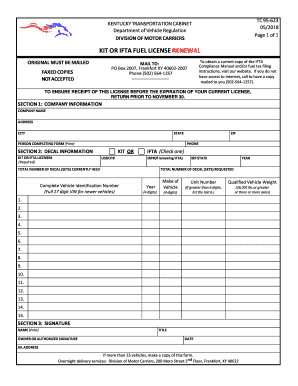

Tc 95 623 2018

What is the TC 95 623?

The TC 95 623 form is a specific document utilized primarily for tax purposes in the United States. It is often required by the Internal Revenue Service (IRS) for various reporting and compliance needs. Understanding the purpose of this form is essential for individuals and businesses to ensure they meet their tax obligations accurately. The TC 95 623 may include information related to income, deductions, and other financial data necessary for proper tax filing.

How to use the TC 95 623

Using the TC 95 623 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific requirements set by the IRS.

Steps to complete the TC 95 623

Completing the TC 95 623 form requires careful attention to detail. Here are the key steps:

- Gather all relevant financial documents.

- Begin filling out the form, starting with personal information.

- Input income details accurately, ensuring all sources are included.

- List any applicable deductions and credits.

- Review the form for completeness and accuracy.

- Submit the form electronically or by mail, as required.

Legal use of the TC 95 623

The TC 95 623 form is legally binding when completed and submitted according to IRS regulations. It is essential to ensure that all information is accurate and truthful, as discrepancies can lead to penalties or audits. The form must also be signed appropriately, either electronically or with a handwritten signature, to maintain its legal validity. Compliance with all applicable laws and regulations is crucial for the proper use of this form.

Filing Deadlines / Important Dates

Filing deadlines for the TC 95 623 form are critical to avoid penalties. Typically, the form must be submitted by the tax deadline, which is usually April 15th for individual taxpayers. Businesses may have different deadlines depending on their entity type. It is advisable to check the IRS website or consult a tax professional for the most current deadlines and any extensions that may apply.

Who Issues the Form

The TC 95 623 form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers have the necessary resources to comply with tax laws. It is important to refer to the IRS website for the latest updates and changes regarding the TC 95 623 form.

Quick guide on how to complete 2019 tc 95 623

Accomplish Tc 95 623 effortlessly on any device

Digital document management has become increasingly favored by both companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the necessary form and safely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents promptly without any delays. Manage Tc 95 623 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Tc 95 623 without hassle

- Find Tc 95 623 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or errors that necessitate printing new versions. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Tc 95 623 and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 tc 95 623

Create this form in 5 minutes!

How to create an eSignature for the 2019 tc 95 623

The best way to make an electronic signature for a PDF document in the online mode

The best way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is 2019 tc 95 623?

The term '2019 tc 95 623' refers to a specific compliance standard that may be relevant for businesses using electronic signatures. Understanding this standard is crucial for companies that want to ensure their digital signing processes meet regulatory requirements. AirSlate SignNow complies with various standards, including '2019 tc 95 623', to provide legal compliance in e-signatures.

-

How does airSlate SignNow support '2019 tc 95 623' compliance?

AirSlate SignNow is designed with compliance in mind, supporting regulations such as '2019 tc 95 623'. By using strong encryption and authentication methods, we ensure that every document signed is legally binding. This makes it easier for businesses to adhere to compliance standards while maintaining a smooth workflow.

-

What features of airSlate SignNow are aligned with the '2019 tc 95 623' standard?

Key features of airSlate SignNow that align with '2019 tc 95 623' include advanced security protocols, audit trails, and user authentication. These features not only enhance security but also boost trust in the signing process. Businesses can rest assured that their e-signatures are compliant and secure.

-

What are the pricing plans available for airSlate SignNow?

AirSlate SignNow offers various pricing plans that accommodate different business needs, even for those concerned with '2019 tc 95 623' compliance. Each plan provides a range of features, allowing businesses to choose according to their signing volume and requirements. To find the best plan for your needs, you can visit our pricing page.

-

Can airSlate SignNow integrate with existing systems to meet '2019 tc 95 623' requirements?

Yes, airSlate SignNow offers seamless integrations with a variety of platforms and software to help meet '2019 tc 95 623' requirements. This flexibility ensures that businesses can easily incorporate e-signature solutions into their existing workflows. Integrations help enhance productivity and ensure compliance across different systems.

-

What are the benefits of using airSlate SignNow for '2019 tc 95 623' compliance?

Using airSlate SignNow simplifies the process of obtaining compliant signatures as per '2019 tc 95 623' standards. The platform’s easy-to-use interface and robust security features make it accessible for all users. Furthermore, it greatly reduces the time needed for document turnaround, enhancing overall efficiency.

-

How does airSlate SignNow ensure the security of documents related to '2019 tc 95 623' compliance?

AirSlate SignNow ensures the security of documents related to '2019 tc 95 623' compliance through advanced encryption techniques and secure access controls. These security measures protect documents from unauthorized access and tampering. This not only safeguards sensitive information but also reinforces trust in the e-signature process.

Get more for Tc 95 623

- C1 fillable form

- C 1 notice of injury or occupational disease incident report unr form

- Soh instructions statement of health form and the authorization form that follow this section

- Off hours use of a smartphone intervention to extend form

- Attorney regulation state bar of california form

- Va form 10091 va fsc vendor file request form fsc vendor file 10091

- Azdorgov file 12144arizona form az 140v azdorgov

- Adding a signer to a form in docusign that has already

Find out other Tc 95 623

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple