PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel 2007-2026

Understanding the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel

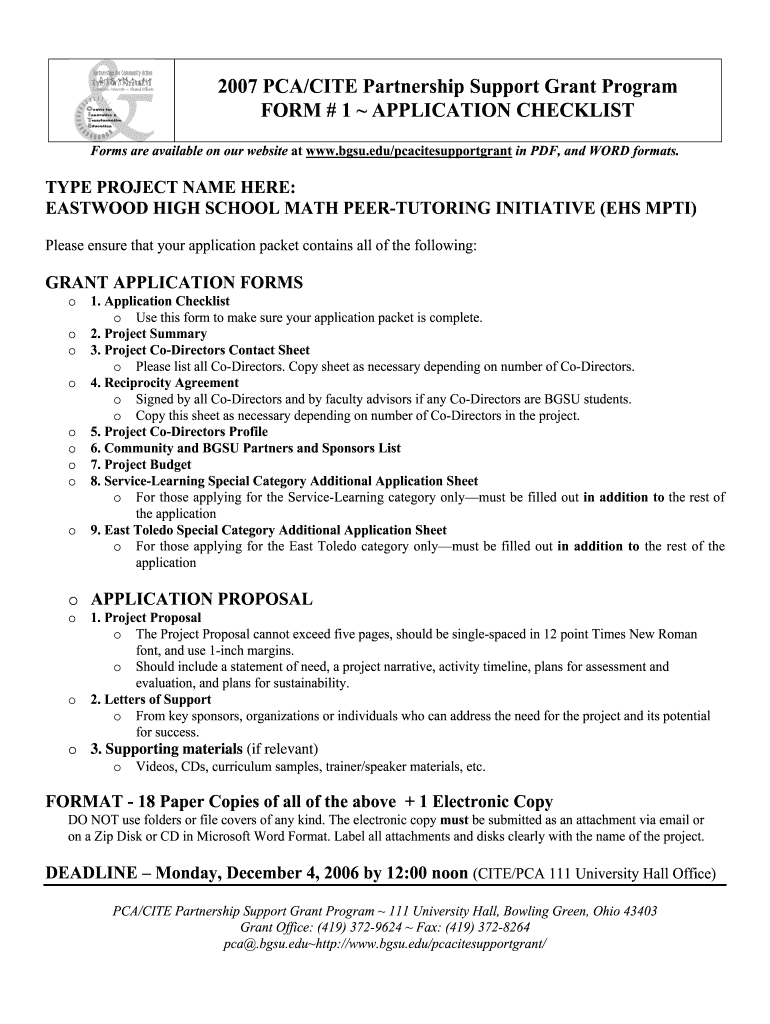

The PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel is designed to provide financial assistance to eligible applicants involved in partnership initiatives. This form serves as a formal request for funding, enabling organizations to support collaborative projects that align with the program's objectives. Understanding the purpose and requirements of this form is crucial for ensuring a successful application process.

Steps to Complete the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel

Completing the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel involves several key steps:

- Gather necessary information about the partnership, including details of all parties involved.

- Review the eligibility criteria to ensure compliance with the program requirements.

- Fill out the form accurately, providing all requested information and documentation.

- Double-check the form for completeness and accuracy before submission.

- Submit the form through the designated method, whether online or via mail.

Legal Use of the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel

The legal use of the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel is governed by specific regulations that ensure compliance with funding guidelines. It is essential to adhere to these legal standards to maintain the integrity of the application process. This includes understanding the implications of the information provided and ensuring that all parties involved are aware of their responsibilities under the grant terms.

Eligibility Criteria for the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel

Eligibility for the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel is determined by several factors, including:

- The nature of the partnership and its alignment with program goals.

- The qualifications and experience of the applicants involved.

- Compliance with any specific requirements outlined by the funding agency.

Applicants should carefully review these criteria to ensure their application meets all necessary qualifications.

Form Submission Methods for the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel

Submitting the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel can be done through various methods, including:

- Online submission via the designated portal, which may offer a streamlined process.

- Mailing the completed form to the appropriate office, ensuring it is sent well before any deadlines.

- In-person submission, if applicable, which may allow for immediate confirmation of receipt.

Examples of Using the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel

Examples of successful applications using the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel can provide valuable insights. These examples may include:

- Collaborative educational initiatives between institutions that enhance learning opportunities.

- Community development projects that foster partnerships between local organizations.

- Research collaborations that leverage resources from multiple entities to achieve common goals.

Studying these examples can help applicants understand how to effectively present their partnership initiatives.

Quick guide on how to complete 2007 pcacite partnership support grant program form 1 mathcs bethel

Explore how to effortlessly navigate the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel process with these simple guidelines

Submitting and verifying documents digitally is becoming more and more widespread and is the preferred choice for many clients. It provides multiple advantages over outdated printed documents, such as ease, time-saving, improved accuracy, and security.

With platforms like airSlate SignNow, you can find, edit, sign, enhance, and transmit your PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel without getting tangled in endless printing and scanning. Follow this concise guide to begin and complete your form.

Utilize these steps to access and complete PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel

- Begin by clicking the Get Form button to access your document within our editor.

- Observe the green label on the left indicating required fields to ensure you don’t overlook them.

- Employ our sophisticated tools to annotate, modify, sign, secure, and enhance your document.

- Secure your document or transform it into a fillable form using features available in the right panel.

- Review the document and verify it for any mistakes or inconsistencies.

- Select DONE to complete your edits.

- Rename your form or leave it as is.

- Pick the storage solution where you’d like to save your document, send it via USPS, or click the Download Now button to obtain your file.

If PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel isn’t what you were searching for, you can explore our extensive library of pre-uploaded forms that you can complete with minimal hassle. Check out our service today!

Create this form in 5 minutes or less

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the 2007 pcacite partnership support grant program form 1 mathcs bethel

How to make an eSignature for your 2007 Pcacite Partnership Support Grant Program Form 1 Mathcs Bethel online

How to generate an electronic signature for the 2007 Pcacite Partnership Support Grant Program Form 1 Mathcs Bethel in Google Chrome

How to create an electronic signature for putting it on the 2007 Pcacite Partnership Support Grant Program Form 1 Mathcs Bethel in Gmail

How to generate an eSignature for the 2007 Pcacite Partnership Support Grant Program Form 1 Mathcs Bethel from your mobile device

How to generate an electronic signature for the 2007 Pcacite Partnership Support Grant Program Form 1 Mathcs Bethel on iOS

How to make an eSignature for the 2007 Pcacite Partnership Support Grant Program Form 1 Mathcs Bethel on Android devices

People also ask

-

What is the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel?

The PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel is designed to support educational initiatives through funding opportunities. This program enables institutions to collaborate and enhance their educational offerings with financial assistance, thereby fostering innovation and growth in the community.

-

How can I apply for the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel?

To apply for the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel, visit the official website where the application form is available. Ensure that you meet all eligibility criteria and submit the necessary documentation before the deadline to be considered for funding.

-

What are the benefits of the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel?

The PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel provides numerous benefits, including financial support for educational projects and initiatives. It allows partners to leverage additional resources for enhancing student learning experiences, promoting collaboration, and implementing innovative teaching strategies.

-

What types of projects are eligible for the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel?

Eligible projects for the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel typically include collaborative educational initiatives, technology integration, curriculum development, and community engagement programs. Each project must align with the program's goals of improving educational outcomes.

-

Is there a cost to apply for the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel?

There is no cost to apply for the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel. However, applicants should ensure they provide comprehensive information and meet all requirements to increase their chances of receiving funding.

-

What documentation is required for the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel application?

Applicants for the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel will need to submit a completed application form, project proposal, budget outline, and any supporting documents that demonstrate the project's alignment with the program objectives. Detailed documentation will strengthen your application.

-

How long does it take to receive a decision on the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel application?

The review process for the PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel can vary, but applicants can typically expect to receive a decision within a few weeks after the submission deadline. It is advisable to check the program's website for specific timelines and updates.

Get more for PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel

- Request for service credit cost information leave of absence calpers ca

- Application completion form dvla

- Large group member application blue cross amp blue shield of form

- Indiana form 53421pdffillercom

- Dj le 327 form

- Judges retirement system ii application fillable form

- Anthem provider appeal form

- Alameda library public meeting room reservation form

Find out other PCACITE Partnership Support Grant Program FORM # 1 Mathcs Bethel

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title