For Macbook Users, Download and Open in Acrobat Reader for Form

Understanding the SME Loan Application Form

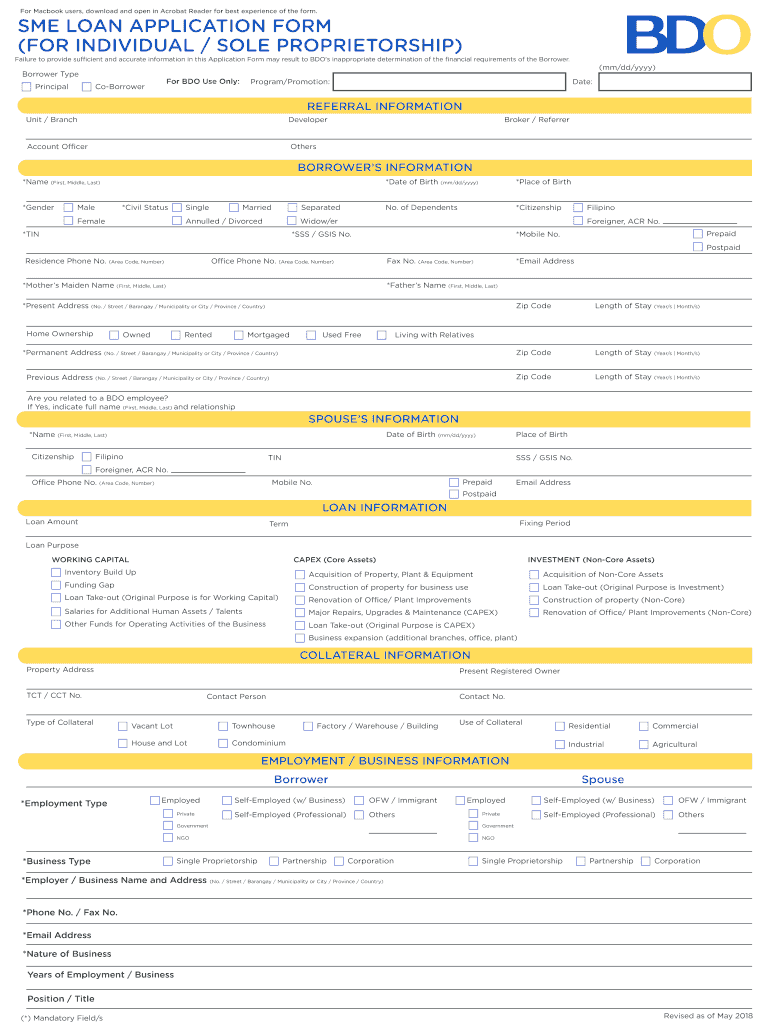

The SME loan application form is a crucial document for businesses seeking financial assistance. It collects essential information about the applicant, including business details, financial status, and purpose of the loan. Completing this form accurately is vital for a smooth application process. This form typically requires information such as business name, address, tax identification number, and financial statements. Providing clear and precise information helps lenders assess the application efficiently.

Key Elements of the SME Loan Application Form

Several key elements are essential when filling out the SME loan application form. These include:

- Business Information: This section requires details about the business structure, ownership, and industry type.

- Financial Information: Applicants must provide financial statements, including profit and loss statements and balance sheets, to demonstrate financial health.

- Loan Purpose: Clearly stating the intended use of the loan funds helps lenders understand the applicant's needs and business plan.

- Personal Information: Personal details of the business owner or principal, including credit history, may be required to assess risk.

Application Process and Approval Time

The application process for the SME loan typically involves several steps. After submitting the completed SME loan application form, lenders will review the information provided. This review process may take anywhere from a few days to several weeks, depending on the lender's policies and the complexity of the application. During this time, lenders may request additional documentation or clarification on certain points. Understanding this timeline can help applicants manage their expectations and plan accordingly.

Eligibility Criteria for SME Loans

Eligibility criteria for SME loans can vary by lender, but common requirements include:

- Business Age: Many lenders require the business to be operational for a specific period, often at least one to two years.

- Credit Score: A minimum credit score is often necessary to qualify for loans, reflecting the business owner’s creditworthiness.

- Revenue Requirements: Lenders may set minimum revenue thresholds that the business must meet to be eligible for financing.

- Business Plan: A well-prepared business plan outlining how the loan will be used and how it will benefit the business can enhance eligibility.

Form Submission Methods

Submitting the SME loan application form can typically be done through various methods, including:

- Online Submission: Many lenders offer online platforms for submitting applications, allowing for quick processing.

- Mail: Applicants may also choose to send a physical copy of the application via postal service.

- In-Person Submission: Some lenders allow applicants to submit their forms directly at a branch location, providing an opportunity for immediate feedback.

Legal Use of the SME Loan Application Form

The SME loan application form is legally binding once submitted, provided it meets specific requirements. This includes the accurate representation of information and the signer's intent to apply for the loan. Understanding the legal implications of the information provided is essential, as inaccuracies can lead to denial or legal consequences. Utilizing a reliable platform for e-signatures ensures compliance with eSignature laws, making the process secure and legally valid.

Quick guide on how to complete for macbook users download and open in acrobat reader for

Effortlessly prepare For Macbook Users, Download And Open In Acrobat Reader For on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed forms, enabling you to effortlessly find the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delay. Handle For Macbook Users, Download And Open In Acrobat Reader For across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign For Macbook Users, Download And Open In Acrobat Reader For with ease

- Find For Macbook Users, Download And Open In Acrobat Reader For and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to finalize your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign For Macbook Users, Download And Open In Acrobat Reader For and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an SME loan application form?

An SME loan application form is a standardized document used by small and medium enterprises to apply for financing. This form typically requires information about the business's financials, ownership, and purpose of the loan. airSlate SignNow makes it easy to create, send, and eSign these forms for efficient processing.

-

How can airSlate SignNow help with my SME loan application form?

With airSlate SignNow, you can streamline the preparation and signing of your SME loan application form. Our platform allows for easy customization of the form, ensuring all necessary information is captured. Additionally, eSigning features help accelerate the approval process.

-

What are the pricing options for using airSlate SignNow for SME loan application forms?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs. Depending on the level of features and integrations you require for handling SME loan application forms, you can choose a plan that best fits your budget. Each plan includes essential tools for document management and eSigning.

-

Are there any integrations available with airSlate SignNow for managing SME loan application forms?

Yes, airSlate SignNow provides several integrations with popular business tools like CRM systems and accounting software. This allows for seamless management of your SME loan application forms alongside existing workflows. By integrating with your preferred applications, you can boost productivity and reduce manual data entry.

-

What benefits does airSlate SignNow offer for SMEs using loan application forms?

Using airSlate SignNow for SME loan application forms provides numerous benefits, including faster processing times and improved accuracy. Our easy-to-use platform enables businesses to reduce paperwork and automate the signing process. This results in more efficient loan applications, helping SMEs access funds when they need them.

-

Is it easy to track the status of my SME loan application form with airSlate SignNow?

Absolutely! airSlate SignNow offers tracking features that let you monitor the status of your SME loan application form in real time. You can see when documents are sent, viewed, and signed, ensuring complete transparency throughout the application process. This visibility helps you stay informed and follow up as needed.

-

Can I customize my SME loan application form in airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your SME loan application form to meet your specific needs. You can add fields, modify layouts, and include branding elements to create a professional appearance. This level of customization ensures that your application form captures all necessary details effectively.

Get more for For Macbook Users, Download And Open In Acrobat Reader For

- Of alabama to wit form

- As grantors do hereby grant convey and warrant unto and form

- Title 42 possessory lien procedures on vehicles okgov form

- Hauling release and waiver nashvillehorselessonscom form

- Writing a property tax appeal letter with sample form

- Technology landscape for digital identification form

- Pestle analysis of mauritius and analysis of 1pdfnet form

- Scott alan english motion for contempt notice of motion form

Find out other For Macbook Users, Download And Open In Acrobat Reader For

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT