Net Profits Occupational License Tax Return 2023

What is the Net Profits Occupational License Tax Return

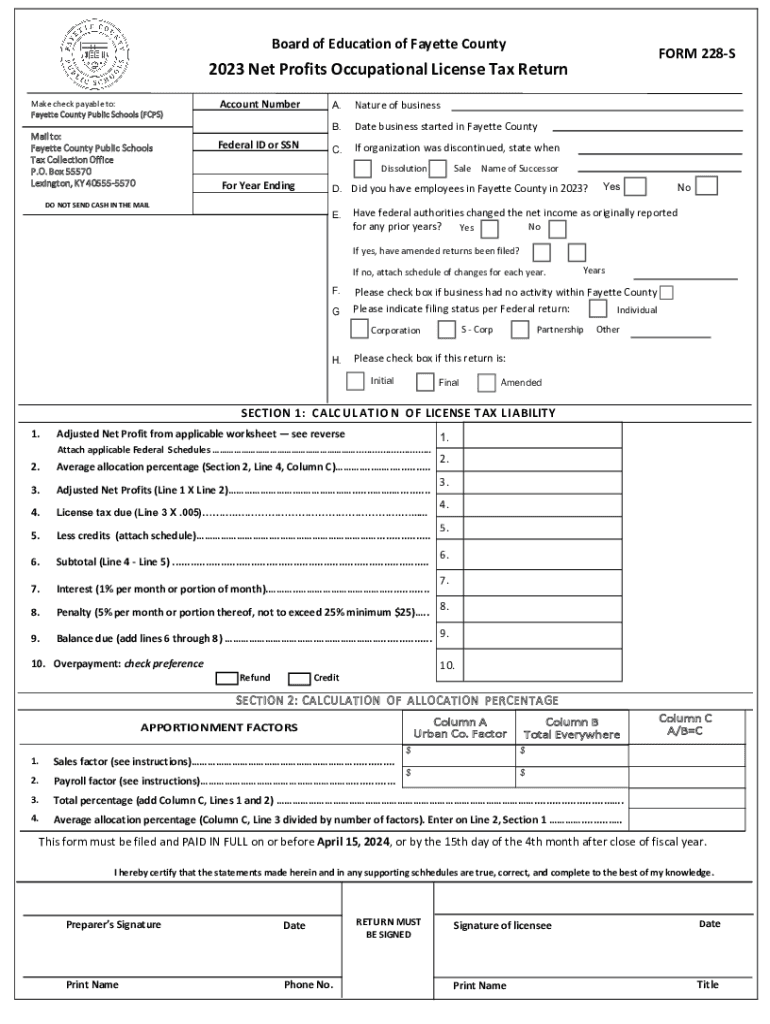

The Net Profits Occupational License Tax Return, commonly referred to as Form 228 S in Fayette County, is a tax document that businesses must file to report their net profits. This form is specifically designed for entities operating within Fayette County, Kentucky, and is a requirement for maintaining compliance with local tax regulations. The tax is assessed on the net profits earned from business activities conducted within the county, ensuring that local governments can fund essential services and infrastructure.

Steps to Complete the Net Profits Occupational License Tax Return

Completing the Net Profits Occupational License Tax Return involves several key steps:

- Gather Financial Records: Collect all relevant financial documents, including income statements, balance sheets, and any other records that detail your business's financial performance.

- Calculate Net Profits: Determine your net profits by subtracting allowable business expenses from total income. This figure is crucial for accurate reporting.

- Fill Out the Form: Complete Form 228 S by entering your calculated net profits and any other required information, such as business name and address.

- Review for Accuracy: Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Submit the Form: File the completed form by the specified deadline, ensuring it reaches the appropriate local tax authority.

Required Documents

When preparing to file the Net Profits Occupational License Tax Return, certain documents are essential:

- Financial Statements: Income statements and balance sheets that reflect your business's financial health.

- Previous Tax Returns: Copies of prior year tax returns can provide a useful reference for completing the current form.

- Business Licenses: Documentation proving that your business is legally registered and licensed to operate in Fayette County.

- Expense Records: Detailed records of all business expenses that can be deducted from your total income.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Net Profits Occupational License Tax Return to avoid penalties:

- Annual Filing Deadline: Typically, the form must be filed by April 15 of each year for the previous calendar year’s income.

- Extensions: If you need more time, you may apply for an extension, but be sure to check the specific requirements and deadlines for extensions.

Penalties for Non-Compliance

Failing to file the Net Profits Occupational License Tax Return can result in significant penalties:

- Late Filing Penalties: If the form is submitted after the deadline, penalties may be assessed based on the amount of tax owed.

- Interest Charges: Interest may accrue on any unpaid taxes, increasing the total amount owed over time.

- Legal Consequences: Continued non-compliance can lead to legal action by local tax authorities, including liens or other enforcement measures.

Who Issues the Form

The Net Profits Occupational License Tax Return is issued by the Fayette County Finance Department. This department is responsible for managing local tax collection and ensuring compliance with tax regulations. For any questions regarding the form or filing process, businesses can contact the finance department directly for assistance.

Quick guide on how to complete net profits occupational license tax return

Complete Net Profits Occupational License Tax Return effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Net Profits Occupational License Tax Return on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Net Profits Occupational License Tax Return with ease

- Obtain Net Profits Occupational License Tax Return and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for those purposes.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Modify and eSign Net Profits Occupational License Tax Return and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct net profits occupational license tax return

Create this form in 5 minutes!

How to create an eSignature for the net profits occupational license tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are fcps net profits and how can airSlate SignNow help improve them?

FCPS net profits refer to the net earnings generated by a company after all expenses are deducted from total revenue. Utilizing airSlate SignNow can streamline your document signing process, reducing turnaround time and increasing efficiency, which can positively impact your fcps net profits. By minimizing delays and enhancing productivity, your business can maximize its profitability.

-

How does airSlate SignNow help reduce costs and boost fcps net profits?

By using airSlate SignNow, businesses can eliminate the need for printing, mailing, and storing physical documents, signNowly reducing operational costs. This reduction in overhead directly contributes to higher fcps net profits. Plus, with our affordable pricing plans, companies can invest more in growing their revenue instead of wasting resources on inefficient processes.

-

What features does airSlate SignNow offer that can enhance fcps net profits?

AirSlate SignNow includes features such as customizable templates, real-time tracking, and automated reminders that help streamline the signing process. These features enable teams to work more efficiently and close deals faster, thus improving fcps net profits. Additionally, the user-friendly interface ensures that all team members can adopt the tool quickly.

-

Can airSlate SignNow integrate with other platforms to enhance fcps net profits?

Yes, airSlate SignNow offers seamless integrations with popular CRMs, cloud storage services, and collaboration tools. By connecting with these platforms, businesses can create a more efficient workflow that drives down operational costs and boosts fcps net profits. Easy integration means that teams can maintain high productivity levels across various software tools.

-

What are the benefits of using airSlate SignNow for enhancing fcps net profits?

The primary benefits of airSlate SignNow include increased efficiency, improved document security, and enhanced customer satisfaction. These factors contribute to faster turnaround times and reduced errors, which can ultimately lead to increased fcps net profits. Furthermore, a streamlined signing experience helps retain customers and encourages repeat business.

-

How does pricing for airSlate SignNow compare to other eSignature solutions while considering fcps net profits?

AirSlate SignNow offers competitively priced plans that are designed to fit various business sizes and budgets. Compared to other eSignature solutions, our pricing can lead to considerable savings, allowing businesses to allocate more resources toward strategies that improve fcps net profits. Investing in a cost-effective solution like ours can yield a favorable ROI.

-

Is airSlate SignNow user-friendly enough to optimize processes for increasing fcps net profits?

Absolutely! AirSlate SignNow is designed with an intuitive interface that ensures users can easily navigate the platform without extensive training. A user-friendly solution promotes higher adoption rates among employees, leading to more efficient processes that can directly elevate fcps net profits. Streamlined operations become crucial in today’s fast-paced business environment.

Get more for Net Profits Occupational License Tax Return

- Permit applications amp forms city of arlington

- Fixed asset form project name project location d

- Registry of motor vehicles id cards photo form

- Application for electrical permit application for an electrical permit for proposed work on residential and commercial form

- Flood permit application form

- City of daytona beach shores mechanical permit application form

- Miami lakes contractor registration form

- Land development waiver application form

Find out other Net Profits Occupational License Tax Return

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document