632 2023

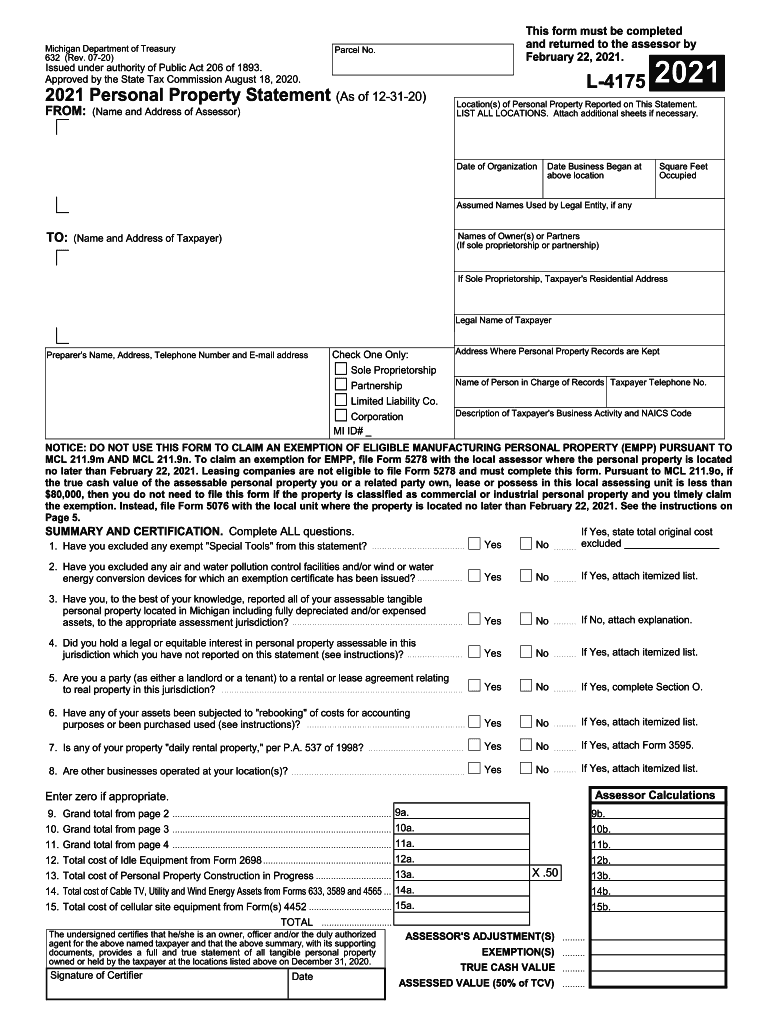

What is the 632 form?

The 632 form, officially known as the Form 632, is utilized in specific tax situations to report certain income or expenses. This form is essential for individuals and businesses to ensure compliance with IRS regulations. Understanding its purpose is crucial for accurate tax reporting and avoiding potential issues with the tax authorities.

How to use the 632 form

Using the 632 form involves several steps. First, gather all necessary financial documents that pertain to the income or expenses you need to report. Next, fill out the form accurately, ensuring that all information is complete and correct. After completing the form, review it for any errors before submission. It is advisable to keep a copy of the submitted form for your records.

Steps to complete the 632 form

Completing the 632 form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, such as receipts and previous tax returns.

- Download the 632 form from the IRS website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Report the required income or expenses in the designated sections of the form.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the 632 form

The 632 form must be used in accordance with IRS guidelines. It is legally binding, and any inaccuracies or omissions can lead to penalties. Ensure that you are using the form for its intended purpose and that all information is truthful and complete. Familiarity with the legal implications of the form can help prevent complications during audits or reviews.

Filing Deadlines / Important Dates

Filing deadlines for the 632 form vary based on the specific tax year and the taxpayer's situation. Generally, the form should be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. It is essential to stay informed about any changes in deadlines, as late submissions can incur penalties and interest on unpaid taxes.

Required Documents

To complete the 632 form accurately, you will need several documents, including:

- Proof of income, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Any other documentation that supports the information reported on the form.

Who Issues the Form

The 632 form is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and tax law enforcement. It is important to ensure that you are using the most current version of the form, as the IRS periodically updates its forms and guidelines.

Quick guide on how to complete 632

Easily prepare 632 on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents quickly and without delays. Manage 632 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign 632 effortlessly

- Locate 632 and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive data using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal value as a traditional handwritten signature.

- Review all the information and click on the Done button to save your updates.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign 632 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 632

Create this form in 5 minutes!

How to create an eSignature for the 632

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 632 2021?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. In 632 2021, it stands out as a cost-effective option for organizations looking to streamline their document workflows and enhance productivity.

-

What are the pricing options for airSlate SignNow in 632 2021?

In 632 2021, airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Whether you're a small startup or a large enterprise, you can choose a plan that fits your budget while enjoying all the essential features.

-

What features does airSlate SignNow offer in 632 2021?

airSlate SignNow provides a range of features including document templates, real-time tracking, and advanced security measures. These features make it an ideal choice for businesses looking to enhance their document management processes in 632 2021.

-

How can airSlate SignNow benefit my business in 632 2021?

By using airSlate SignNow in 632 2021, your business can save time and reduce costs associated with traditional document signing methods. The platform simplifies the signing process, allowing for quicker turnaround times and improved customer satisfaction.

-

Does airSlate SignNow integrate with other software in 632 2021?

Yes, airSlate SignNow offers seamless integrations with various software applications in 632 2021. This allows businesses to connect their existing tools and enhance their workflows without any disruptions.

-

Is airSlate SignNow secure for handling sensitive documents in 632 2021?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all documents are protected with advanced encryption and authentication measures. In 632 2021, you can trust that your sensitive information is safe.

-

Can I use airSlate SignNow on mobile devices in 632 2021?

Yes, airSlate SignNow is fully optimized for mobile use in 632 2021. This means you can send and sign documents on the go, making it easier to manage your business from anywhere.

Find out other 632

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF