Form 631 California State 2002

What is the Form 631 California State

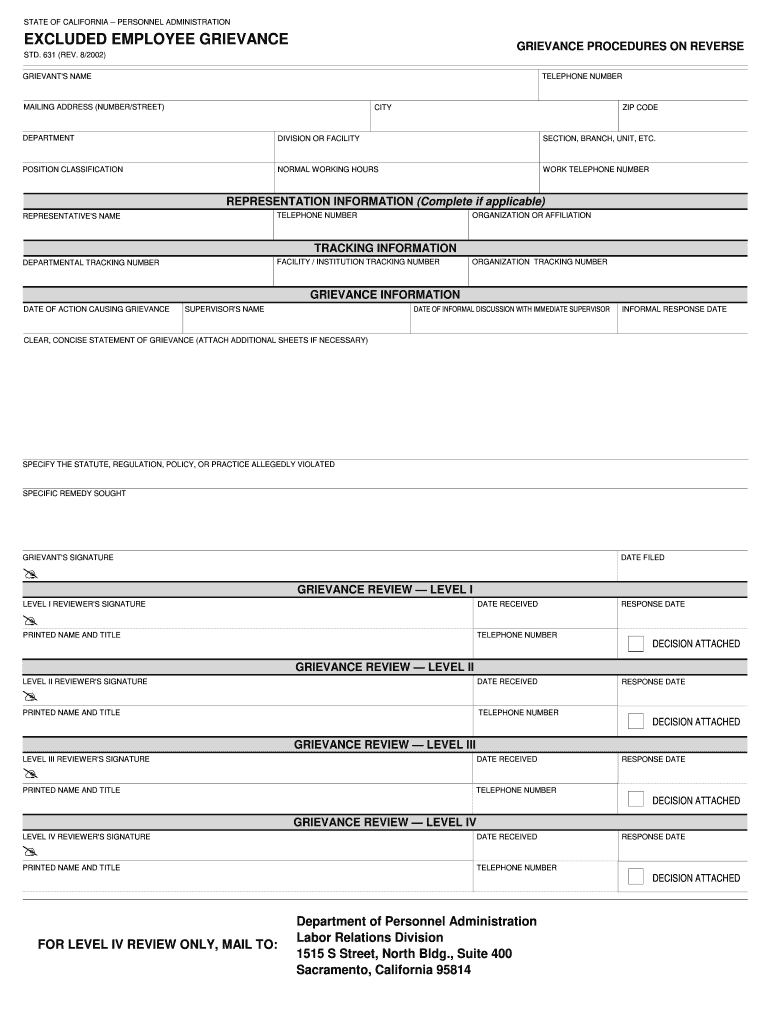

The Form 631 California State is a crucial document used primarily for reporting and managing specific transactions within the state. This form is essential for individuals and businesses that need to comply with state regulations regarding taxation and reporting requirements. Understanding its purpose helps ensure that all relevant information is accurately captured and submitted in a timely manner.

How to use the Form 631 California State

Using the Form 631 California State involves several key steps. First, ensure you have the most recent version of the form, as regulations may change. Fill out the form by providing all required information, including personal details, transaction specifics, and any applicable signatures. Once completed, review the form for accuracy to prevent delays in processing. Finally, submit the form according to the guidelines provided by the state, which may include online submission, mailing, or in-person delivery.

Steps to complete the Form 631 California State

Completing the Form 631 California State requires careful attention to detail. Begin by downloading the form from an official source to ensure you have the correct version. Next, gather all necessary documents that provide supporting information for the entries on the form. Fill in each section methodically, ensuring that you enter accurate data. After completing the form, double-check all entries for errors or omissions. Once confirmed, sign the form where required, and prepare it for submission.

Legal use of the Form 631 California State

The legal use of the Form 631 California State is governed by state regulations that dictate its purpose and the information required. It is essential to understand that submitting this form incorrectly or failing to submit it can lead to legal repercussions, including fines or penalties. To ensure compliance, familiarize yourself with the specific legal requirements associated with the form, including deadlines and any necessary supporting documentation.

Key elements of the Form 631 California State

Key elements of the Form 631 California State include personal identification information, transaction details, and any applicable signatures. Each section of the form is designed to capture specific data that is crucial for accurate reporting. Additionally, the form may require attachments or supporting documents that provide further context to the information submitted. Understanding these elements is vital for ensuring that the form is completed correctly and meets all legal requirements.

Form Submission Methods (Online / Mail / In-Person)

The Form 631 California State can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient, allowing for quicker processing times. If submitting by mail, ensure that you send the form to the correct address and consider using a trackable mailing option. In-person submissions may be required for certain circumstances, so check the specific guidelines for your situation to determine the best submission method.

Eligibility Criteria

Eligibility criteria for using the Form 631 California State can vary based on the type of transaction being reported. Generally, individuals and businesses that engage in specific activities outlined by the state are required to use this form. It is important to review the eligibility requirements to ensure compliance and avoid any potential issues during the submission process. Understanding these criteria can help streamline your experience with the form and ensure that all necessary information is provided.

