Net Profit Occupational License Tax Return 228 S Fayette County Fcps 2009

What is the Net Profit Occupational License Tax Return 228 S Fayette County FCPS

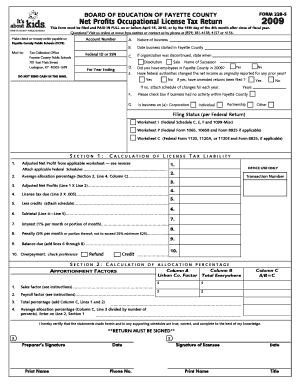

The Net Profit Occupational License Tax Return 228 S Fayette County FCPS is a specific tax form used by businesses operating within Fayette County, Kentucky. This form is essential for reporting net profits and ensuring compliance with local occupational license tax regulations. The return must be filed annually and is applicable to various business entities, including corporations, partnerships, and sole proprietorships. Understanding this form is crucial for maintaining good standing with local tax authorities and avoiding potential penalties.

Steps to complete the Net Profit Occupational License Tax Return 228 S Fayette County FCPS

Completing the Net Profit Occupational License Tax Return 228 S Fayette County FCPS involves several key steps:

- Gather all necessary financial documents, including income statements and expense reports.

- Calculate your net profit by subtracting total expenses from total revenue.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the completed form by the designated deadline, either online or by mail.

Legal use of the Net Profit Occupational License Tax Return 228 S Fayette County FCPS

The legal use of the Net Profit Occupational License Tax Return 228 S Fayette County FCPS is governed by local tax laws in Fayette County. This form must be completed and submitted in accordance with these regulations to ensure that businesses fulfill their tax obligations. Proper completion and timely submission can protect businesses from legal repercussions, including fines and penalties for non-compliance.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Net Profit Occupational License Tax Return 228 S Fayette County FCPS. Typically, the return is due on April fifteenth of each year for the previous calendar year’s earnings. However, businesses should verify specific dates each year, as local regulations may change. Missing the deadline can result in penalties and interest on any unpaid taxes.

Required Documents

When preparing to file the Net Profit Occupational License Tax Return 228 S Fayette County FCPS, businesses should have the following documents ready:

- Income statements detailing revenue generated.

- Expense reports outlining all business-related costs.

- Previous year’s tax returns, if applicable.

- Any additional documentation required by local tax authorities.

Who Issues the Form

The Net Profit Occupational License Tax Return 228 S Fayette County FCPS is issued by the Fayette County government. The local tax authority is responsible for providing the form, along with guidelines for its completion and submission. Businesses can typically obtain the form through the Fayette County website or by contacting the local tax office directly.

Quick guide on how to complete net profit occupational license tax return 228 s fayette county fcps

Complete Net Profit Occupational License Tax Return 228 S Fayette County Fcps effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers a perfect sustainable alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly and without issues. Handle Net Profit Occupational License Tax Return 228 S Fayette County Fcps on any device using the airSlate SignNow Android or iOS applications and streamline any document-related procedures today.

How to modify and eSign Net Profit Occupational License Tax Return 228 S Fayette County Fcps with ease

- Find Net Profit Occupational License Tax Return 228 S Fayette County Fcps and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for those purposes.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to preserve your modifications.

- Decide how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Net Profit Occupational License Tax Return 228 S Fayette County Fcps to ensure clear communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct net profit occupational license tax return 228 s fayette county fcps

Create this form in 5 minutes!

People also ask

-

What is the Net Profit Occupational License Tax Return 228 S Fayette County Fcps?

The Net Profit Occupational License Tax Return 228 S Fayette County Fcps is a tax form that enables businesses operating in Fayette County to report their net profits for taxation purposes. It simplifies the process of calculating and submitting your tax obligations, ensuring compliance with local regulations.

-

How can airSlate SignNow assist with the Net Profit Occupational License Tax Return 228 S Fayette County Fcps?

airSlate SignNow provides a streamlined platform for businesses to electronically sign and submit the Net Profit Occupational License Tax Return 228 S Fayette County Fcps. Our user-friendly interface makes it easy for you to manage documents securely, ensuring timely submission and compliance.

-

What are the key features provided by airSlate SignNow for tax return processing?

airSlate SignNow offers a range of features that enhance the tax return process, including customizable templates, eSignature capabilities, and secure document storage. These features help you effortlessly complete and submit the Net Profit Occupational License Tax Return 228 S Fayette County Fcps while maintaining compliance and efficiency.

-

Is there a cost associated with using airSlate SignNow for the Net Profit Occupational License Tax Return 228 S Fayette County Fcps?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses handling the Net Profit Occupational License Tax Return 228 S Fayette County Fcps. Our cost-effective solutions ensure you have access to the tools you need without breaking the bank.

-

Can I integrate airSlate SignNow with other software for filing the Net Profit Occupational License Tax Return 228 S Fayette County Fcps?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing for a smooth workflow when filing your Net Profit Occupational License Tax Return 228 S Fayette County Fcps. This integration helps streamline your processes and reduces the chances of errors.

-

What benefits does airSlate SignNow offer when filing the Net Profit Occupational License Tax Return 228 S Fayette County Fcps?

By using airSlate SignNow for your Net Profit Occupational License Tax Return 228 S Fayette County Fcps, you benefit from increased efficiency, reduced paperwork, and enhanced security. Our platform ensures your documents are signed, stored, and managed securely, allowing you to focus on your business.

-

How secure is airSlate SignNow for handling sensitive tax information like the Net Profit Occupational License Tax Return 228 S Fayette County Fcps?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your sensitive information while handling documents, including the Net Profit Occupational License Tax Return 228 S Fayette County Fcps. Your data is safe with us.

Get more for Net Profit Occupational License Tax Return 228 S Fayette County Fcps

- Vince and joes form

- Security guards service job application form

- New sites for ultimate security ltd form

- Sexual harassment acknowledgement form

- Certificate of origin korea us trade agreement fill form

- Certifying official documents for foreign use form

- Private bird hunting area application pwd 348 texas form

- Discovering family and local history form

Find out other Net Profit Occupational License Tax Return 228 S Fayette County Fcps

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile