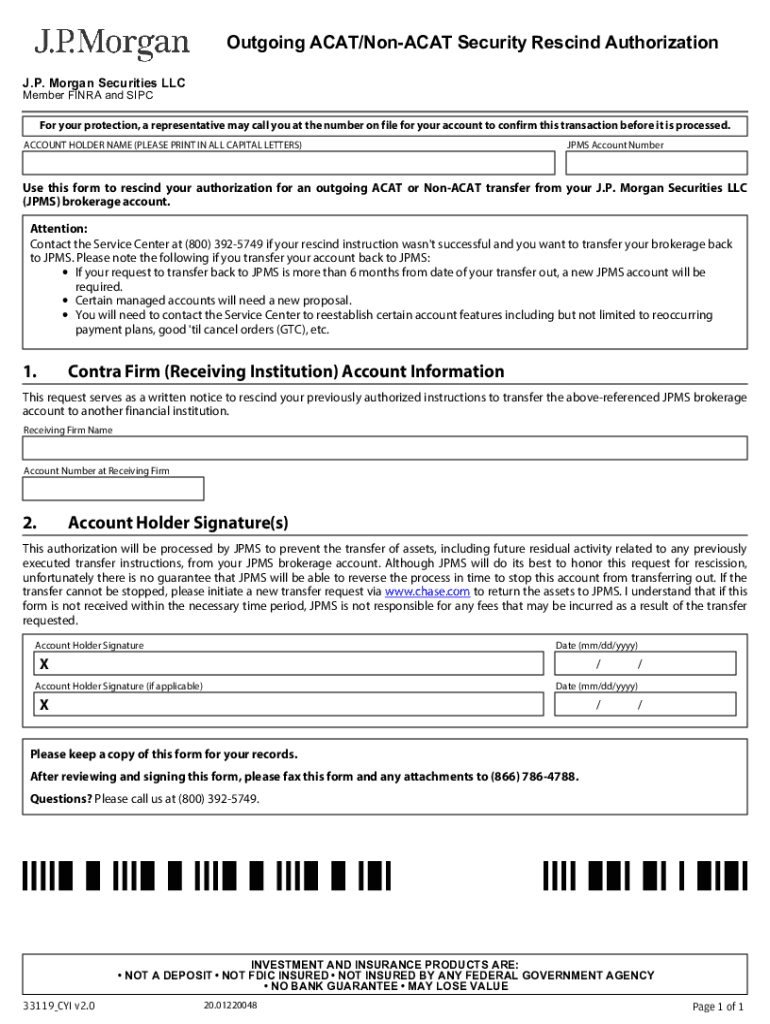

Outgoing ACATNon ACAT Security Rescind Chase Com Form

Steps to complete a Chase check

Filling out a Chase check involves several key steps to ensure accuracy and clarity. Begin by writing the date in the top right corner. This is important as it indicates when the check is issued. Next, write the name of the payee on the line that starts with "Pay to the order of." This should be the individual or entity receiving the funds.

In the box to the right of the payee's name, write the amount of the check in numbers. Ensure that this amount matches what you write on the line below. On the line beneath the payee's name, spell out the amount in words. This provides a clear and legal representation of the payment amount.

Finally, sign the check on the bottom right line. Your signature authorizes the payment and is essential for the check to be valid. Make sure all information is correct to avoid any issues when the check is presented for payment.

Key elements of a Chase check

Understanding the key elements of a Chase check can help you fill it out correctly. Each check includes specific fields that must be completed:

- Date: The date the check is issued.

- Payee: The individual or business to whom the check is payable.

- Amount in numbers: The payment amount written in numerical form.

- Amount in words: The payment amount written out in words for clarity.

- Signature: Your signature, which authorizes the payment.

- Memo (optional): A space to note the purpose of the payment.

Each of these elements plays a crucial role in the check's validity and ensures that the transaction is clear and legally binding.

Legal use of a Chase check

When using a Chase check, it is important to understand the legal implications. A check serves as a written order to a bank to pay a specified amount from the issuer's account. It is essential that the check is filled out correctly to avoid disputes. If the check is not properly signed or if there are discrepancies between the numerical and written amounts, it may be considered invalid.

Additionally, checks must comply with banking regulations and guidelines. This includes ensuring that there are sufficient funds in the account to cover the amount of the check. Failure to comply with these legal requirements can result in penalties, including fees for bounced checks or legal action from the payee.

Form submission methods for a Chase check

Chase checks can be submitted for payment in several ways. The most common method is to present the check in person at the bank where the payee holds an account. This allows for immediate processing. Alternatively, checks can be deposited using an ATM or through mobile banking apps, which allow users to take a photo of the check for electronic submission.

It is also possible to mail the check to the payee, though this method may take longer for processing. Regardless of the method chosen, it is important to keep a record of the check, including the check number and amount, for personal financial tracking.

Common mistakes when filling out a Chase check

When filling out a Chase check, several common mistakes can lead to complications. One frequent error is mismatching the written amount with the numerical amount. This discrepancy can cause confusion and may result in the check being rejected.

Another mistake is failing to include a signature, which is essential for the check's validity. Additionally, neglecting to write the date can lead to the check being considered stale-dated, especially if it is not cashed within a certain timeframe.

Lastly, ensuring that the payee's name is spelled correctly is crucial. Errors in the name can prevent the payee from cashing or depositing the check.

Quick guide on how to complete outgoing acatnon acat security rescind chasecom

Prepare Outgoing ACATNon ACAT Security Rescind Chase com effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed paperwork, as you can access the right template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any delays. Manage Outgoing ACATNon ACAT Security Rescind Chase com seamlessly on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related procedures today.

The easiest way to edit and eSign Outgoing ACATNon ACAT Security Rescind Chase com without breaking a sweat

- Obtain Outgoing ACATNon ACAT Security Rescind Chase com and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or redact sensitive details with tools specifically designed for that function by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your updates.

- Choose your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Outgoing ACATNon ACAT Security Rescind Chase com and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for how to fill out a chase check using airSlate SignNow?

To fill out a Chase check using airSlate SignNow, start by uploading the check template to our platform. Use the intuitive editor to input the necessary information, including the date, payee name, and the amount. Once completed, sign the document digitally, and it's ready for distribution.

-

Are there any costs associated with learning how to fill out a chase check on airSlate SignNow?

Learning how to fill out a Chase check on airSlate SignNow is free of charge. Our platform offers various pricing tiers for different features, but the resources and guides on filling out checks are accessible to everyone. Consider trying our free trial to explore the capabilities of our service.

-

Can I store my completed Chase checks securely after learning how to fill out a chase check?

Absolutely! Once you learn how to fill out a Chase check using airSlate SignNow, you can securely store your completed documents in our cloud-based system. This ensures your checks are safe, organized, and easy to retrieve whenever you need them.

-

What features does airSlate SignNow offer for filling out checks like Chase checks?

airSlate SignNow offers a variety of features to streamline how to fill out a Chase check. From an intuitive document editor to digital signatures and templates, our platform simplifies the entire process. You can also integrate with other applications for enhanced functionality.

-

Is there a mobile app for airSlate SignNow to help with how to fill out a chase check on the go?

Yes! airSlate SignNow has a mobile app that allows you to fill out a Chase check from anywhere. This flexibility ensures you can easily manage your documents and sign checks while on the move, providing convenience for busy professionals.

-

How does airSlate SignNow integrate with other tools when learning how to fill out a chase check?

airSlate SignNow seamlessly integrates with various tools to enhance your experience while learning how to fill out a Chase check. Our platform supports integrations with services like Google Drive, Dropbox, and CRM systems, allowing for a smooth workflow across different applications.

-

What benefits can I expect from using airSlate SignNow for how to fill out a chase check?

Using airSlate SignNow to understand how to fill out a Chase check offers numerous benefits, including efficiency, reduced errors, and enhanced security. Our electronic signature features ensure your checks are legally binding and fast to process, saving you valuable time.

Get more for Outgoing ACATNon ACAT Security Rescind Chase com

- Application for bondsmans process forms

- Order for out patient evaluation of defendants forms

- Presence of lead based paint andor lead based paint hazards or form

- Scra letter for residential lease form

- Orders alabama administrative office of courts form

- State wage garnishment proceduresfair debt collection form

- Notice of appeal to circuit court municipal ordinance violation form

- Court of criminal appeals alabama judicial system form

Find out other Outgoing ACATNon ACAT Security Rescind Chase com

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document