Quick guide on how to complete form 631 california state 2002

Simplify your HR processes with Form 631 California State Template

Each HR professional understands the importance of keeping employees’ data tidy and well-organized. With airSlate SignNow, you gain access to a vast collection of state-specific labor documents that greatly streamline the retrieval, management, and storage of all employment-related files in a single location. airSlate SignNow empowers you to oversee Form 631 California State management from beginning to end, with comprehensive editing and eSignature tools available whenever you require them. Enhance your precision, document safety, and eliminate minor manual errors in just a few clicks.

The optimal method to edit and eSign Form 631 California State:

- Choose the relevant state and search for the form you need.

- Access the form page and click on Get Form to begin working on it.

- Allow Form 631 California State to load in the editor and follow the prompts indicating required fields.

- Enter your information or add more fillable sections to the form.

- Utilize our tools and features to modify your form as necessary: annotate, obscure sensitive information, and create an eSignature.

- Review your document for mistakes before proceeding with its submission.

- Simply click Done to save changes and download your form.

- Alternatively, dispatch your documents directly to your recipients and collect signatures and information.

- Securely store completed documents within your airSlate SignNow account and access them whenever you wish.

Using a flexible eSignature solution is vital when managing Form 631 California State. Make even the most intricate workflow as seamless as possible with airSlate SignNow. Initiate your free trial today to explore what you can achieve with your department.

Create this form in 5 minutes or less

Find and fill out the correct form 631 california state 2002

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Do you have to fill out a separate form to avail state quota in NEET?

No..you dont have to fill form..But you have to register yourself in directorate of medical education/DME of your state for state quota counselling process..DME Will issue notice regarding process, date, of 1st round of counsellingCounselling schedule have info regarding date for registration , process of counselling etc.You will have to pay some amount of fee at the time of registration as registration fee..As soon as neet result is out..check for notification regarding counselling on DmE site..Hope this helpBest wishes dear.

-

Do I need to fill out the state admission form to participate in state counselling in the NEET UG 2018?

There is two way to participate in state counseling》Fill the state quota counseling admission form(for 15% quota) and give the preference to your own state with this if your marks are higher and if you are eligible to get admission in your state then you will get the college.》Fill out the form for state counseling like karnataka state counseling has started and Rajasthan counseling will start from 18th june.In 2nd way you will fill the form for 85% state quota and has higher chances to get college in your own state.NOTE= YOU WILL GET COLLEGE IN OTHER STATE (IN 15% QUOTA) WHEN YOU WILL CROSS THE PARTICULAR CUT OFF OF THE NEET AND THAT STATE.BEST OF LUCK.PLEASE DO FOLLOW ME ON QUORA.

Create this form in 5 minutes!

How to create an eSignature for the form 631 california state 2002

How to generate an electronic signature for your Form 631 California State 2002 in the online mode

How to make an eSignature for your Form 631 California State 2002 in Google Chrome

How to generate an electronic signature for signing the Form 631 California State 2002 in Gmail

How to make an eSignature for the Form 631 California State 2002 from your smart phone

How to generate an electronic signature for the Form 631 California State 2002 on iOS

How to create an electronic signature for the Form 631 California State 2002 on Android devices

People also ask

-

What is Form 631 California State?

Form 631 California State is a document used by businesses to register as a fictitious business name in the state of California. This form is essential for any entity wishing to conduct business under a name that is not their legal business name. By using airSlate SignNow, you can easily fill, sign, and manage your Form 631 California State electronically.

-

How can airSlate SignNow help with filling out Form 631 California State?

airSlate SignNow offers a user-friendly interface that simplifies the process of filling out Form 631 California State. With features like templates and real-time collaboration, users can complete and eSign the document quickly. This saves time and ensures that all necessary information is accurately captured.

-

Is there a cost associated with using airSlate SignNow for Form 631 California State?

Yes, airSlate SignNow offers a range of pricing plans that cater to different business needs, including features for eSigning documents like Form 631 California State. The subscription gives you access to a secure platform for managing your business documents efficiently. You can explore various pricing options to find the best fit for your organization.

-

What features does airSlate SignNow provide for Form 631 California State?

airSlate SignNow provides various features such as customizable templates, secure storage, and the ability to eSign documents like Form 631 California State. The platform also includes tracking capabilities, so you can monitor the status of your documents online. This streamlines the paperwork process for businesses.

-

Can I integrate airSlate SignNow with other software for processing Form 631 California State?

Absolutely! airSlate SignNow offers a variety of integrations with popular business applications to enhance your workflow when processing Form 631 California State. These integrations help you connect your documents with tools you already use, making document management seamless and efficient.

-

What are the benefits of using airSlate SignNow for Form 631 California State?

Using airSlate SignNow for Form 631 California State allows businesses to streamline their document signing process, reduce turnaround time, and improve compliance. The easy-to-use platform ensures that teams can work on documents from anywhere, increasing productivity. Additionally, the secure eSigning feature ensures that your documents remain confidential and legally binding.

-

Is it easy to send Form 631 California State for eSignature with airSlate SignNow?

Yes, sending Form 631 California State for eSignature with airSlate SignNow is straightforward. You can upload your form, add the necessary signers, and send out the document within minutes. The recipient will receive an email notification prompting them to eSign, making the process quick and efficient.

Get more for Form 631 California State

Find out other Form 631 California State

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal