and identification documents. Using the India bank KYC form PDF simplifies the process of fulfilling regulatory requirements and ensures customer information is maintained securely.

-

How can airSlate SignNow help with the India bank KYC form PDF?

airSlate SignNow provides businesses the tools to send, sign, and manage the India bank KYC form PDF electronically. This simplifies the completion and submission process, allowing for quicker verification of customer identities. With robust features, this solution enhances overall operational efficiency and ensures compliance with KYC regulations.

-

Is airSlate SignNow cost-effective for managing KYC forms?

Yes, airSlate SignNow is a cost-effective solution for managing India bank KYC form PDFs. It reduces the need for physical paperwork, which can be costly in terms of printing and storage. Additionally, the streamlined eSigning process saves time and resources, making it a valuable investment for businesses.

-

What features does airSlate SignNow offer for KYC document management?

airSlate SignNow offers features such as customizable templates for the India bank KYC form PDF, secure eSignature capabilities, and automated workflow management. These features enhance the document handling process, making it easier for businesses to manage and verify KYC submissions efficiently. The platform also ensures compliance with legal standards.

-

Are there integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates with various third-party applications, which can further enhance the management of the India bank KYC form PDF. These integrations make it easy to connect existing systems and streamline business processes. Whether you're using CRM systems or document storage solutions, SignNow’s flexibility allows for seamless connectivity.

-

How secure is the process of handling India bank KYC form PDFs with airSlate SignNow?

The handling of India bank KYC form PDFs with airSlate SignNow is highly secure. The platform employs bank-level encryption, authentication features, and audit trails to ensure that sensitive customer information is protected. Compliance with data protection regulations further ensures that your KYC documents are in safe hands.

-

Can multiple users collaborate on India bank KYC form PDFs?

Absolutely! airSlate SignNow allows multiple users to collaborate on India bank KYC form PDFs. This means that teams can easily work together, edit documents, and track changes in real time. Enhanced collaboration helps in expediting the KYC completion process and improves overall efficiency in document management.

Get more for Indian Bank Kyc Form

- Declaration by medical practitioner for a tenants dependent form

- Committee application form 19102015

- Z1525 form

- Bdm120 form

- Why did informal sector workers stop paying for health

- Pay equity in the state sector tools and resources form

- Application for nz citizenship adulthow to apply for nz citizenshipnew zealand governmenthow to apply for nz citizenshipnew form

- Get the application for new zealand citizenship child pdf govtnz form

Find out other Indian Bank Kyc Form

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form