Personal Property Statement Form L 4175 2025-2026

Understanding the Personal Property Statement Form L 4175

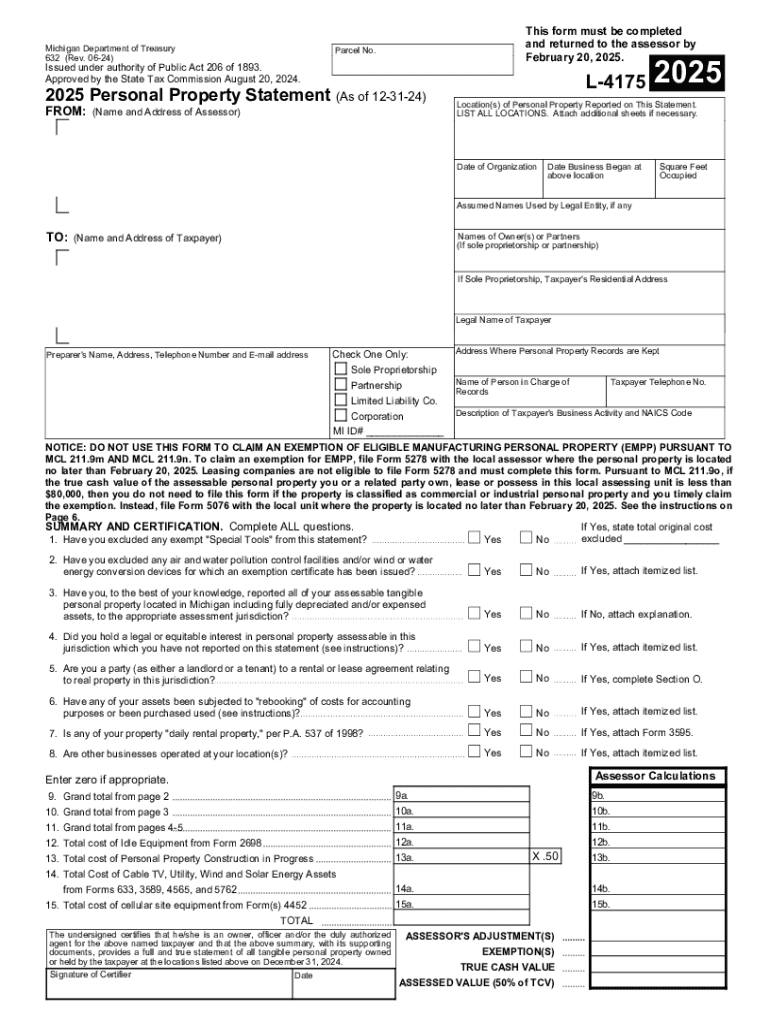

The Personal Property Statement Form L 4175 is a crucial document used in the state of Michigan for reporting personal property owned by businesses. This form is essential for ensuring compliance with local tax regulations. It provides a comprehensive overview of the personal property a business possesses, including machinery, equipment, and other tangible assets. Accurate completion of this form helps local tax assessors determine the taxable value of personal property, which in turn affects the overall tax obligations of the business.

Steps to Complete the Personal Property Statement Form L 4175

Completing the Personal Property Statement Form L 4175 involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect details about all personal property owned, including descriptions, purchase dates, and costs.

- Fill out the form: Enter the gathered information into the appropriate sections of the form, ensuring all details are accurate and complete.

- Review for accuracy: Double-check all entries for correctness to avoid potential penalties for misinformation.

- Submit the form: Follow the preferred submission method, whether online, by mail, or in person, before the designated deadline.

Legal Use of the Personal Property Statement Form L 4175

The Personal Property Statement Form L 4175 is legally mandated for businesses in Michigan that own personal property. Filing this form is not just a procedural requirement; it is a legal obligation that helps maintain transparency in business operations. Failure to submit the form can result in penalties, including fines or increased assessments by local tax authorities. Understanding the legal implications of this form is essential for business owners to avoid compliance issues.

Filing Deadlines and Important Dates

Timeliness is crucial when submitting the Personal Property Statement Form L 4175. The deadline for filing this form typically falls on February 20th each year. It is important for businesses to be aware of this date to avoid late fees or penalties. Additionally, any changes in property ownership or significant acquisitions should be reported promptly to ensure accurate tax assessments.

Obtaining the Personal Property Statement Form L 4175

Businesses can obtain the Personal Property Statement Form L 4175 through the Michigan Department of Treasury's official website or by contacting local tax assessors. The form is available in both digital and paper formats, allowing for flexible access depending on the business's preference. Ensuring that the most current version of the form is used is essential for compliance with state regulations.

Key Elements of the Personal Property Statement Form L 4175

Several key elements must be included in the Personal Property Statement Form L 4175 to ensure it meets legal requirements:

- Business Information: Name, address, and contact details of the business.

- Property Details: A detailed list of all personal property owned, including descriptions and values.

- Signature: The form must be signed by an authorized representative of the business to validate the information provided.

Create this form in 5 minutes or less

Find and fill out the correct personal property statement form l 4175

Create this form in 5 minutes!

How to create an eSignature for the personal property statement form l 4175

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to treasury management?

airSlate SignNow is a digital solution that empowers businesses to send and eSign documents efficiently. In the context of treasury management, it streamlines the process of signing financial documents, ensuring that treasury operations are both secure and efficient.

-

How can airSlate SignNow improve my treasury operations?

By using airSlate SignNow, treasury teams can automate document workflows, reducing the time spent on manual processes. This leads to faster approvals and enhances overall productivity, allowing treasury professionals to focus on strategic financial management.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses, including those in treasury management. You can choose from various tiers based on features and usage, ensuring that you get the best value for your treasury operations.

-

Does airSlate SignNow integrate with treasury management systems?

Yes, airSlate SignNow integrates seamlessly with various treasury management systems and financial software. This integration allows for a smooth flow of information, enhancing the efficiency of your treasury processes and ensuring that all documents are easily accessible.

-

What features does airSlate SignNow offer for treasury professionals?

airSlate SignNow provides features such as customizable templates, secure eSigning, and automated workflows specifically designed for treasury professionals. These features help streamline document management and ensure compliance with financial regulations.

-

Is airSlate SignNow secure for handling treasury documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your treasury documents. This ensures that sensitive financial information remains confidential and secure throughout the signing process.

-

Can airSlate SignNow help with compliance in treasury operations?

Yes, airSlate SignNow is designed to help businesses maintain compliance with various financial regulations. By providing an audit trail and secure document storage, it ensures that your treasury operations adhere to necessary compliance standards.

Get more for Personal Property Statement Form L 4175

- Quitclaim deed from husband and wife to husband and wife georgia form

- Warranty deed from husband and wife to husband and wife georgia form

- Georgia revocation form

- Georgia agreement form

- Amendment to postnuptial property agreement georgia georgia form

- Quitclaim deed from husband and wife to an individual georgia form

- Deed wife to 497303633 form

- Statement claim draft form

Find out other Personal Property Statement Form L 4175

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF