632, Personal Property Statement as of 12 31 19 L 4175 632, Personal Property Statement as of 12 31 19 L 4175 2019

Understanding the 632 Personal Property Statement

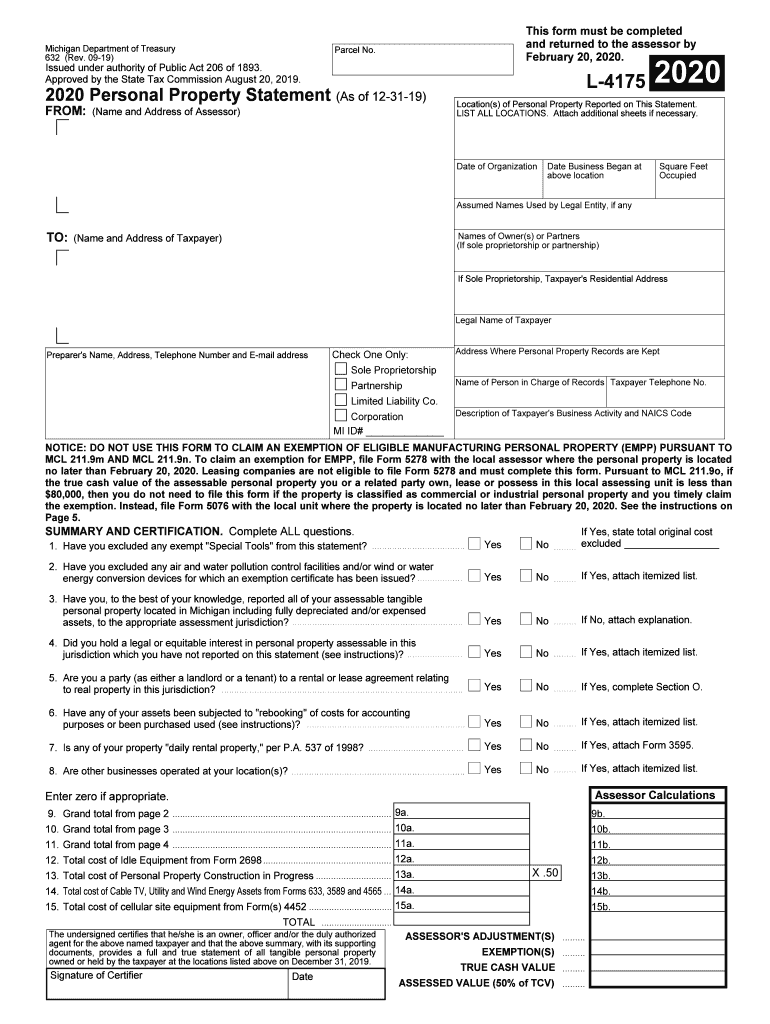

The 632 Personal Property Statement is a crucial document used in Michigan for reporting personal property owned by businesses as of December 31 of the tax year. This form is essential for tax assessment purposes, as it helps local governments determine the value of personal property for taxation. The form requires detailed information about the property, including its type, location, and estimated value. Completing this statement accurately ensures compliance with state tax regulations and avoids potential penalties.

Steps to Complete the 632 Personal Property Statement

Filling out the 632 Personal Property Statement involves several key steps:

- Gather necessary information: Collect details about all personal property owned, including machinery, equipment, and furniture.

- Determine property value: Assess the fair market value of each item, as this will be required on the form.

- Complete the form: Fill in the required sections, ensuring all information is accurate and complete.

- Review for accuracy: Double-check all entries to prevent errors that could lead to complications.

- Submit the form: File the completed statement with the appropriate local tax authority by the designated deadline.

Legal Use of the 632 Personal Property Statement

The 632 Personal Property Statement serves a legal purpose in Michigan's tax framework. It is a formal declaration of personal property, and failure to file it can result in penalties or increased assessments. The information provided on this form is used by local assessors to evaluate property taxes, making it essential for businesses to comply with filing requirements. Understanding the legal implications of this document helps ensure that businesses fulfill their tax obligations responsibly.

Key Elements of the 632 Personal Property Statement

Several key elements must be included in the 632 Personal Property Statement:

- Business information: Name, address, and contact details of the business.

- Property description: Detailed descriptions of each item of personal property, including type and location.

- Value assessment: Estimated fair market value for each item, which is critical for tax calculation.

- Signature: The form must be signed by an authorized representative of the business to validate the information provided.

Obtaining the 632 Personal Property Statement

The 632 Personal Property Statement can typically be obtained through the local tax assessor's office or the Michigan Department of Treasury's website. It is important to ensure that you are using the most current version of the form, as outdated versions may not be accepted. Additionally, local jurisdictions may have specific requirements or additional forms that need to be submitted along with the 632 statement.

Filing Deadlines for the 632 Personal Property Statement

Timely filing of the 632 Personal Property Statement is essential to avoid penalties. In Michigan, the deadline for submission is typically February 20 of the tax year. Businesses should mark this date on their calendars and ensure that all necessary documentation is prepared in advance. Late submissions may result in penalties or increased assessments, making it crucial to adhere to the filing timeline.

Quick guide on how to complete 632 2020 personal property statement as of 12 31 19 l 4175 632 2020 personal property statement as of 12 31 19 l 4175

Prepare 632, Personal Property Statement as Of 12 31 19 L 4175 632, Personal Property Statement as Of 12 31 19 L 4175 with ease on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it on the internet. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle 632, Personal Property Statement as Of 12 31 19 L 4175 632, Personal Property Statement as Of 12 31 19 L 4175 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign 632, Personal Property Statement as Of 12 31 19 L 4175 632, Personal Property Statement as Of 12 31 19 L 4175 effortlessly

- Find 632, Personal Property Statement as Of 12 31 19 L 4175 632, Personal Property Statement as Of 12 31 19 L 4175 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides for this specific purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 632, Personal Property Statement as Of 12 31 19 L 4175 632, Personal Property Statement as Of 12 31 19 L 4175 to ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 632 2020 personal property statement as of 12 31 19 l 4175 632 2020 personal property statement as of 12 31 19 l 4175

Create this form in 5 minutes!

How to create an eSignature for the 632 2020 personal property statement as of 12 31 19 l 4175 632 2020 personal property statement as of 12 31 19 l 4175

How to make an eSignature for your PDF in the online mode

How to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is mi personal in the context of airSlate SignNow?

Mi personal refers to the personalized experience that airSlate SignNow offers to its users. With features tailored to your needs, you can manage, send, and eSign documents easily, enhancing productivity and workflow.

-

How can I create my mi personal account on airSlate SignNow?

To create your mi personal account, simply visit the airSlate SignNow website and sign up using your email address. Once registered, you can customize your account settings to match your preferences and enhance your document management experience.

-

What are the pricing options for mi personal users?

airSlate SignNow offers flexible pricing plans for mi personal users, ensuring access to essential features at a competitive rate. Various plans cater to individual needs, providing options for monthly or annual payments based on your usage requirements.

-

What features can I expect from mi personal on airSlate SignNow?

Mi personal users can expect a range of features, including document templates, custom branding, and eSignature capabilities. The platform is designed to streamline document workflows, making it easier for you to manage and sign documents efficiently.

-

How does airSlate SignNow enhance the mi personal eSigning experience?

airSlate SignNow enhances the mi personal eSigning experience by providing a user-friendly interface that allows for quick and secure signing of documents. You can sign documents from any device, ensuring flexibility and convenience.

-

Can I integrate mi personal with other business tools?

Yes, airSlate SignNow allows you to integrate mi personal with various business tools, including CRMs and project management software. These integrations help streamline your workflow and ensure seamless collaboration across applications.

-

What are the benefits of using mi personal for my business?

Using mi personal for your business offers numerous benefits, such as improved document turnaround times and enhanced compliance with legal standards. The cost-effective solution also helps save time and resources, allowing you to focus on growing your business.

Get more for 632, Personal Property Statement as Of 12 31 19 L 4175 632, Personal Property Statement as Of 12 31 19 L 4175

Find out other 632, Personal Property Statement as Of 12 31 19 L 4175 632, Personal Property Statement as Of 12 31 19 L 4175

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment