Net Profits 2019

What is the net profits form?

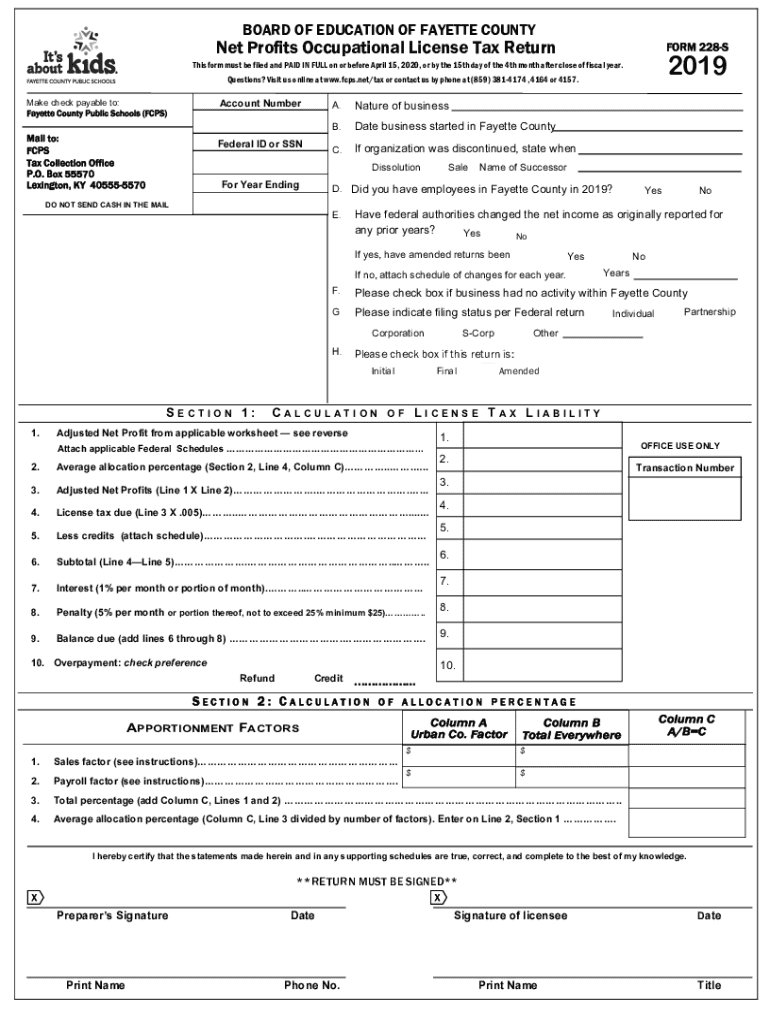

The net profits form is a crucial document used by businesses to report their earnings after all expenses have been deducted. This form provides a clear overview of a company's financial performance, allowing stakeholders to assess profitability. It typically includes details such as revenue, operating costs, and net income. Understanding this form is essential for business owners, as it plays a significant role in tax reporting and financial planning.

How to complete the net profits form

Completing the net profits form involves several key steps. First, gather all necessary financial documents, including income statements and expense reports. Next, calculate total revenue and subtract all allowable expenses to determine net profits. Ensure that you accurately categorize each expense to comply with IRS guidelines. Finally, review the form for accuracy before submission to avoid potential penalties.

Legal use of the net profits form

The net profits form must be completed in accordance with U.S. tax laws to ensure its legal validity. This includes adhering to regulations set forth by the IRS and maintaining accurate records of all financial transactions. An electronically signed net profits form is considered legally binding, provided it meets specific requirements, such as compliance with the ESIGN and UETA acts. Utilizing a reliable eSignature solution can enhance the legal standing of your document.

Key elements of the net profits form

Several key elements are essential when filling out the net profits form. These include:

- Total revenue: This represents all income generated from business activities.

- Operating expenses: These are costs incurred in the normal course of business, such as rent, utilities, and salaries.

- Net income: This is the profit remaining after all expenses have been deducted from total revenue.

- Tax obligations: Understanding how net profits affect tax liabilities is critical for compliance.

Filing deadlines for the net profits form

Filing deadlines for the net profits form vary based on the business structure. Generally, sole proprietors must file by April fifteenth, while corporations have different deadlines depending on their fiscal year. It is important to stay informed about these dates to avoid late fees and penalties. Keeping a calendar of important tax dates can help ensure timely submissions.

Examples of using the net profits form

Businesses utilize the net profits form in various scenarios. For instance, a self-employed individual may use it to report earnings on their personal tax return. Similarly, a corporation may submit the form to provide shareholders with insights into financial performance. Understanding these examples can help business owners grasp the importance of accurately completing the form.

IRS guidelines for the net profits form

The IRS provides specific guidelines for completing the net profits form. These guidelines outline acceptable accounting methods, allowable deductions, and reporting requirements. Familiarizing yourself with these rules is essential for compliance and can help prevent audits or penalties. Consulting with a tax professional can also ensure that you are following all necessary regulations.

Quick guide on how to complete net profits

Effortlessly Prepare Net Profits on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your files swiftly without any delays. Manage Net Profits on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The Easiest Way to Modify and eSign Net Profits Seamlessly

- Find Net Profits and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information using the tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether it's via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Net Profits while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct net profits

Create this form in 5 minutes!

How to create an eSignature for the net profits

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

How can airSlate SignNow help increase my net profits?

By streamlining the document signing process, airSlate SignNow reduces time spent on paperwork, allowing businesses to focus more on revenue-generating activities. This efficiency not only saves time but also minimizes operational costs, ultimately contributing to higher net profits.

-

What pricing plans does airSlate SignNow offer to support my business net profits?

airSlate SignNow provides various pricing plans tailored to different business needs. By choosing a plan that aligns with your operational scale, you can manage your costs effectively and improve net profits through optimized document management.

-

What features of airSlate SignNow will benefit my bottom line?

Key features like template management, automated workflows, and real-time notifications enhance productivity. By improving workflow efficiency, these features can help boost your net profits by enabling quicker turnaround times for contracts and agreements.

-

Are there any integrations that can further enhance net profits?

Yes, airSlate SignNow integrates seamlessly with popular applications like Salesforce, Google Drive, and Dropbox. These integrations allow for efficient data management and streamline communication channels, ultimately supporting better customer service and increasing net profits.

-

How does airSlate SignNow ensure the security of documents while maximizing net profits?

airSlate SignNow employs robust security measures such as encryption and two-factor authentication to protect your sensitive documents. By safeguarding your data, businesses can avoid costly bsignNowes and legal issues, safeguarding their net profits.

-

Can airSlate SignNow help reduce operational costs and improve net profits?

Absolutely, airSlate SignNow eliminates the need for physical paperwork and reduces storage costs. This not only decreases operational expenses but also allows for a more agile business model, which can positively impact your net profits.

-

What types of businesses benefit the most from using airSlate SignNow to enhance net profits?

Both small and large businesses across various industries can benefit from airSlate SignNow. By simplifying document management and enhancing collaboration, companies of all sizes can improve efficiencies and see an increase in net profits.

Get more for Net Profits

- Arkansas statutory form power of attorney

- Control number ar p010 pkg form

- Address is city state form

- Revocation of power of attorney form sample

- Agents certification as to the validity of power of form

- Arkansas us legal forms

- Identity theft pro bono attorney application arkansas legal form

- Legal life documents for form

Find out other Net Profits

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe